The Trudeau government has unveiled the 2017 federal budget. Here’s everything you need to know about how the budget will affect you.

- Big investment in affordable housing, nothing to cool red-hot markets

- Federal Budget 2017 in 3 charts

- How the budget will affect your pocketbook

- Liberals extend parental leave to 18 months, boost childcare funding

- Trudeau government projects $28.5 billion deficit in 2017-2018

- What’s missing from the 2017 federal budget?

- Federal budget 2017 is a plan to train, but not retain, Canadian brains

Note: This story was published before the budget was released. For the latest information, please read the stories linked to above.

The Liberal government is set to unveil its second federal budget on Wednesday.

The budget is expected to contain initiatives that would boost Canada’s “innovation economy,” with funds that could help some of the country’s young firms enter the next stages of their development.

But it also comes at a challenging time for Canada’s economy.

U.S. President Donald Trump has promised a host of tax reforms down south that could erode Canada’s competitiveness.

That doesn’t give the federal government much freedom to raise taxes.

Analysts with RBC and Scotiabank have released budget previews that give Canadians some idea of what they can expect in Wednesday’s budget.

Here are seven things that may appear when the budget is released:

1) Deficits as far as the eye can see

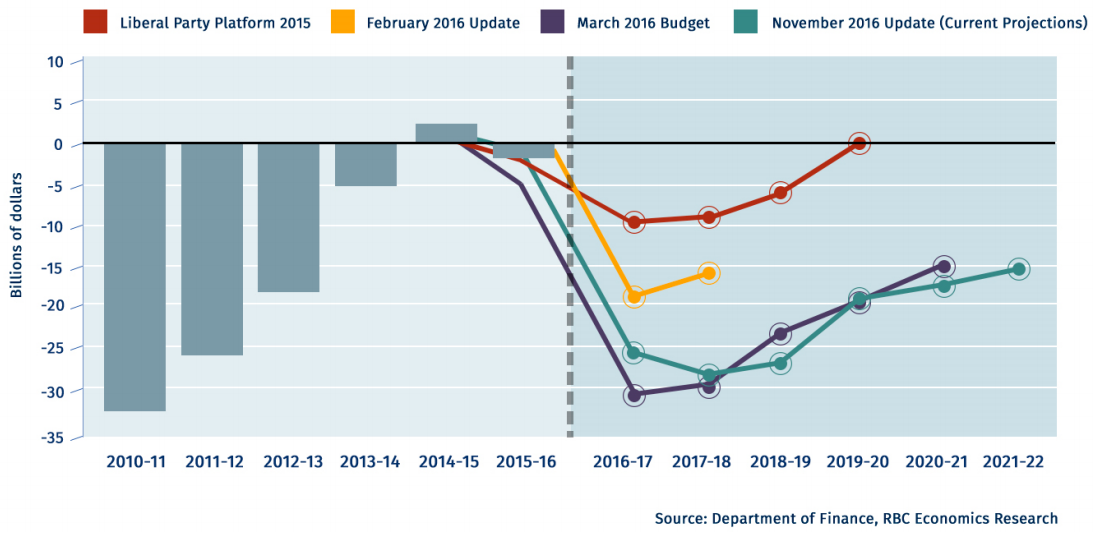

During the 2015 election, the Liberal Party sold Canadians on a plan to run deficits of up to $10 billion per year, and reach a surplus in 2019.

But the Liberals revised their expectations in last year’s budget, when they projected a $29.4-billion deficit for the 2016/17 fiscal year, with a plan to bring the shortfall down to $14.3 billion in 2020/21, after their mandate ends.

WATCH: The Liberals promised their deficit spending would boost the GDP and create jobs. Has it? And how will ballooning deficits affect this budget? Vassy Kapelos reports.

RBC’s “Federal Budget Preview” envisions similar projections in Wednesday’s budget. Economists Laura Cooper and Craig Wright expect the deficit to hit $25.1 billion in the current fiscal year before it climbs to $27.8 billion in the next one.

