It appears there’s some truth to that hunch you had the last time you were filling up, according to petroleum industry experts.

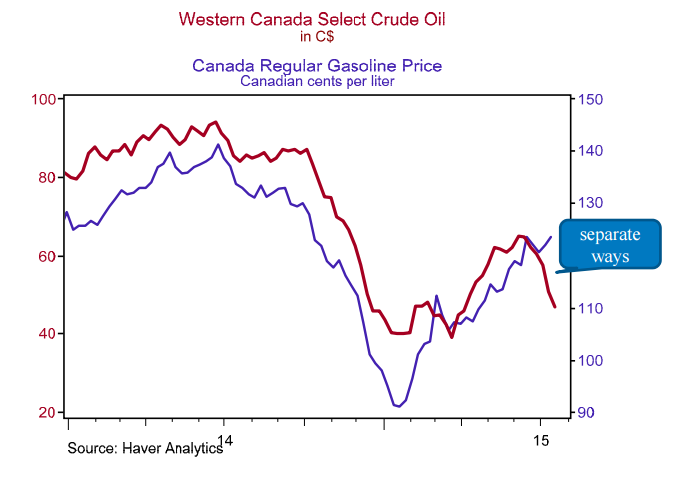

Gas prices have marched higher across Canada this summer even as oil prices have hit multi-year lows, causing a jarring disconnect between crude and gasoline, two commodities that typically move up and down in price in general unison. At least historically.

Prices at the pump are reflecting to some degree the precipitous drop in oil, with the average cost of a litre down 13 per cent compared to last August. But much of the windfall in extra cash economists said would benefit consumers this year is being reclaimed by fuel expenses.

Experts Global News spoke to offered a number of reasons why gas remains relatively expensive amid a glut of cheap oil – high demand from North American motorists; a consumer shift to bigger vehicles; overstretched refineries; as well as the loonie’s sharp decline in recent months.

Another major contributor, according to experts, has been upward pressure on pump prices from big oil firms.

“Integrated” oil companies who own the whole value chain — from oil production to refinement into gas to retail distribution through owned or franchised stations – appear to be hitting consumers at the pump to help offset the revenue hit they’re taking from $40 oil (a 58 per cent plunge from a year ago).

‘That’s why prices at the pump don’t seem to reflect what’s happening with the price of crude’

“That’s why prices at the pump don’t seem to reflect what’s happening with the price of crude,” he said.

MORE: Oil prices drop below $40 per barrel

The average price for a litre of gas this week was just shy of $1.19, according to Natural Resources Canada. That’s roughly what the average price was last October. Back then, a barrel of oil was selling for around $85 (U.S.). On Friday, West Texas Intermediate slipped below $40/barrel for the first time since 2009 .

The advocacy group has been flooded with queries from Canadians wondering why pump prices have been rising as crude renews a slide that began last fall. “I don’t know what to tell them,” Cran said.

Free market

Imperial Oil, Shell and Suncor are the biggest integrated players in Canada. Each operates, either directly or through franchisees, hundreds of stations under the Esso (Imperial), Shell and Petro-Canada (Suncor) banners.

They have kept the bar high at their stations, which has set the tone for others, McKnight said.

“They’re the ones that really establish the market price for gasoline on a daily basis, and the rest just merely follow,” he said.

This is all perfectly above board, according to experts. It’s not price maintenance, something that’s prohibited by competition laws. It’s the market.

Big disconnect

Spokespeople for Imperial Oil and Suncor directed questions about industry pricing practices to Canadian Fuels Association, an industry group. Shell did not respond to a request for comment.

Comment from the industry group wasn’t immediately available.

Fed up

The federal regulatory body has fined franchisees as well as oil companies for engaging in alleged price-fixing schemes in the past (a list of those fines can be found here).

A criminal case is currently before the courts that alleges Irving Oil and its Quebec manager “fixed” retail prices at stations in Victoriaville, Thetford Mines and Sherbrooke.

It isn’t clear whether the Competition Bureau is looking into the widening discrepancy in oil and Canadian gas prices.

The impact on consumers has been more an annoyance than meaningful financial drag so far, experts say. But if economic conditions and employment levels deteriorate through the fall, climbing gas prices could become a bigger issue.

The CAC’s Cran said a deeper probe into industry pricing practices is necessary, but his organization doesn’t have the money to fund a study. Besides, previous attempts from consumer groups haven’t shed much light, he said.

Nevertheless, the consumer association is meeting with bureau officials in early November where the issue is on the agenda.

“I suspect they’re as fed up as we are,” Cran said.

Comments