Tim Hortons hasn’t minced words since combining with Burger King last year to form Restaurant Brands International – the game plan is to aggressively “bring one of Canada’s most iconic brands to the world.”

One of its first stops on that journey: Ohio.

Tim’s is partnering with Ampex Brands, a Texas-based franchisee of banners like Taco Bell, A&W Restaurants and KFC in the United States. Ampex’s deal calls for an “aggressive” roll-out of locations in the Buckeye state over the next several years, a statement said.

Analysts suggest Tim’s could double the number of stores from the current count of about 140, based on location numbers in other states such as Michigan. “Herein lies the ‘growth’ opportunity,” experts at Scotiabank said in a research note.

Fastest-growing

For its part, Ampex is pretty enthusiastic about Tim Hortons’ prospects south of the border. Ampex CEO Tabbassum Mumtaz said the company decided Tim Hortons was the “most-compelling opportunity in the industry” after looking at several fast-food brands to partner with.

“We firmly believe Tim Hortons can be the fastest-growing QSR brand in the United States for the foreseeable future,” Mumtaz said.

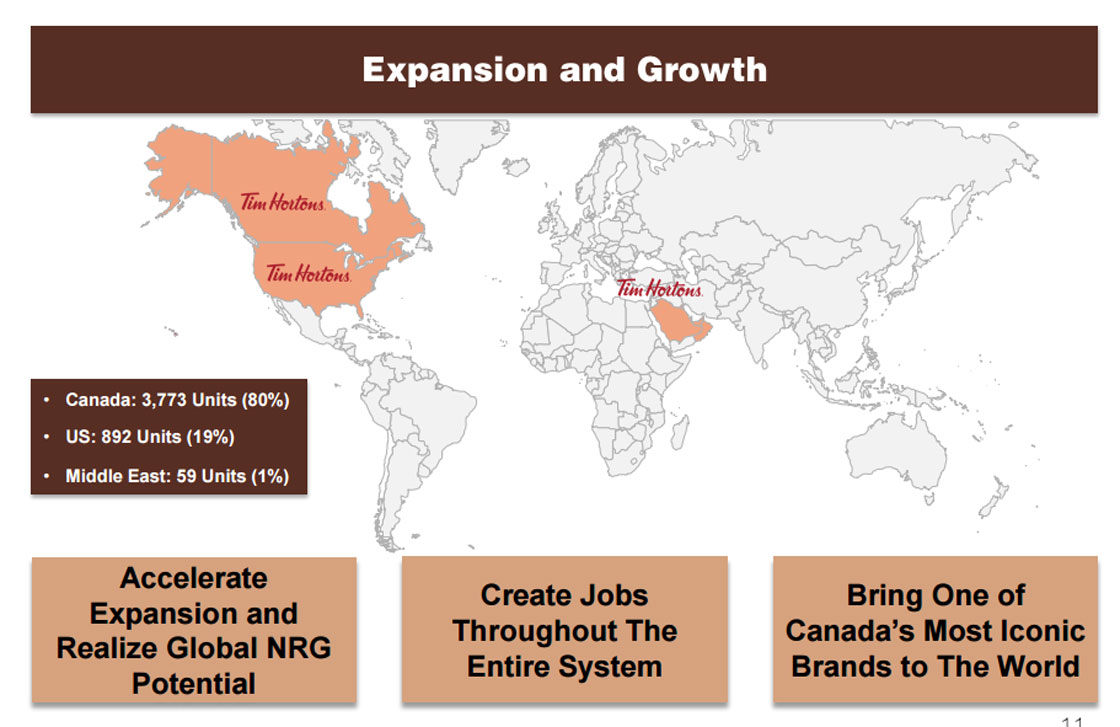

Here’s s a look at Tim’s current store count globally based on its last quarterly report:

- High blood pressure drug recalled over low blood pressure pill mix-up

- ‘Doesn’t make sense’: Union files labour complaint over federal 4-day in-office mandate

- Canadian Tire ordered to pay nearly $1.3 million for false advertising

- Ottawa gives Canada Post a $1.01-billion loan amid ongoing financial struggles

First of many

Get weekly money news

This is the second such deal to ramp up the U.S. store counts. In October, Tim Hortons announced a partnership with U.S. developer Seven Invest to open more than 150 coffee shops in the Cincinnati area over the next decade.

The chief executive of Restaurant Brands, which bought Tim Hortons last year, said the expansion plan was “the first of many such agreements” in the pipeline for the Tim Hortons brand as it looked to expand internationally.

Success is far from guaranteed. Tim Hortons has struggled for more than a decade to gain a stronghold in the U.S. market in the face of heavy competition from more established brands such as Starbucks.

In November, the chain pulled the plug suddenly on some locations in New York state and Maine following performance evaluations.

The closings sparked plenty of attention from local news outlets, which reported that employees said they were not given any notice and in some cases diners were kicked out of restaurants when the lights turned off in the middle of the day.

In 2009, the company tried to buck those trends with a splashy rollout of locations in high-traffic spots such as Times Square and Broadway in Manhattan.

The next year, Tim Hortons pulled out of the northeastern United States, closing 54 stores in New England.

WATCH: The owners of a Tim Hortons franchise in new York say they were seeing growth in their business before head office decided to shut it down. Alex Resila reports.

— With files from The Canadian Press

!["We firmly believe Tim Hortons can be the fastest-growing [fast-food] brand in the United States for the foreseeable future.” .](https://globalnews.ca/wp-content/uploads/2016/01/timmys.jpg?quality=65&strip=all)

Comments