WATCH ABOVE: The premier warned cuts were coming and now we know just how much more Albertans will pay. Tom Vernon has more on Alberta Budget 2015 from the legislature.

EDMONTON — Albertans will pay more to get married, go camping, have a drink, go for a drive or do pretty much anything else as the province fights to get out from under the collapse in oil prices.

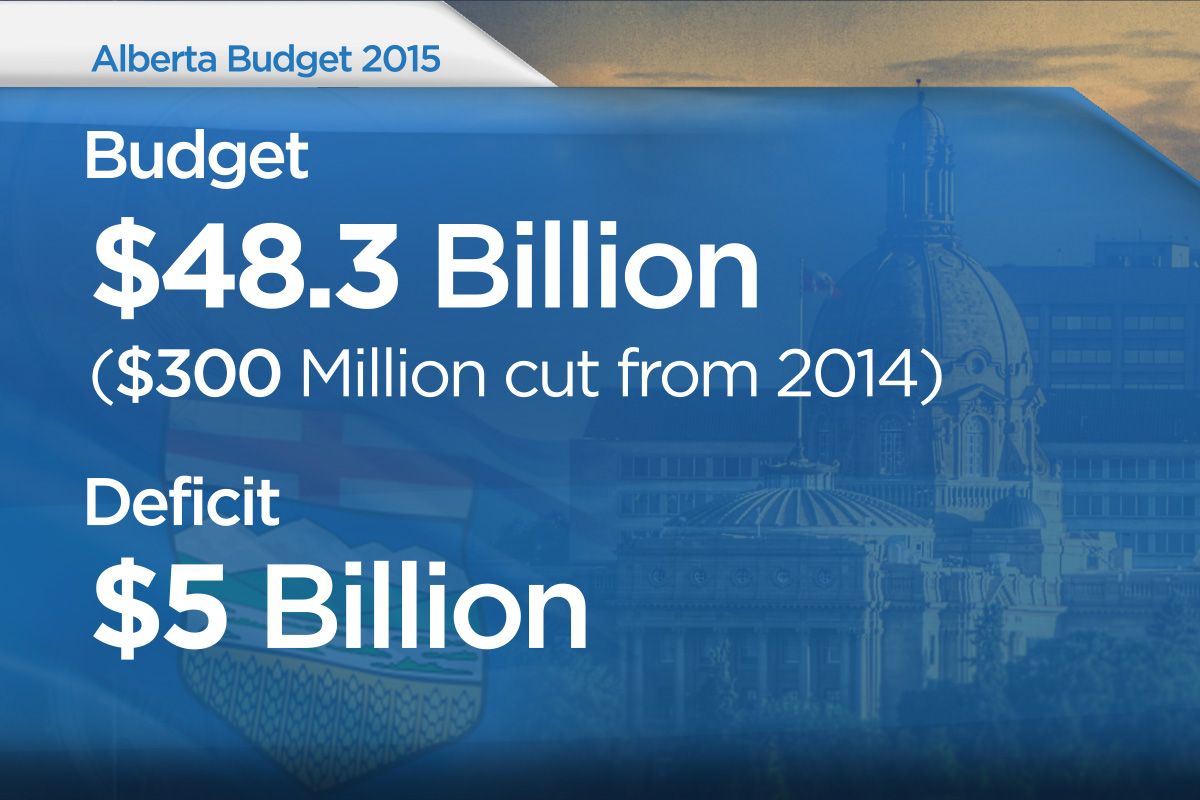

The 2015-16 budget tabled Thursday increases taxes and fees virtually across the board and runs the largest deficit in Alberta’s history at $5 billion.

The government is retooling its tax take so that the wealthy will pay more. It’s also bringing in a health-care levy, boosting the gasoline tax by four cents a litre and increasing sin taxes on cigarettes and booze.

“This has been one of the hardest budgets to develop in many years and has required tough decisions,” Finance Minister Robin Campbell told reporters before he introduced the 2015-16 budget in the legislature Thursday.

“We’re going to get off of oil.”

READ MORE: Taxes and fees: Some highlights of Alberta Budget 2015

Premier Jim Prentice has billed the document as transformational and necessary to make up for billions in lost oil revenue and to insulate the province’s day-to-day spending from roller-coaster swings in energy prices.

The premier has also said he needs a mandate to implement the budget and is expected to call an election soon.

The budget details $1.5 billion in hikes and new levies and outlines a new tax model.

Albertans will no longer be charged a 10 per cent flat tax. Everyone will still pay that much on the first $100,000 of taxable income, but there will be two new tax brackets for anyone earning more than that.

There will be a new refundable tax credit and improvements to existing rules to aid lower-income working families.

READ MORE: Tax credits expanded for low-income families

Above: Fletcher Kent reports on the impacts to Albertans.

Fuel taxes will go up four cents to a total of 13 cents a litre starting Friday, although Alberta still has the lowest fuel taxes in the country.

Traffic fines will rise by an average of 35 per cent. Other increases will hit registration fees, court and land-title searches, marriage certificates and camping costs.

Alcohol taxes are going up by 16 cents for a bottle of wine and 90 cents for a 12-pack of beers as of Friday. Tax on a carton of cigarettes escalates to $45 a carton from $40.

READ MORE: Alberta Budget 2015: What will your sins cost you?

There will be a new levy added to provincial income tax starting July 1 to help offset the cost of health care. It will be paid on an escalating basis starting with individuals earning $50,000 or more in taxable income, with a cap at $1,000 a year.

The province says the average Alberta family – with two children and two working parents making a combined $120,000 a year – will pay an estimated $288 more in taxes this year and $480 in 2016.

Corporate income taxes will remain at 10 per cent, the lowest in Canada. Campbell said it’s important to keep those rates low to prevent further damage to Alberta’s fragile economy.

Alberta still does not have a provincial sales or payroll tax.

WATCH BELOW: Finance Minister Robin Campbell unveils 2015 Alberta Budget

There are also to be spending reductions in some government department budgets, while others will hold the line. There will be slight increases for education and social services.

Government revenue is projected to be $43.4 billion and expenses are pegged at $48.4 billion. The deficit will be covered off mainly by the $6.5-billion contingency fund.

Borrowing for infrastructure will increase Alberta’s debt burden to almost $18 billion.

Bitumen and conventional oil royalties – Alberta’s two main money-makers – are pegged to bring in $2 billion. That’s more than $5 billion less than had been projected before oil prices plunged from US$107 a barrel last summer to the current mid-$40s.

READ MORE: Alberta Budget 2015: Winners and losers

The long-term plan is to have the budget back in the black by 2018, as long as there is a modest rally in oil prices over the next few years.

After that, the government plans to use increasing percentages of oil revenues to replenish the contingency fund and reinvest in the long-term Heritage Savings Fund.

READ BELOW: Full 2015 Alberta Budget

Comments