From the best travel and gas perks to the top rewards at the grocery story, the results are in.

Personal finance website RateSupermarket.ca analyzed dozens of credit cards in 15 categories, for the eighth straight year, to determine which ones will give Canadians the best bang for their buck in 2019.

RateSupermarket.ca analyst Jacob Black said with so many cards out on the market, it really comes down to what fits your needs best.

“Everybody is looking for that personal touch,” Black said.

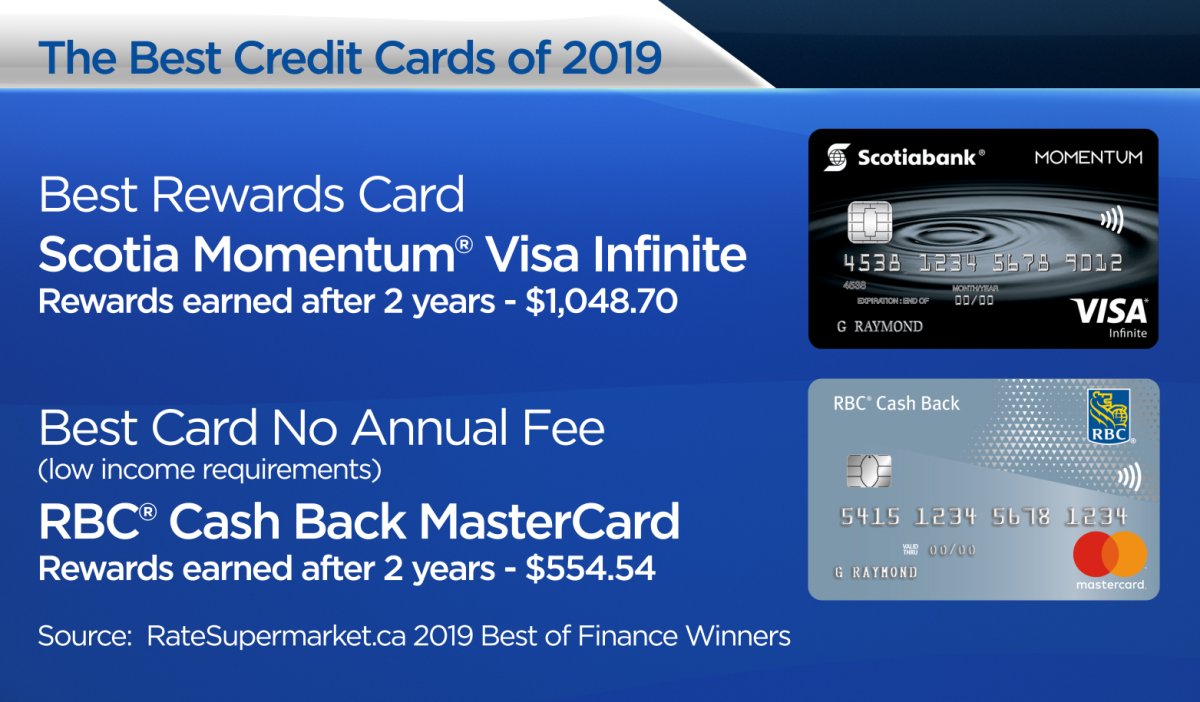

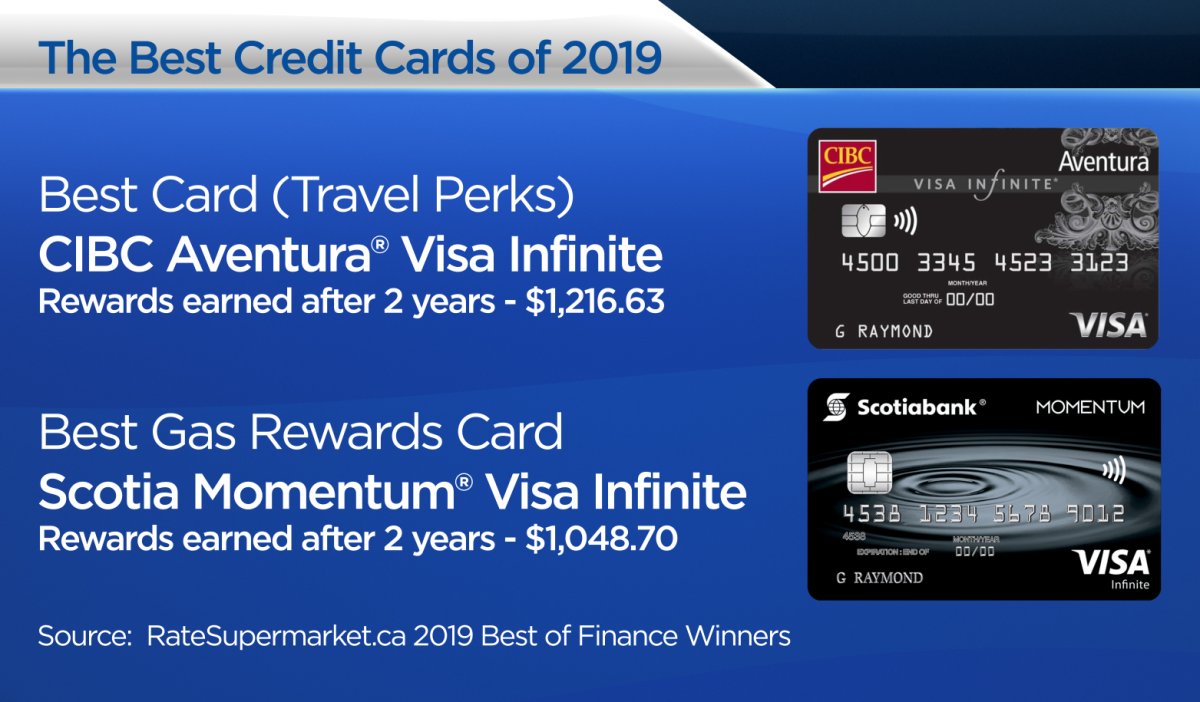

Best reward credit cards 2019 survey results:

Black added the credit card rewards market is changing rapidly, with an influx of new and innovative products on the market.

“We’re seeing this evolution where everybody is trying to find a way to maximize your value for money so that you’ll stay with them,” he said. “The credit card companies are fighting for every little piece of space that they’ve got.”

RBC is just one financial institution competing for Canadians’ credit card business.

Get weekly money news

Vice President of Global Loyalty & Rewards for RBC, Jacquelina Calisto, said it’s definitely a growing market.

“Canadians absolutely love their loyalty programs and their points,” Calisto added.

RBC has now gone beyond, letting consumers just use points for flights, food or entertainment.

It’s making it easier for consumers to redeem their points for everyday expenses like car payments and phone, internet and utility bills, plus other things.

Calisto said it’s about creating a highly personal experience.

“We know that our clients want to use their points for what’s relevant to them,” Calisto said. “Today that might be travel, but tomorrow it may be ‘hey I need to pay down my children’s education and I want that currency to use for that.'”

But financial experts also warn about racking up too many points — on too many credit cards.

“Don’t get every card that’s offered to you,” Black said. “Don’t sign up for a dozen credit cards because that will hurt your credit score.”

His advice: use your cards responsibly, pay them off and then you will truly reap the benefits of rewards.

Methodology

RateSupermarket.ca reviewed and analyzed 15 credit cards and personal finance products from April 1-10, 2019.

For credit cards it converted miles, points and cash back into dollar figures. Interest rates, balance transfer rates and annual fees were examined, and each product’s fine print was carefully deciphered. The credit cards that provided the most value ranked at the top of their category.

For fan favourite credit card Canadians voted on Facebook for the credit cards that best performed for them.

Comments