Canada largely fails to successfully convict money launderers with almost three-quarters of people accused going free, a Global News investigation has found.

From 2000-2016, Canada recorded 321 guilty verdicts in money-laundering cases, according to an analysis of data provided by Statistics Canada.

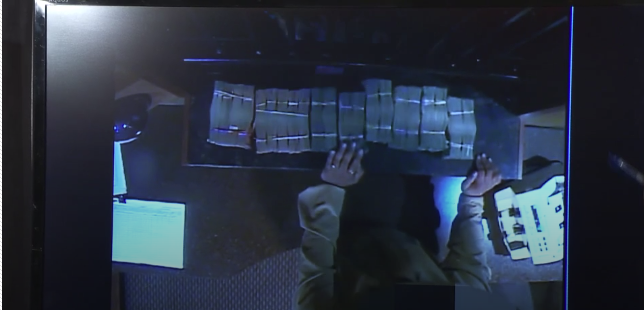

WATCH: Money laundering flowing through back-door channels in B.C. casinos

Another roughly 809 cases were either stayed, withdrawn or dismissed, according to the data, resulting in a conviction rate of around 27 per cent. That’s far fewer than other crimes, as roughly 63 per cent of all adult criminal court cases in 2017 resulted in a guilty verdict.

“It’s scandalous,” said forensic accountant Matt McGuire, who previously worked for FINTRAC — Canada’s watchdog against money laundering. “It’s quite clear the system isn’t working. It’s mind-boggling.”

The data comes amid growing calls for an inquiry into money laundering and organized crime in B.C, but the new numbers show it’s a problem touching every province.

McGuire, co-founder of the AML Shop in Toronto, said Canada’s reputation as a stable financial system, coupled with investigators that are unwilling or lack resources to prosecute complex financial crimes, has turned Canada into a “utopia” for money launderers.

“Our violent crime is at the lowest crime rate in 30 years. It’s hard to convince anybody really that crime is a monster problem at the moment,” he said. “The criminals have moved from baseball bats to balance sheets.”

The U.K. and the U.S. have been far more successful in prosecuting money launderers. Between 1999 and 2007, there were 7,569 money-laundering prosecutions in the U.K., resulting in 3,796 convictions (a roughly 50 per cent conviction rate). The most recent data available from the U.S. Department of Justice show that in 2015, 727 people were prosecuted for money laundering, with 615 being convicted – a rate of 85 per cent.

Examining prosecution rates for these crimes in Canada is challenging. No federal government agency collects the data directly from provincial courts and information from Superior Courts is not available to be analyzed. Cases where a person was charged with money laundering in addition to other crimes were not available.

WATCH: Canada fails to convict cash-cleaning criminals

StatCan noted the data — compiled through the Integrated Criminal Court Survey — does not include information from Superior courts in Prince Edward Island, Ontario, Manitoba and Saskatchewan, as well as municipal courts in Quebec, and may result in a “slight underestimation.”

Global News reached out to 10 provinces for prosecution outcomes for charges under section 462.31 which deals with laundering proceeds of crime. Some provinces provided the number of charges, meaning one individual could face multiple charges.

Here’s what we found:

- B.C. saw 50 money-laundering cases submitted to the BC Prosecution Service between 2002 and 2018, the B.C.’s Ministry of the Attorney General said. Thirty-four accused were charged with at least one count. Just 10 were found guilty. A spokesperson for the ministry noted the figures do not account for accused who may have been found guilty of other offences.

- Alberta saw 422 money-laundering charges from 2002 to November 2018 with just 24 resulting in guilty convictions, according to the province’s Ministry of the Attorney General. 321 were quashed, dismissed, stayed, or withdrawn. 77 charges were classified as “other,” which includes outcomes such as discharged or waived out of province.

- Ontario received a total of 3,133 charges between 2006 and 2017, resulting in 186 guilty outcomes. Roughly 2,360 resulted in a not-guilty finding, which includes acquittals if the charges were stayed or withdrawn, according to the province’s Ministry of the Attorney General. A spokesperson for the ministry noted the data only includes charges disposed of in the Ontario Court of Justice and not the Superior Court of Justice.

- P.E.I. had three cases related to money laundering from 2002-2018. In 2006, two people were found guilty and in 2014, one person charged with two counts had their case dismissed.

- Nova Scotia saw 63 charges of money laundering filed from 2005-2018. Just 13 charges resulted in a guilty finding.

Get daily National news

Ministries for Saskatchewan, Manitoba, Quebec, New Brunswick and Newfoundland were not able to provide any data.

Victoria criminal defence lawyer Michael Mulligan said it’s difficult to draw a conclusion based on the available information, as charges that are stayed could later lead to a charge. However, he was surprised by the overall prosecutions in B.C.

“What is going on there?” Mulligan said. “You’re just simply not investigating these crimes.”

B.C. is unique from other provinces as police cannot lay criminal charges without approval from B.C. prosecutors. Mulligan said it’s often easier for police to investigate crimes like assaults or thefts, and are more reluctant to address complex money laundering cases.

“You wind up with policing focused on the public nuisance activity on the street and not on those cases.”

