There can be little doubt about B.C.’s attractiveness as a place to retire.

The province was home to four out of the top 10 places to retire in Canada in a list generated by MoneySense earlier this year.

Coverage of seniors on Globalnews.ca/bc:

But statistics reported by the Fraser Institute show that B.C. is taking an outsize number of seniors compared to other provinces — and, in effect, incurring an outsized health care cost for people who spent most of their lives paying taxes elsewhere.

A new report from the free-market think tank shows that B.C. took in a net migration of over 40,000 people aged 65 and over from 1980 to 2016.

That’s almost four times more than any other province did — Alberta was closest at just over 11,000.

READ MORE: Survey gives mixed grades to B.C. seniors’ care homes

Get weekly health news

Such a trend comes with a cost — in B.C.’s case, it was $7.2 billion in extra health care costs, while Quebec saved about $6 billion as over 37,000 seniors left that province, according to the institute.

“When seniors move from one province to another, because of the way that we’re financing health care, we have this imbalance between where you’re paying your taxes for most of your life, versus where you’re going to consume your health care costs,” Jason Clemens, a report co-author and executive director at the Fraser Institute, told Global News.

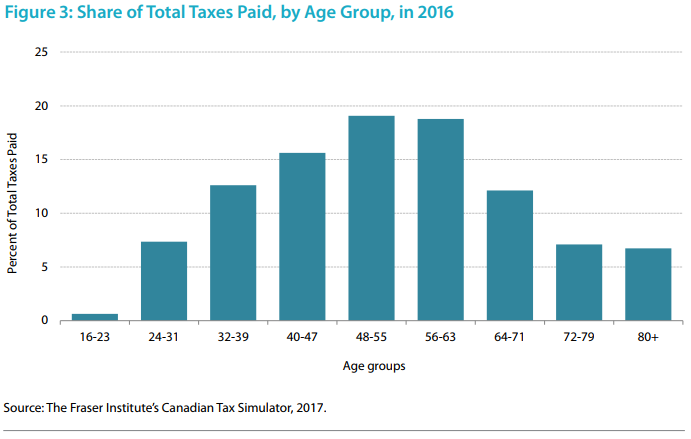

The report identified a “contrast” between how much money is spent on health care for seniors, and how much different age groups pay in taxes.

That contrast was illustrated in the following charts:

In calculating Canadians’ tax bills, the Fraser Institute took into account taxes on income, property, sales, profits, social security and employment, as well as import duties, alcohol and tobacco taxes, fuel taxes and more.

“This isn’t a material issue for the structure of health care spending and financing in Canada except when seniors migrate to another province which means they would have paid a majority of their taxes in one province but consumed a majority of their lifetime health care spending in another,” the report said.

B.C. pays a higher price because of how health care is funded in Canada, the institute added.

“The Canada Health Transfer is done on a per capita basis, so it would treat someone who’s 45 in their prime working age the same as they would treat someone who’s 75 at the peak of their health care consumption,” Clemens said.

“So currently there is no mechanism to adjust for the movement of seniors, and therefore this demographic effect when we look at health care costs.”

And the cost to B.C. is a problem that’s only set to increase as seniors as a share of the population grows from 16.9 per cent this year to 23.1 per cent in 2031.

The Fraser Institute suggested that health transfers be adjusted based on migration patterns.

But it also said changes could come through “larger scale — even wholesale reform — of the country’s universal health care system.”

- Video report by Keith Baldrey

Comments