Airbnb has handed over more than $14 million in PST to the B.C. government in the first six months of tax remittance.

On top of that the short term vacation rental company has handed over around $4 million in Municipal and Regional District Tax.

“We always do a bit of an estimate before we get into a tax agreement like we did in B.C. Our estimate was that we would collect about $16 million in PST for the first 12 months,” Airbnb’s head of public policy in Canada Alex Dagg said.

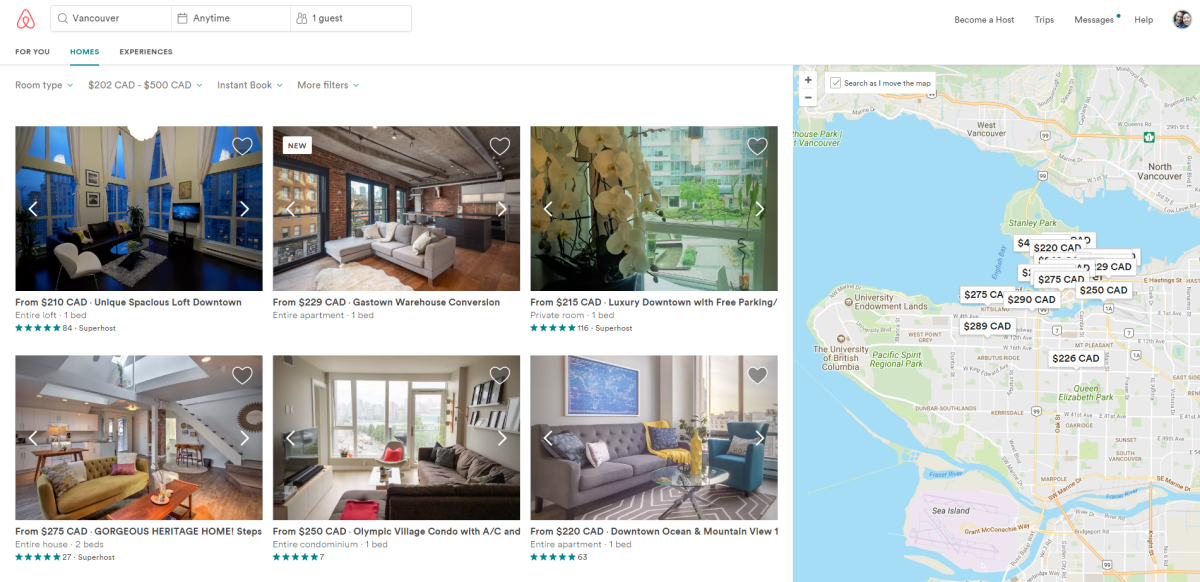

“Our platform is popular, it is growing, people are continuing to use our platform as a way to visit Vancouver. It’s a combination between Airbnb being popular and B.C. being popular.”

The tax numbers, provided exclusively to Global News, are from October 1, 2018 to March 31, 2019. The PST goes into provincial coffers designated for affordable housing funding.

The Municipal tax goes to each municipality, with $1.4 million going to Vancouver and $350,000 going to Victoria. The money is for tourism promotion funding.

Get daily National news

“We are now coming into the summer season and that number should continue to grow,” Dagg said.

British Columbia is the only jurisdiction in Canada collecting the provincial sales tax from vacation rental companies. Airbnb is the only company that has signed a deal with B.C. The tax works out to about 11 per cent on the rental that wasn’t there before the deal.

WATCH (February 7, 2018): Airbnb announce they will collect provincial tax for B.C.

WATCH (aired April 11, 2018): City of Vancouver announces ban on Airbnb in secondary homes

“British Columbia and Vancouver are really getting it right,” Dagg said.

“They have put guard rails around the online activity. They are getting funds to contribute to affordable housing.”

Vancouver city Coun. Pete Fry says his council is waiting back to hear back from staff in September to see how “the Airbnb thing is going.”

Fry also is calling for short term vacation rentals to be given commercial designation.

“That could bring substantial revenues to the city of Vancouver to fund things like sidewalks, parks and child care and maybe even affordable housing,” Fry said.

The commercial designation, which would come with greater taxes to the municipality, is not something Airbnb agrees with.

“We think it’s really important to treat this activity as residential. Bed and breakfasts that have been around for generations are treated as residential,” Dagg said.

Comments