A recent survey by the Edmonton Chamber of Commerce finds local businesses aren’t thrilled by the red tape in the city and feel they’re not getting good value for the property taxes they pay.

The survey, on business conditions in the Edmonton Metropolitan Region, saw Trend Research interview a random sample of 250 businesses in the region.

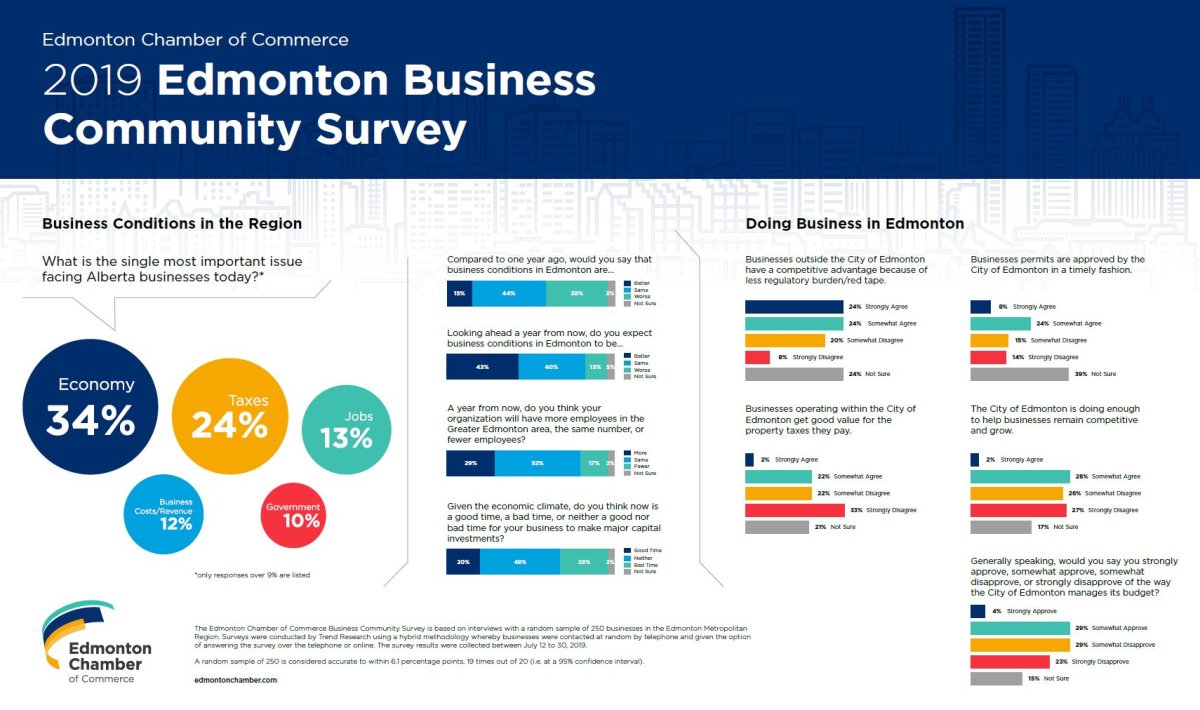

Nearly half of respondents (48 per cent) said that operating outside city limits comes with a competitive advantage, thanks to less red tape and a lighter regulatory burden.

Just one-quarter of respondents (24 per cent) agreed that Edmonton businesses get good value for their property taxes. In fact, 55 per cent of respondents somewhat or strongly disagreed that’s the case.

About one-third (32 per cent) agreed the City of Edmonton approves business permits in a timely fashion, with 29 per cent either somewhat or strongly disagreeing.

Over half (52 per cent) said they disapprove of the way the city manages its budgets.

- Ultra-processed food tied to higher risk of early death, study finds. What to avoid

- A ‘zombie’ virus is raging among raccoons. What to know

- N.S. couple felt they won ‘doctor lottery’ after years on wait-list. Now they’re back on it

- Begin breast cancer screening at age 40, Canadian Cancer Society urges

“Those businesses surveyed have sent a strong message: the city needs to do more to help businesses remain competitive, grow and thrive,” Janet Riopel, president & CEO of the Edmonton Chamber of Commerce, said.

The mayor says he hears those concerns from the business community.

“I think Edmonton has been shouldering, for a long time, the burden of city building for the region and that has hit all taxpayers, especially business,” Don Iveson said.

He said council has tried to level off spending to the rate of inflation in its budgets to put the brakes on the tax pain. Iveson said he’s also asked for a report on the impact of taxes on businesses and particular kinds of businesses.

“I’m really interested in the business community’s feedback on that and their continuing support of our effort to get some equity in the region,” Iveson added. “Much is made of the fact that taxes are lower in the region. Well, the region has less to buy on behalf of this whole metropolitan economy than the city of Edmonton. So, there are some outstanding equity questions we’re trying to solve with our neighbours through the Shared Investment for Shared Benefit discussions.”

Iveson also said the city is constantly doing work to streamline the permitting processes.

“We’re also looking at a number of red tape reduction suggestions for ourselves, as well as recommendations we can make to the province to ease their rules that we administer on their behalf, to make things easier for business.”

However, business confidence in the region seems to be growing.

One in seven believe business conditions have improved over the last year, and over one in four believe business conditions will get better in the next year.

Still, compared to one year ago, 38 per cent said business conditions in Edmonton are worse now, 44 per cent said conditions are the same and 15 per cent said they’re better now.

Only three in 10 businesses expect to hire more staff in the coming year, and only one in five think it is a good time to make large capital investments.

“Taken together, these findings tell us that many in the Edmonton business community continue to face challenges and there’s more the city should be doing to create a healthy business environment,” said Riopel.

“At the Edmonton Chamber, we’ll continue to use our powerful voice to positively influence government decisions to help more businesses in our region succeed.”

The survey responses were collected between July 12 and 30, 2019.

Watch (Jan. 10, 2019): Business owner questions jump in property tax assessment

Comments