You could work as long or as hard as you can to make a living in Vancouver.

Or you could own a single-family home in the city and earn twice as much by basically doing nothing.

That’s the conclusion of Dr. Jens von Bergmann, a data visualizer with Vancouver-based firm MountainMath.

He analyzed BC Assessment data for 2016 and found that people who owned single-family homes in the city last year earned double what local residents did by working.

In other words, a select group of lucky Vancouverites made $1 million or more last year by “twiddling their thumbs.”

This map highlights properties whose land value grew by over $1 million last year:

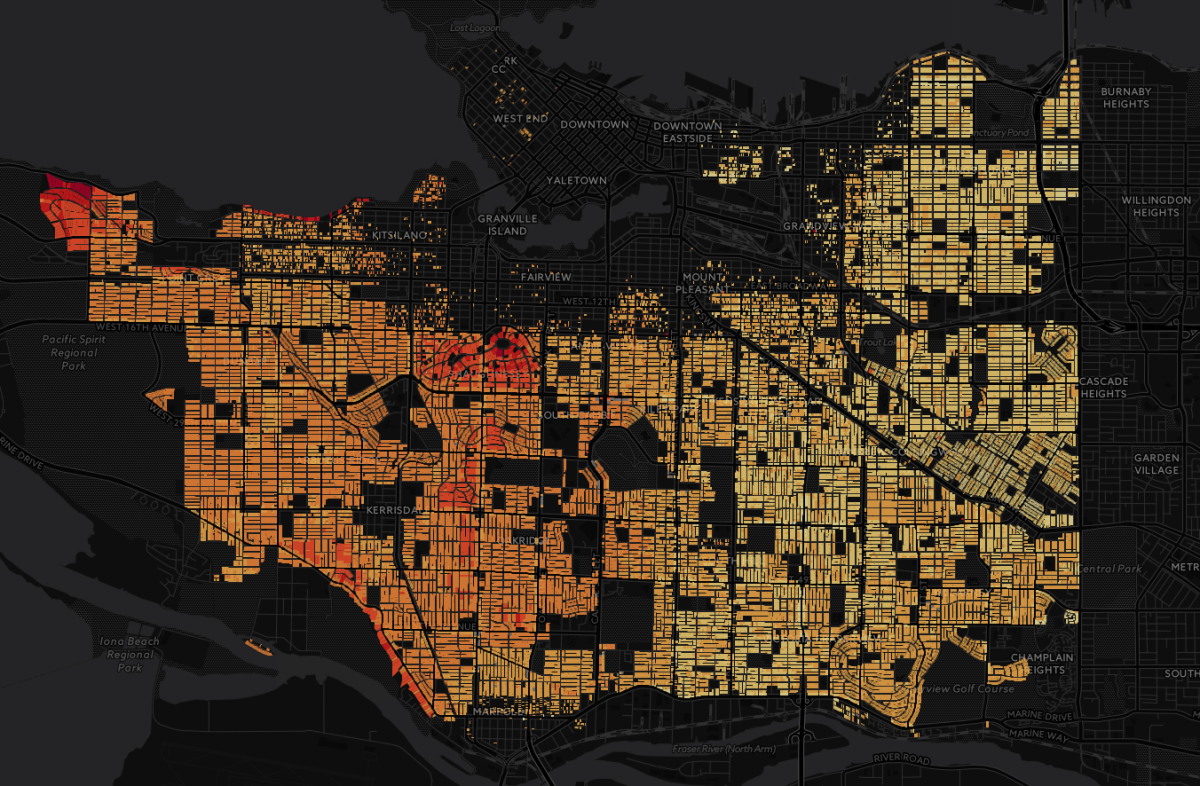

And this map shows how much land values grew all over the city in 2016:

Von Bergmann’s latest research comes a year after he completed a similar project which found that single-family homeowners could earn more by holding on to their properties than the whole population of Vancouver did by working.

He was inspired to do the research after seeing how much assessed values were increasing, and he was looking for something to compare them to.

Get weekly money news

READ MORE: Chip Wilson’s Vancouver home now worth over $75 million

This time, however, “the comparable doesn’t even work anymore,” von Bergmann told Global News.

“Just single-family houses alone went up twice as much, the rise was twice as much as the income of the City of Vancouver.”

Figuring out Vancouver’s cumulative income required some estimating, as Statistics Canada only has data up to 2014.

Von Bergmann extrapolated the data for the two years up to 2016 and came up with an estimate of $26.8 billion of pre-tax income, or $22.3 billion after-tax.

That number is dwarfed by the land value increase for single-family homes — $46,717,326,799, according to von Bergmann’s research.

That’s about $239 per hour last year alone. It was $126 per hour in 2015.

Of course, these increases don’t necessarily mean that homeowners immediately brought in $1 million just by owning their homes — it’s not like they can access the money until they sell.

The data is also based on the BC Assessment, which only accounted for home values as of July 1, 2016, before B.C. slapped a 15 per cent Property Transfer Tax on foreign buyers on Aug. 2.

Von Bergmann thinks it’s possible that the new tax could dampen home values.

But he remains concerned that rising property values could mean that the next generation can’t buy a home in the city.

“If I look at my son who is now seven years old, I would like to tell him that if you work hard and study hard, you can be whatever you want to be,” von Bergmann said.

Now, he said, members of his generation often need a financial boost from their parents to make it happen.

“And it’s just not the story I want to tell him.”

Comments