The B.C. New Democrats have delivered their first budget update since taking office. And as promised, the new government is increasing taxes for anyone with an annual income of more than $150,000.

The proposed increase would rise to 16.8 per cent a year from 14.7.

“Those at the top can pay a little bit more for the services that benefit all British Columbians,” Finance Minister Carole James said Monday.

The New Democrats are also bumping up corporate income tax from 11 per cent to 12 per cent.

The government is also eliminating the controversial International Business Activity Program, which was blasted for giving tens of millions in tax breaks to international financial institutions without evidence of job creation locally.

For small businesses, the NDP is lowering the tax rate from 2.5 per cent to 2 per cent.

The government is also bringing in a $5-per-tonne increase to the carbon tax, which was part of the NDP’s deal with the Green Party.

One key difference from the B.C. Liberals is that the tax will no longer be revenue neutral, which means the money will now go towards green initiatives.

“It will be critical to be upfront about where those dollars are being spent: where the revenue is coming in, and where the green initiatives are,” said James.

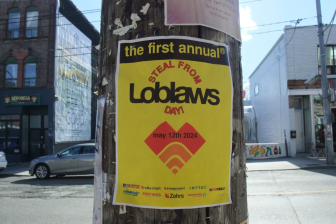

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Canadian food banks are on the brink: ‘This is not a sustainable situation’

- Is home ownership only for the rich now? 80% say yes in new poll

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

“I would not expect the public to think that they’re just paying an increase without being accountable for exactly where those dollars are spent.”

However, this could mean an additional cost to some residents.

She added that the province will also be increasing the low- and middle-income climate action tax credit to help more families with increased costs.

But there is one change in the budget update many didn’t predict: come tax time, parents will lose several key tax breaks.

The children’s fitness, children’s fitness equipment, and children’s arts credits are being eliminated, adding $11 million a year to the province’s coffers.

Comments