Ask any Conservative politician in Ottawa, and they’ll tell you exactly why proposed changes to Canada’s tax laws are a terrible idea.

The changes discourage small business owners from expanding or investing in their shops, farms and clinics, the Tories contend. They impose an unfair burden on those same hard-working Canadians, taxing them not once, but twice on investment income — to the the tune of almost 73 cents on the dollar.

On top of that, they allegedly target small bakeries, garages and corner stores, not just wealthy doctors and lawyers.

WATCH: Majority of Canadians against proposed tax reforms, poll suggests

A copy of the Conservative playbook on this contentious issue was recently obtained by Vice News, and it shows that the official Opposition is hoping to hammer the government on its “small business tax hike” for weeks to come.

On Tuesday, leader Andrew Scheer unveiled a new website where people can go to “save local business.” Meanwhile, Conservative MPs have been busy on social media rolling out the attack strategy.

But are these criticisms legitimate? Let’s explore the facts.

Passive income aggression

First, it’s important to note that many (although certainly not all) of the Conservatives’ concerns are based on one particular loophole that may be closing; the one having to do with so-called passive income.

READ MORE: It might not be much, but business owners and doctors can get federal mat leave benefits

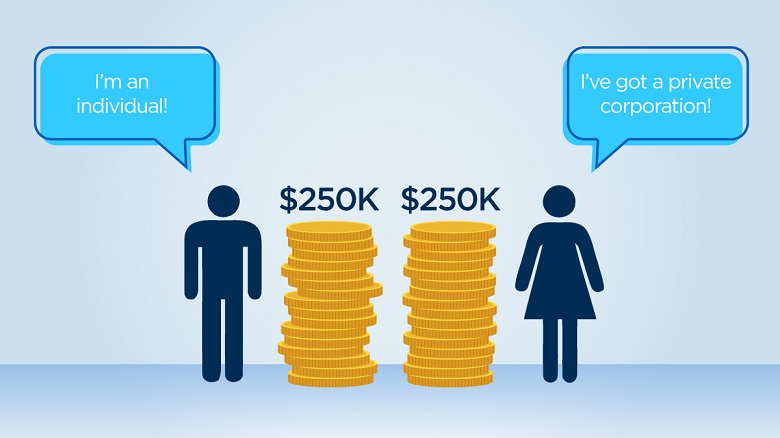

In this simplified example, we’ll assume that two successful Canadians are doing the same job and taking in $250,000 a year. That puts them firmly in the top income tax bracket. The more you make in Canada, the more you pay.

The only difference between these two is that one has set up a private corporation, and the other has not.

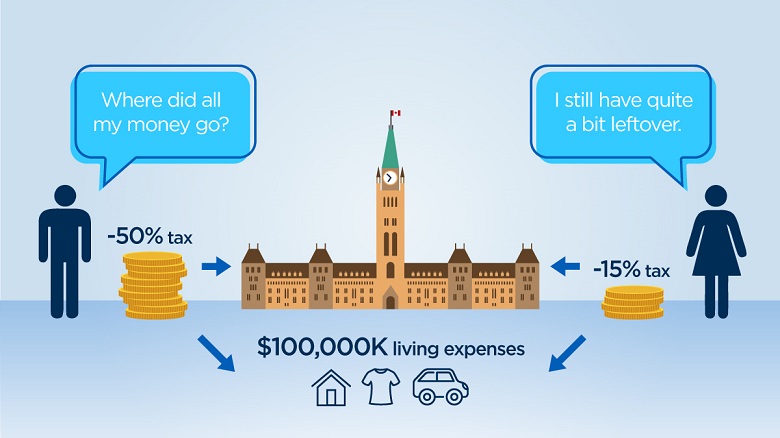

At tax time, the person with the corporation sees their income taxed at a much lower rate than their non-incorporated counterpart.

Once you subtract living expenses, our two successful Canadians end up with significantly different totals left over.

Now, let’s assume they’re both trying to save for retirement and invest all that extra cash every single year.

Get weekly money news

The non-incorporated person uses up all his RRSP room and TFSA room. He then puts the rest of the money into a taxable savings account. The incorporated Canadian, meanwhile, keeps all of her $90,000 inside her business and invests it in a mutual fund.

Let’s also say that both of them repeat this every year and enjoy a six per cent return on investment. (In this example, we’re considering only non-income earning investments, or investments that realize fully as capital gains in year 25.)

The advantages to the incorporated business owner become more pronounced as the investments grow.

At the end of year 25, they both take all the money out.

Even though the incorporated Canadian has to pay a hefty business tax on the investment returns, and personal tax on withdrawing the money, her overall nest egg is $3.4 million. The non-incorporated Canadian ends up with $2.8 million, a significant difference.

