Smart speakers like the Amazon Echo and Google Home were one of the hot items on Canadians’ shopping lists last holiday season. But according to one recent study, in a few years they may become the main tool we’ll use to fulfill those shopping lists.

The past year has been a “decisive” one for the spread of so-called conversational commerce, the use of voice-activated assistants like Amazon’s Alexa, Google Assistant and Apple’s Siri to make purchases, according to a survey of consumers in the U.S., the U.K., and France by Capgemini. And uptake is expected to continue to increase fast, with those who already use voice assistants expected to do nearly 20 per cent of their spending that way, a sixfold increase from today.

But could mouthing shopping orders at a speaker make us spend more than we realize?

READ MORE: Staggering share of Canadians fear bankruptcy if interest rates rise much more

A wealth of research has found that we tend to spend more when we rely on credit cards rather than cash, and even more when we just tap our piece of plastic rather than punching in our PINs. In general, the easier the payment method, the more slippery the slope toward impulse buys and busted budgets, it seems.

READ MORE: Your debt in 2018: The economic trends that could hit your pocketbook

“The outflow of money is very vivid when individuals use legal tender such as cash making it painful to part with. In contrast, any payment mode that makes the outflow of money less vivid, and thus less painful, reduces the psychological barrier to spend,” reads a seminal article published in the Journal of Experimental Psychology (JEP) in 2008. Many studies have since come to similar conclusions.

LISTEN: Erica Alini talks voice-activated assistants with Tasha Kheiriddin on 640 Toronto

With credit cards, in particular, the “pain of paying” is further softened in two ways, continued the authors of the JEP study. First, the actual payment is delayed. Second, consumers typically pay off credit cards as an aggregate bill, which decouples the payment from single purchases.

Another study found that people were ready to spend US$175 on a Thanksgiving party when using a credit card, but only US$145 when using cash.

Similarly, a 2012 study by Mastercard found consumer spending rose by 30 per cent within the first year of adoption among cardholders who received tap-enabled cards.

Voice-activated assistants “could easily be” another step in that direction, said Stacy Yanchuk Oleksy, director of education and community awareness at the Credit Counselling Society.

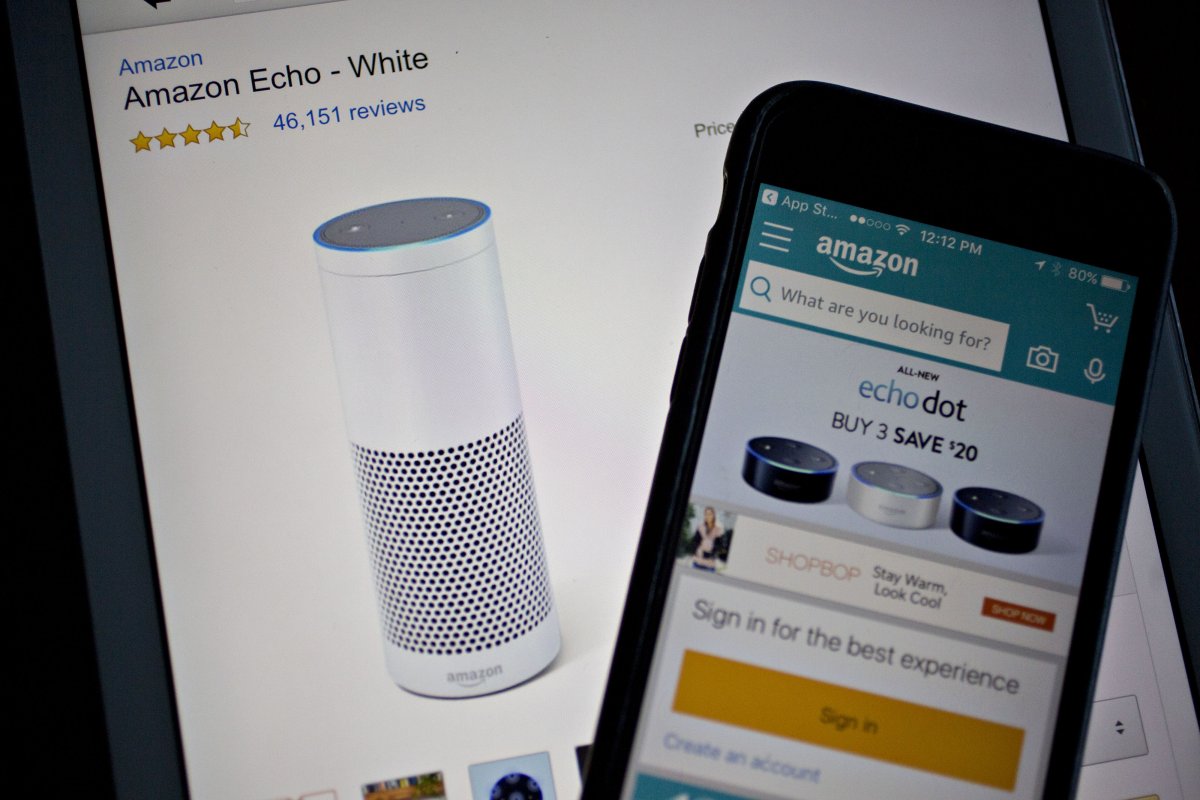

WATCH: Everything you need to know about the Amazon Echo

Convenience, speed and the ability to shop while attending to other tasks are among the top reasons why consumers love voice assistants, according to the Capgemini survey.

And consumers will likely pile up those purchases on their credit card balances, which perpetuates the issue of de-linking purchase from payment.

But “that comfort and ease could make our spending easier,” Yanchuk Oleksy said. And perhaps a little too comfortable.

In a country where average credit card debt hovers around $4,000 and many say they fear bankruptcy if interest rates rise much more, that’s cause for concern.

But “convenience doesn’t need to break us financially,” said Yanchuk Oleksy.

WATCH: An in-depth look at smart home speakers

A common piece of advice for people who struggle with debt is to keep enough cash for a week’s purchases in an envelope. Watching those bills dwindle, goes the theory, will help big spenders tame their instincts.

But Yanchuk Oleksy says she tends to spend more when using bills and coins.

“I become quite generous with cash,” she told Global News.

Technology, she said, doesn’t change the fundamentals of what it takes to stick to a budget and avoid overspending.

“Track your expenses, have some ‘fun’ money, and understand your instincts,” she said. “And always ask yourself the question: ‘Do I need this or do I want it?'”

In the era of voice-assisted shopping, one could translate that as “think before you speak.”

Comments