REGINA – Post-secondary graduates are still sorting out the changes to a Saskatchewan tax incentive designed to keep them in the province.

The government won’t be cutting any more cheques, which is expected to save $33.5 million in the short term.

For the majority of students and recent graduates, the next tax season will be status quo – most will still collect a full tax incentive, though some may not get nearly the same benefit.

“If you don’t make enough money to owe $2,000 … too bad,” said University of Regina economist Jason Childs.

READ MORE: Five things you need to know about the 2015 Saskatchewan budget

The graduate retention program used to be a fixed rebate applied to your income taxes. If the bill was low, the province would make up the difference – up to $2,000.

Who loses?

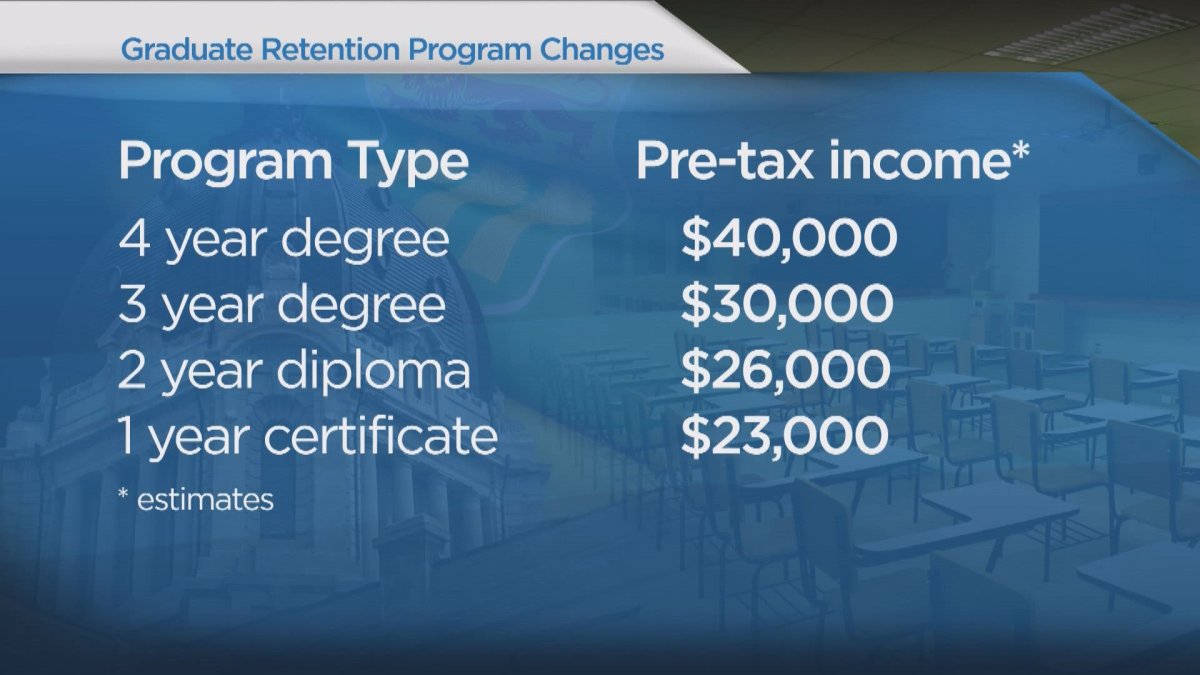

Childs said the highest earners won’t see a change, but university grads will now have to take home roughly $40,000 or more in gross income to maximize their refund.

In other post-secondary programs, it’s a little easier to achieve the full benefit:

- Life in the forest: How Stanley Park’s longest resident survived a changing landscape

- ‘They knew’: Victims of sexual abuse by Ontario youth leader sue Anglican Church

- Carbon rebate labelling in bank deposits fuelling confusion, minister says

- Senator references ‘Trumpian denialism’ in foreign interference debate around China

The bottom line, if you don’t make enough?

“You’re going to see less money coming back at the end of the year,” Childs said. “Your tax refund for 2015 is going to be smaller than it was for 2014.”

Credits will now roll out over ten years instead of seven, meaning a small number of grads won’t have enough time to take full advantage of the credit.

University of Regina president Vianne Timmons said Wednesday that the vast majority of graduates are staying in the province, which is something the institution will continue to monitor.

Comments