Amazon isn’t stealing enough business away from the likes of Canadian Tire, Rona, Walmart or other big traditional retailers in Canada to worry them much, a new report suggests. At least not yet.

Canadians are going online to make more purchases, experts say, but many of those purchases aren’t for products Canada’s big retailers typically sell a lot of in stores and rely on to drive a big portion of purchases.

Research from BMO Capital Markets released Monday looked at Amazon’s annual one-day sales blitz called Prime Day, which was launched for the first time in Canada on July 15.

Earbuds and e-readers

“Some of the top-sellers included baby products (Huggies Diapers) and technology hardware (Kindle, Apple USB cables and headphones), which are not core merchandising areas for Canadian bricks-and-mortar retailers,” the BMO note said.

Sales for homeware, health and beauty products and other general merchandise “was likely immaterial,” the report said.

Amazon.ca’s product offering pales in comparison to the flagship U.S. site, BMO said, with the total number of products in stock numbering 58 million compared to the more than 260 million products sold through Amazon.com, the note said.

Get weekly money news

Amazon.ca still relies heavily on book sales (40 per cent) whereas the U.S. site counts on book sales for 18 per cent of its total.

In Canada, there’s “minimal overlap” currently between top-selling items on Amazon.ca compared to the “core product offerings” of established retailers, BMO’s retail analysts concluded.

Canadian retailers have been slower to roll out digital e-commerce offerings than retailers in the United States and other countries, experts say. The pace of development is quickening though as more shoppers head online to compare and shop for deals.

MORE: Think online shopping in Canada is exploding? Hardly

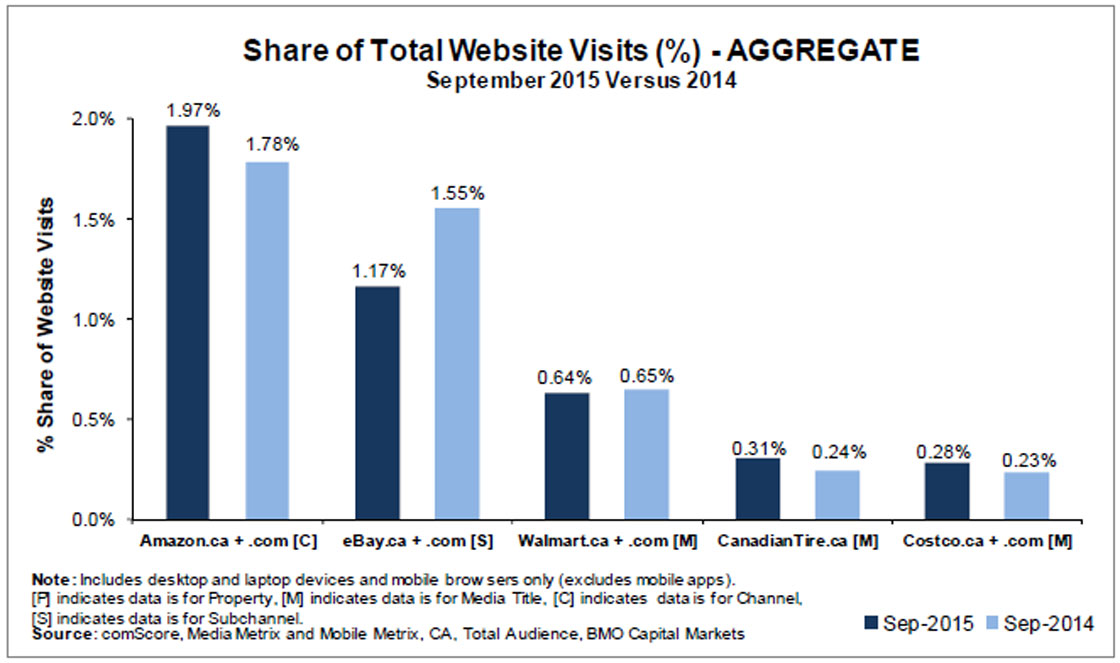

Amazon remains the market-share leader in Canadian retail website visits, BMO said Monday. While eBay has gained some ground, online visits from desktops, laptops and mobile devices to traditional retailers’ sites continue to lag, the note showed (see graph below).

‘Underwhelming’

In the note, the BMO experts took an in-depth look at “Prime Day”, which Amazon has put on in the United States in recent years to drive enrollment in its Prime subscription service.

While the Canadian event generated “record” visits and sales in its inaugural launch, BMO said the outcome was “underwhelming.”

Amazon.ca touted deep discounts on items like PlayStation 4s and Samsung TVs ahead of the event, then cut prices only modestly, the note said. Some customers were likely turned away by sales requiring them to purchase an Amazon product before receiving a deal, the note said.

“The discounts seemed to fall short,” BMO’s analysts said. In all, Canadian retailers likely didn’t see their own sales suffer, BMO said. “We do not believe Prime Day had a significant negative impact on their revenues.”

When reached for comment, a spokesperson for Amazon.ca said “we’re excited to make Prime Day even better next year.”

Comments