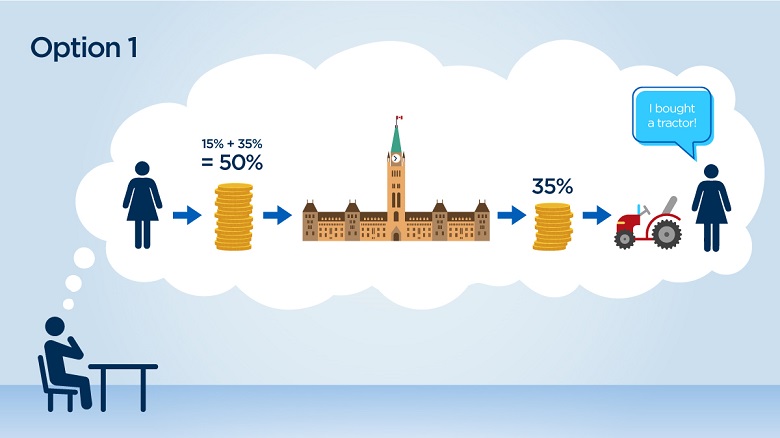

It’s this outcome that the government alleges is unfair, and Ottawa is looking at a few options to change it. The first is to tax the incorporated owner at a higher rate right at the start.

Instead of 15 per cent, they’d have to hand over 50 per cent just like their non-incorporated counterpart. But — and this is critical — they would get up to 35 per cent of it back if they planned on using the extra money to, say, hire another staffer or buy a new piece of machinery for their farm.

The Conservatives have suggested that the tax changes will prevent small business owners from purchasing needed equipment or hiring new staff, but this particular fix is designed to avoid that.

If, however, our incorporated owner decides not to use the money for extra staff or a new tractor, the 50 per cent stands. The two Canadians in the example would, therefore, end up with the exact same amount of money to invest, and in 25 years they have the same amount to withdraw.

- Ontario government home care vendor paid ransom to regain access to its servers: report

- Latest B.C. budget most unpopular since Gordon Campbell’s 2010 budet: poll

- Manitoba government proposes health charter but Opposition questions effectiveness

- Manitoba Tories say minors may have access to planned drug consumption site

The government isn’t keen on this fix, however, because there are too many variables in play.

Which brings us to option two: taxing the investment profits at a higher level on the other end (by removing an existing refund). This is a highly simplified illustration of that idea:

The ’73 per cent tax’

The Conservatives are arguing that incorporated small business owners would, under the proposal, end up paying a 73 per cent tax on investment income. Note that this is not a tax on their overall income, or even on the total value of their investments. It’s a tax on the additional money they earn over time through those investments.

“The Minister of Finance’s proposal is to tax small business investment income at 73 per cent,” said Conservative MP Gerard Deltell in the House of Commons on Wednesday.

Finance critic Pierre Poilievre contends it’s the little guys who will really be hit hard.

While the 73 per cent figure is technically accurate, there are a few holes here.

First, that eye-popping rate would only apply if and when the money earned on investments is paid out to the business owner’s personal account from their corporation; i.e. if Joe Smith gets money paid out to him from his company, Joe Smith Inc.

READ MORE: Ex-Liberal finance minister says Trudeau’s tax changes driving out businesses

If the money stays inside Joe Smith Inc., however, and it’s withdrawn to pay for a new piece of equipment, the tax on the investment income stays the same as it has always been — closer to 50 per cent.

University of British Columbia economist Kevin Milligan also points out that the “73 per cent tax” would only apply to investment income earned by a very specific subset of incorporated business owners. Namely, those living in Ontario and earning over $220,000 a year. The numbers would be different if you make less, or live in another province.

Finally, as Milligan points out in a recent blog post, the Conservative calculations ignore the fact that the incorporated Canadian we saw above had a lot more money than her counterpart to invest, and grow, in the first place.

Bottom line: the opposition isn’t wrong, but they have simplified a pretty complex set of variables here.

According to the government, the goal overall is to ensure that investment income is treated exactly the same whether it’s been sitting inside a corporation before being paid out to an owner, or sitting in a personal savings account.

What about income sprinkling?

The government’s plan for so-called “income sprinkling” has also come under fire from the opposition. What’s important to note is that the practice of dividing up income among family members in lower tax brackets (thus paying less tax overall) will be permitted to continue.

The Liberals estimate, however, that 50,000 families across the country are using this technique illegitimately — in other words, the family members “earning” the income aren’t doing any work related to the business.

The Liberals have proposed a “reasonableness” test to determine if members of a family are actually contributing on the farm or in the bakery.

The Conservatives are correct when they say that it’s still unclear what that might involve, or how the Canada Revenue Agency would go about administering it. Such a test would also likely place additional burdens on small business owners when it comes to paperwork and general bureaucratic red tape.

Comments

Want to discuss? Please read our Commenting Policy first.