Get daily National news

By the end of its mandate, Cooper and Wright expect the Liberal government to post a $25.9 billion deficit, with a plan to reduce it to $14.6 billion in 2021/22.

2) The end of the Children’s Fitness and Arts Tax Credits

It shouldn’t come as a surprise, but Wednesday’s budget could spell the end for the Children’s Fitness and Arts Tax Credits, Scotiabank said in a Fiscal Pulse report.

The Children’s Fitness Tax Credit allowed taxpayers to claim fees for children enrolled in physically active programs, up to $500 in the 2016 tax year. They used to be able to claim $1,000.

The Children’s Arts Tax Credit, meanwhile, allowed taxpayers to claim fees for arts, cultural, recreational or developmental activities, up to $250 in the 2016 tax year. They used to be able to claim $500.

The Liberals proposed to phase these tax credits out in the 2016 budget. The Canada Revenue Agency website also says they will be phased out.

3) A worsening debt-to-GDP ratio

Canada’s debt-to-GDP ratio is a point of pride for the Great White North — it’s among the lowest of all G7 countries.

That status is unlikely to be threatened by the budget. But the government’s revised deficit forecasts could add $130 billion to its debt load, RBC said.

The debt-to-GDP ratio will remain low, but Canada won’t look as good compared to other countries with AAA credit ratings, it added.

Canada’s debt-to-GDP ratio was estimated at 31.1 per cent in 2015/2016. It’s projected to hit 31.8 per cent in the two subsequent fiscal years, according to long-term economic and fiscal projections released by the government last year.

RBC did not provide an updated forecast of what the debt-to-GDP ratio could be with the new budget.

4) The comeback of the fiscal cushion

A fiscal cushion is a tool that allows a government to guard against “unforeseen costs.”

The Liberal government dropped the fiscal cushion in last year’s fall economic update, but it’s expected to come back in this one.

The move would push the deficit up by about $6 billion, compared to what was announced in the fall economic update.

5) Little room to raise taxes

The election of U.S. President Donald Trump leaves Canada with very little room to raise taxes.

While Trump has yet to roll out his tax reforms, he has promised to slash personal income taxes to the point that U.S. income taxes would trail those in every Canadian province by an average of 13 per cent, RBC analyst Matthew Barasch noted last year.

Trump also wants to slash corporate income tax rates from 35 per cent to 15 per cent, erasing Canada’s advantage.

In other words, Canada can’t do much as far as hiking taxes, if it wants to remain competitive.

There has been speculation that Canada’s budget could raise taxes on capital gains, but that could be “hard to square with the government’s billing of the document as an innovation budget, given that some sectors use stock-based compensation to attract talent,” the RBC report noted.

6) Skills development

The budget may include some initiatives designed to broaden workforce participation, according to Scotiabank.

That could mean the adoption of a “FutureSkills Lab,” which could help boost training so that workers could adjust to technological changes.

It could also mean the implementation of the “Global Skills Strategy,” which would establish a “two-week standard for processing visas and work permits for low-risk, high-skill talent for companies doing business in Canada.”

7) More claims that the budget will lift Canada’s GDP (even though it’s not clear that happened last time)

It’s not easy for a government to boost its economy using fiscal policy.

That much is apparent from last year’s budget, which the feds said would grow GDP by about half a percentage point in 2016 and 2017.

There is “scant evidence that this occurred,” the RBC report said.

Canadians may be told to expect more economic growth this year, or see it spill into 2018, it added.

8) More details on Canada’s infrastructure bank

In the fall economic update, Finance Minister Bill Morneau announced the creation of a Canadian infrastructure bank that would help to fund construction projects across the nation.

The Liberals promised to kick $35 billion into the bank with the hope that they would attract $4 to $5 in private sector funding for every $1 of federal cash.

The Wednesday budget may provide more clarity on the infrastructure bank, Scotiabank said.

It may also offer more details on delays that have plagued projects announced as part of Phases 1 and 2 of the Liberals’ 12-year, $187-billion infrastructure program.

Comments