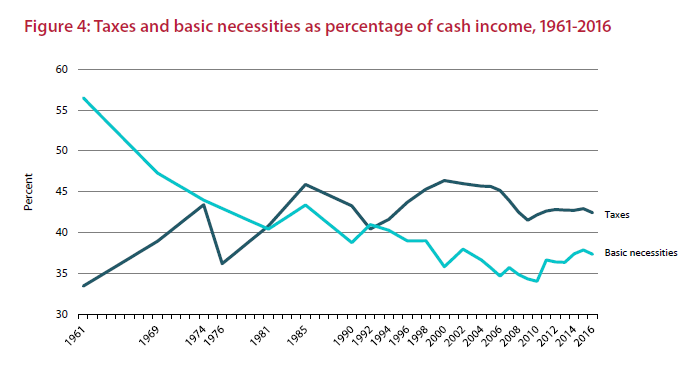

Canadians pay a whopping 42.5 per cent of their income in taxes, according to a new report by the Fraser Institute.

An average family with an income of about $83,000 paid roughly $35,000 in taxes last year, the Vancouver, B.C.-based think-tank calculated. That overall tax bill accounts for federal, provincial and local taxes, including income, payroll, sales and property taxes.

READ MORE: Bill Morneau, provincial finance ministers to start deep dive on pot taxes

By comparison, a typical Canadian household used only 37 per cent of its income on basic necessities, according to the report. Spending on housing (including rent and mortgage payments), food and clothing amounted to $31,000 for the typical family.

“Many Canadians may think housing is their biggest household expense, but in fact, the average Canadian family spent more on taxes last year than on life’s basic necessities — including housing,” said Charles Lammam, director of fiscal studies at the Fraser Institute.

READ MORE: Canada pays OAS to seniors with over $100K in income. It shouldn’t, economists say

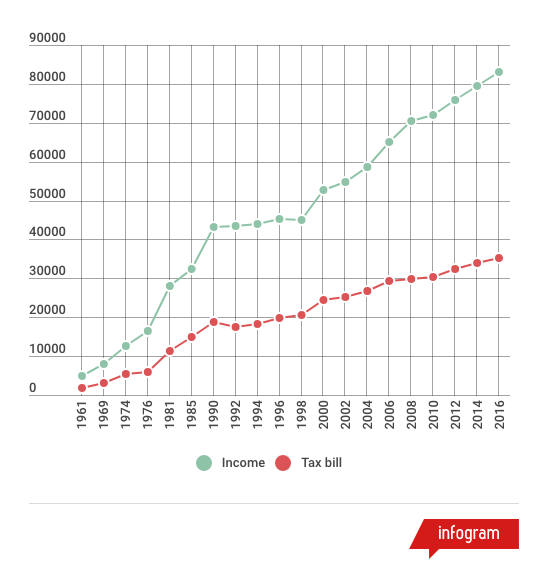

Canadians’ tax bill has risen by over 2,000 per cent since 1961, much faster than the price of many consumer products.

The Consumer Price Index (which measures the average price that consumers pay for food, shelter, clothing, transportation, health and personal care, education, and other items) rose by only 718 per cent over the period, the report said.

Get weekly money news

READ MORE: What do Canadians think of basic income? It will reduce poverty but could raise taxes

This represents “a marked shift” since the early 1960s, when the average Canadian family spent around a third of its income on taxes and nearly two-thirds of it on food, clothing and housing.

Still, Canadians are paying a relatively lower tax bill today than they were between the late 1990s and the financial crisis, the data suggests.

WATCH: Changes to taxes in 2017 for Canadians

In 2000, for example, a whopping 46 per cent of Canadian income was flowing to taxes, the highest share since 1961.

The ratio of taxes to incomes was still hovering around 45 per cent in 2006, but dropped to roughly the current level in 2012.

And the share of income Canadians used to devote to basic necessities literally collapsed during the 1960s and was in steady decline until the early 1980s.

The numbers also show that Canadians’ incomes rose much faster than their overall taxes:

Comments