Why it matters

WATCH ABOVE: B.C.’s attorney general sits down with federal minister to talk money laundering

Money laundering is a billion-dollar problem in Canada, with estimates ranging from $5- to $100-billion, according to the CD Howe Institute.

Whether it’s drug dealers, organized crime, terror groups or white-collar criminals, hiding large amounts of cash from law enforcement is necessary to conduct business.

Global News revealed that in B.C., police believe that as much as $5 billion could have been laundered in Vancouver’s real-estate market since 2012, which has distorted housing prices and helped fuel the opioid crisis.

B.C. casinos have also become laundromats for dirty money with estimates of nearly $2 billion flowing through them from 2013-2017. Former casino investigators told Global News that they believe officials turned a blind eye to the issue, allowing government-regulated casinos to be used as hubs for laundering cash.

The latest report from the Financial Action Task Force (FATF) — an international governing body that sets anti-money-laundering standards — raised red flags about Canada’s ability to prosecute money launderers.

The 2016 report found that Canada only led 35 prosecutions and obtained 12 convictions for single-charge money-laundering cases between 2010-2014, which officials called “a concern.”

“It is possible and, according to the authorities, very likely that a professional money launderer would also be charged with another charge such as conspiracy, fraud, or organized crime,” the report said. “The numbers nevertheless appear too low in light of the risk.”

How Canada tackles money laundering

Prosecutors can also pursue money-laundering charges under the possession of proceeds of crime (PPOC) section of the Criminal Code and combine them with other charges related to drug dealing or fraud.

However, the FATF report notes that while the roughly 149,000 possession of crime-related cases entered the court system between 2010-2014 resulted in a conviction rate of almost 70 per cent, “most of the defendants were convicted of the predicate offenses,” meaning convictions for drug offences rather than money laundering.

“Canada does not pursue the ML charges sufficiently,” the report said. “The reasons provided for the withdrawal of the ML charges included insufficient evidence, the lack of public interest in the pursuit of the charges, the avoidance of overcharging, as well as repackaging of charges and plea bargaining.”

WATCH: Global News uncovers reason why “Project E-Pirate” failed

FINTRAC, which has the power to impose fines for money-laundering cases, rarely does. Since 2008, it has administered 95 monetary penalties totalling $3,535,550.

McGuire said that police agencies across the country lack the resources and expertise in finance or forensic accounting to follow the digital movement of cash by launderers. Increasing civil forfeiture claims – where investigators confiscate property from criminals and organized crime – is another way of attacking the problem, he said.

“Without dedicated police, prosecution and trained judges, this will never go anywhere,” McGuire said. “All this money is being expended on current initiatives that is producing very little in terms of results.”

Canada’s weak laws, that allow hidden ownership of real estate and trial time limits, also make it extremely difficult to prosecute financial crime.

The 2016 Supreme Court decision R. v. Jordan states that provincial court cases must be concluded within 18 months of criminal charges, creating further disadvantages for prosecutors, McGuire said.

Mulligan said hiring specialized investigators also requires higher salaries to keep them from being lured away to the private sector.

“What we need are people who want to investigate financial crimes,” he said. “These things are resource intensive if you wish to properly investigate and prosecute them.

Calls for inquiry in B.C.

WATCH ABOVE: David Eby acknowledges ‘huge’ public interest in money-laundering inquiry

Canada’s inability to tackle the issue was highlighted by the spectacular collapse of a case in B.C. in which alleged underground bankers were estimated to be laundering over $1 billion a year for criminals, including an international cocaine trafficker with ties to Mexico.

Criminal charges in the RCMP’s E-Pirate investigation that began in 2015 were stayed in November and sparked outrage that international crime groups appeared to be operating with impunity in the province.

In January, B.C. Attorney General David Eby demanded more resources from Ottawa to deal with the problem, leading to a pledge from Federal Minister of Border Security and Organized Crime Reduction Bill Blair to improve how information is shared among law enforcement agencies across the country.

On Friday, Eby told Global News the public wants to see an inquiry to examine how billions have been laundered through casinos and the housing market.

“There is a huge interest from British Columbians. I am hearing that and I know my cabinet colleagues are hearing it as well,” Eby said. “The premier has been very clear a public inquiry is still a possibility in our province.”

READ MORE: El Chapo’s Sinaloa cartel made nearly $3M a day in Canada, former DEA agent claims

Minister Blair’s office declined to answer a detailed list of questions, but said in a statement that his office takes the threat posed by money laundering and organized crime “very seriously.”

“We are taking action to combat this by enhancing the RCMP’s investigative and intelligence capabilities both in Canada and abroad, and our Financial Intelligence Unit further helps protect Canadians and our financial system,” Marie-Emmanuelle Cadieux, Blair’s press secretary, said in a statement.

“Minister Blair continues to collaborate with province and territories to further reduce instances of money laundering across Canada.”

McGuire said he’s “hopeful” things will change, but said there needs to be more concrete steps taken at all levels of government.

“Our approach to this point has really been, ‘Let’s put in a system that appeases the international community,’ not one that fights crime.”

Comments

Comments closed.

Due to the sensitive and/or legal subject matter of some of the content on globalnews.ca, we reserve the ability to disable comments from time to time.

Please see our Commenting Policy for more.