More and more Albertans have or are in danger of losing their homes to the bank, according to numbers from the province.

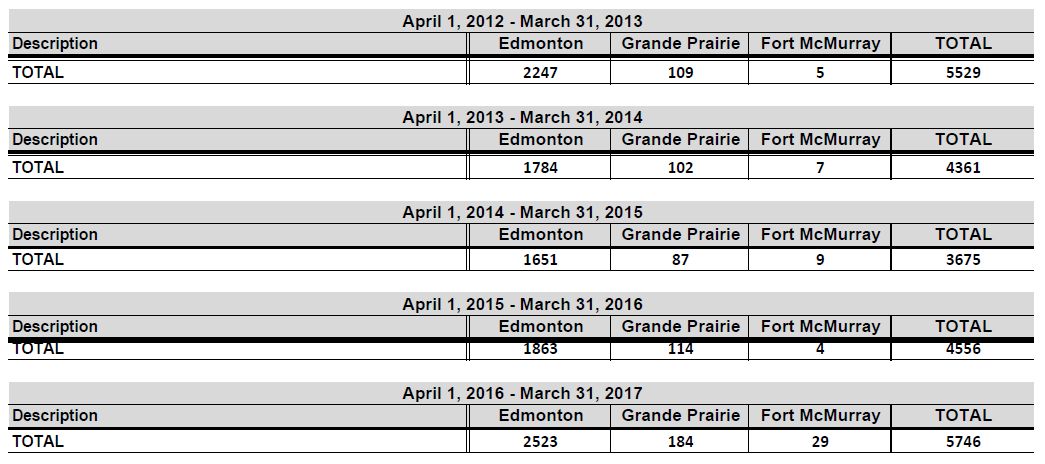

Foreclosures are on the rise, up by about 25 per cent annually over the past two years. Statistics from the province show a total of 5,746 properties were foreclosed on between April 1, 2016 and March 31, 2017. Of those, 2,277 were in Calgary and 2,523 were in Edmonton.

The Alberta total for the same time period the previous year was 4,556. In 2015, the total was 3,675.

“Due to the commodity crisis, the oil patch being depressed, a lot of people lost their jobs, there’s a lot of single-income households right now and that’s been really driving the increase of foreclosures over the last year to a year-and-a-half,” said Tim Reid with Phoenix Real Estate Investing.

The number of foreclosures in Alberta spiked back in 2013, when Edmonton saw 2,247 and the province as a whole saw 5,529. However, this past year, the number of foreclosures has exceeded even that.

READ MORE: Alberta unemployment hits 9%, highest in 22 years

More Albertans are also falling behind on their mortgage payments. The Canadian Bankers Association tracks the number of homeowners three months or more behind on payments to 10 major lending institutions.

As of February this year, there were 2,736 mortgages in arrears in Alberta. That represents less than half a per cent (0.47 per cent) of total mortgages. It’s still a three-year high, but below the January 2011 peak of 0.84 per cent.

READ MORE: Construction of new homes in Canada hits highest level in nearly a decade

“I think we’re going to see more foreclosures, especially in the Edmonton market because that market typically follows Calgary by about six to nine months, and we’re seeing that now,” Reid said. “As far as the Calgary market is concerned, I think we’ve seen about as low as it’s going to go.

“No one can truly predict the bottom but I think we’re starting to see some optimism in the marketplace and competing offers are even happening today.”

“What I think it’s going to take to turn things around is for… oil to come back, the jobs to kind of come back into Alberta, and again, have an influx of people,” added John Shwetz, with VII Ltd. in Edmonton. “I think that’s starting to happen a little bit, but we definitely need to see more housing starts and more oil.”

Fort McMurray saw a huge spike in foreclosed properties this past year, recording 29 between April and March. That’s over three times more than any other year since 2013.

READ MORE: ‘It’s been a struggle’: Rebuilding Fort McMurray could take up to 5 years

Experts suggest seeking out support or advice before banks and lawyers get involved.

“I think fear strikes a lot of people, they’re not sure what to do in that situation, they panic and then end up making bad decisions,” Shwetz said.

“A lot of times people just kind of want to hide and not talk to anybody, and that’s one of the worst things they could do because then the bank starts calling them, they start wanting payments and they just kind of hide and don’t know what to do and end up in a situation where the bank’s knocking on their door asking for keys when it could have been easily solved by contacting somebody who could help them through the process.”

They say filing for foreclosure should be a last resort as it can damage credit and may prevent you from getting another home for seven years.

Comments