Uber Technologies posted a $708 million loss in the first quarter of 2017, the company confirmed this week.

It also lost Gautam Gupta, its head of finance, The Wall Street Journal reported Thursday.

That’s a lot of money and one big name to lose.

But for some investors, the financial results qualify as “good” news at a company that lost billions of dollars last year — and enough in total to be considered the “most heavily-lossmaking private company in the history of Silicon Valley,” according to The Financial Times.

As a private company, Uber doesn’t have to disclose its finances.

But news of its financial situation has trickled out of news outlets such as the Journal, Bloomberg and Forbes since at least last year.

This year, Uber started disclosing “selective” results, according to Business Insider, and they paint a picture of a company that has started to stem the flow of cash it loses on a quarterly basis, as signs mount that it could go to an Initial Public Offering (IPO).

READ MORE: Uber asks Canadians to call their MPs when asked to pay taxes

The most recent results show a loss of just over $700 million in the first three months of this year, it confirmed to Business Insider and the Journal.

Uber made its first-quarter results public after the company declined to do so in April, The Financial Times reported.

That’s down from a loss of $991 million that was recorded in the fourth quarter of 2016.

It also comes after Uber Technologies lost $2.8 billion last year, as the company ramped up its expansion efforts around the world.

Numerous reasons have been cited for the losses.

One of them is the amount of money Uber has to spend in order to enter markets where taxis hold a monopoly, Simon Fraser University marketing professor, Lindsay Meredith, told Global News.

Get breaking National news

“Uber doesn’t seem to like to take no for an answer,” he said.

“You’ve got a very aggressive management team and they’re prepared to spend some serious money to basically hack their way into these markets, and it means putting up a lot of up front money with absolutely no return coming in at the front end.”

Uber has been locked in battles in numerous Canadian cities including Calgary, where it first launched in October 2015 before the city filed an injunction against it the following month.

Calgary later passed ride-sharing regulations that would allow Uber to operate there legally, but the company balked at them, saying the city was “trying to fit ride-sharing into a taxi model.”

Uber started operating in Calgary again in December 2016.

READ MORE: Uber comes back to Calgary: operations resume Dec. 6, 2016

The amount of money Uber pays to drivers has also been cited as a major cost.

Last year, Bloomberg reported on a company conference call in which then-finance head Gupta discussed a loss of over $750 million in the second quarter of 2016, which represented an increase over a loss of $520 million in the first quarter.

One of the biggest reasons for the losses was subsidies to Uber drivers, Gupta said at the time.

As noted by Gizmodo, documents published by The Information showed the company paying $2.72 billion to drivers in 2015, while only losing $72 million due to price cuts and promotions around the same period.

READ MORE: Uber CEO Travis Kalanick says it’s time for him to ‘grow up’

But losing money is common practice in Silicon Valley, where it’s possible to lose billions but still manage to draw investors who see potential for growth, CNN noted.

Snap, the parent of Snapchat, experienced losses of $2.2 billion in the first quarter after its IPO, but the company is still trading at about the price it was when it went public.

And then there’s Amazon, which has lost money while increasing its market value, though its losses never topped $1.4 billion in 2000, Bloomberg reported.

Uber did not return a request for comment to Global News by press time.

Investors unconcerned

But the ride-hailing company’s losses haven’t exactly been a cause for concern with certain investors.

As CNN noted, angel investor Jason Calacanis was happy with its most recent financials, noting an 18 per cent growth in revenue (it was $3.4 billion) and a one-third reduction in losses.

Investor Bradley Tusk was similarly unconcerned.

“The trend is good,” he said.

“Revenue up. Losses down, even though they keep investing heavily around the world.”

READ MORE: Uber executive asked to resign after he didn’t disclose sexual harassment allegation

But Uber’s first quarter wasn’t all good news for the company.

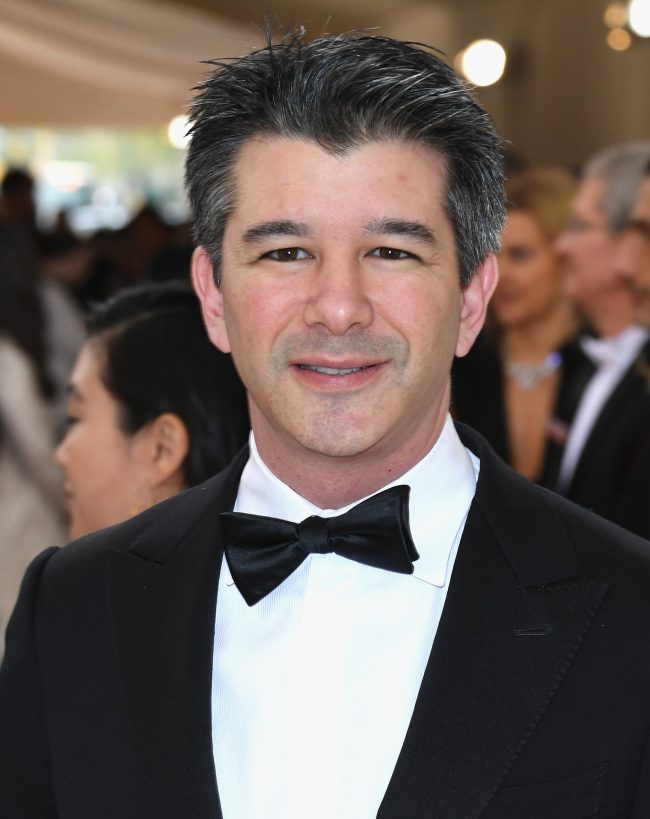

The ride-sharing company was also dogged by allegations of sexual harassment and concerns over CEO Travis Kalanick’s behaviour.

In February, former Uber employee Susan Fowler wrote a blog post in which she described being sexually harassed by her manager, and a lack of response by the company’s human resources department.

Uber Technologies subsequently hired former U.S. attorney general, Eric Holder, to carry out a review of sexual harassment allegations at the company.

Meanwhile, in March, Kalanick said it was time for him to “grow up” after a video showed him in a heated argument with an Uber driver.

At one point the driver said, “people are not trusting you anymore.”

Kalanick responded, “Some people don’t like to take responsibility for their own s***. They blame everything in their life on somebody else. Good luck!”

The CEO apologized for how he treated the driver.

- With files from The Associated Press

Comments