A Carbon tax is an efficient way to reduce greenhouse gas emissions without slowing down an economy, a comprehensive study found.

Eleven teams participated in a detailed study called the Stanford Energy Modeling Forum (EMF) project, which examined the economic and environmental impact of an economy-wide carbon tax in the United States.

Every single team found the same result: not only does a carbon tax lead to substantially fewer emissions, it also could have long-term positive economic growth.

“At a broad level, the results are very unsurprising to me,” said Dale Beugin, executive director of Canada’s Ecofiscal Commission. “The consensus is that carbon tax is going to have a small economic impact, whether positive or negative.”

“Carbon tax is a no-brainer,” he added.

How the study worked

The project looked at various carbon tax prices and different options for using the revenues from the tax — such as revenue recycling, in which the funds created from a carbon tax are returned to taxpayers.

There were 11 scenarios, all examining different regions (some only in the U.S. and others outside the country); emissions (such as carbon and nitrogen); and energy (like nuclear, coal and hydro).

COMMENTARY: A carbon tax is effective policy, despite what seven in 10 Ontarians think

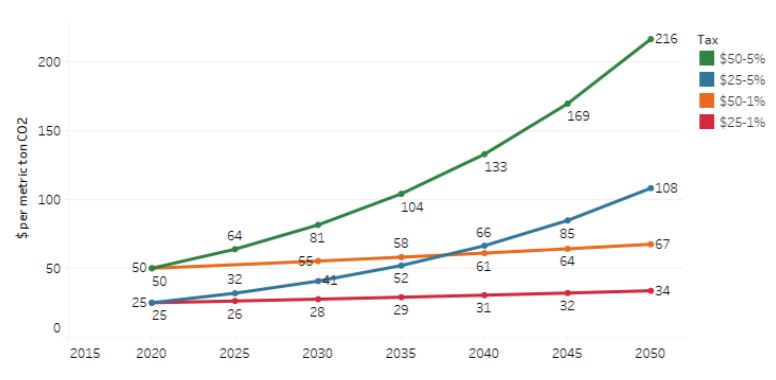

Each scenario imposed a carbon tax that begins in 2020 and increases annually until 2050. The modelling teams examined four carbon-tax scenarios, with starting prices of $25 or $50 per ton of carbon dioxide, rising at one per cent or five per cent per year.

The most aggressive scenario was $50 per ton rising at five per cent a year.

‘Long-term positive economic growth’

The authors said one of the most important findings was that all four models show a decline in energy consumption from 2020 to 2040.

A second important takeaway is that all four scenarios show the direct economic impact is minimal.

“In every policy scenario, in every model, the U.S. economy continues to grow at or near its long-term average baseline rate, deviating from reference growth by no more than about 0.1 per cent points,” the authors state.

Get breaking National news

WATCH: Who should have the final say on carbon tax?

“We find robust evidence that even the most ambitious carbon tax is consistent with long-term positive economic growth, near baseline rates, not even counting the growth benefits of a less-disrupted climate or lower ambient air pollution.”

In all of the models, it showed that the coal-energy sector would decline substantially if a carbon tax were implemented. And the costs associated with health impacts from other pollutants released by burning coal, such as mercury, are substantial.

“Carbon-price scenarios lead to significant reductions in CO2 emissions, with the vast majority of the reductions occurring in the electricity sector and disproportionately through reductions in coal,” the authors stated.

Beugin said the reason carbon tax could be beneficial for an economy is that it’s the cheapest and more flexible way to reduce greenhouse emissions.

“Carbon tax is reliant on market forces, it lets individuals and businesses make their own choice on how to reduce CO2 emissions. It’s the lowest cost for reducing emissions in the economy.”

How governments use the revenue from the carbon tax is another net benefit, he said. Whether it’s giving the money back to individuals in a lump sump or cutting other taxes (like income), “it will make the economy run smoother,” he said.

WATCH: UN warns world economy at risk if global climate change not addressed

Climate change and economy

Pollutants that contribute to climate change, like coal plants, have a negative impact on the economy, the study stated. And this is not the first report to warn about the economic impact of greenhouse gas emissions.

In October, a non-partisan federal watchdog in the U.S. released a report stating climate change is already costing U.S. taxpayers billions of dollars each year, with those costs expected to rise as devastating storms, floods, wildfires and droughts become more frequent in the coming decades.

“The costs of climate change are harder to quantify,” Beugin said. “But as extreme weather events become more frequent, sea level rising, loss of species, changes in migration policies, more droughts … it will impact every sector in Canada and the world.”

Canada’s carbon tax

Canada’s proposed carbon tax would see families pay at least $20 per tonne of carbon dioxide emitted, starting in January 2019 and rising to $50 per tonne by 2022.

In the federal plan, all carbon-tax money collected in a province would remain in that jurisdiction.

The provinces now have until September to submit carbon plans to the federal government that meet standards, or face an imposed carbon tax starting Jan. 1, 2019.

But the issue is a politically diverse one in Canada. Most Conservatives argue it will raise the price of almost everything without actually cutting emissions.

Ontario Premier Doug Ford announced plans to axe the province’s cap-and-trade agreement and challenge the federal carbon tax on the basis that it’s a money grab that won’t help the environment. In Alberta, Opposition United Conservatives Leader Jason Kenney has promised to do away with the tax altogether if elected in 2019.

But economists say it’s still the cheapest way to cut emissions, rather than regulations or subsidies.

B.C.’s carbon tax

British Columbia has had a carbon tax since 2008 and it has not hurt the province’s economy, according to Stewart Elgie, chair of the Smart Prosperity Institute and professor of law and economics at the University of Ottawa.

Not only has B.C. outperformed the rest of the country on lowering emissions, its economy has almost doubled, he said.

WATCH: New B.C. carbon tax goes into effect

— With files from Global News’ Jane Gerster

_640x360_1219234371874.jpg?w=1200&quality=70&strip=all)

Comments