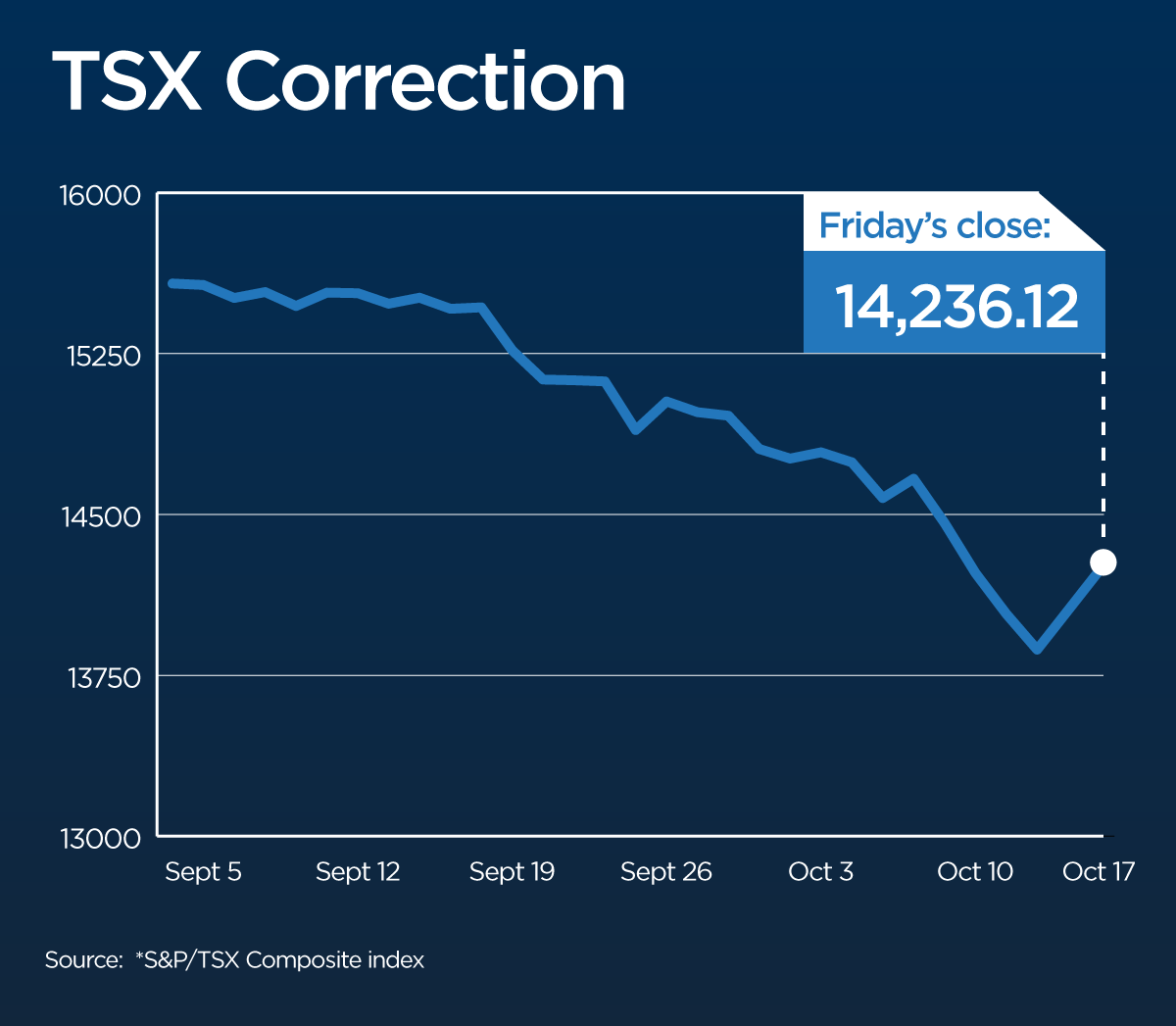

On one occasion during this frenetic week, as the uneasiness that’s seeped into international financial markets this fall slipped into unalloyed panic, share prices in Canada collectively fell more than 10 per cent from their September peak – official correction territory.

But on Friday, the alarm bells had diminished again, drowned out by commentators’ calls to “buy the dip” and the sound of stampeding investors rushing back in.

Shares in Toronto rose 174 points or 1.24 per cent; the Dow Jones industrial average surged 263 points or 1.63 per cent in the United States while U.S. blue chips were on the march as the S&P 500 climbed 1.29 per cent, or 24 point.

“Global growth fears are getting overdone,” CIBC World Markets said in a note to clients.

MORE: Canadian stocks plunge into official ‘correction’ mode

Where things go after the events of the past week is anyone’s guess, but there’s no shortage of views.

Why stocks are see-sawing

Experts say the market swoon is coming from a multitude of fronts, all pointing toward one thing: risk of shrinking economic growth.

Sal Guatieri, a senior economist at BMO Capital Markets said by phone Europe is on the “cusp” of its third recession in less than six years, while Japan and China – two other pillars of economic activity — have posted data signals lately that suggest those countries are headed for slowdowns if not recessions, as well.

Moreover, stock prices have boomed this year, with many public companies boasting share prices well in excess of what their forecasted earnings should support. The market has been waiting for a reason to sell off.

“Valuations were getting pretty close to prior tops,” Guatieri said.

Will slide continue?

Experts suggest there could be more turmoil ahead if economic sluggishness descends into contraction in bigger economies now on the bubble. But experts at CIBC suggested governments are stepping in to support growth, which will keep markets buoyed.

“We believe that, despite the near-term volatility, the secular bull market remains intact,” CIBC said.

European Central Bank officials said Friday they will implement more stimulus measures within days, while the Bank of England suggested interest rates will be kept “lower for longer” to keep credit flowing to businesses and consumers.

The U.S. economy meanwhile is “looking solid,” with data for housing and consumer sentiment released on Friday that were both better than expected.

“Canada’s largest trading partner has escaped the growth disappointments” seen in Europe, China and Japan, CIBC said. At least for now.

Oil’s dive

A by-product of slowing economic growth is less need for oil, leading not surprisingly to a sell-off of the commodity similar to the flight from stock markets this week. Growth fears are also being coupled with oversupply of oil on global markets at the moment, a double whammy for crude prices.

With oil falling to around $85 a barrel – down nearly a third from its June highs – Canadian energy producers have been walloped this week. Shares in resource companies shed a quarter of their combined market cap on the TSX before Friday’s buying spree.

Producers are now eyeing cutbacks in production, which would tap the brakes on Canada’s real economy as hiring is frozen among other negatives for growth in Alberta, Saskatchewan and beyond.

“The further declines in oil prices over the past week has stoked greater fears of a widespread economic slump in Canada,” experts at Capital Economic said.

MORE: Oil’s crash threatens to derail booming Alberta — and Canada too

Still, the Toronto-based research firm suggests oil prices won’t fall much further, and even if they do, it doesn’t see oilsand development declining much as a result.

“Most oilsands projects are fixed-cost in nature, so shutting them down or cutting production would only be more costly,” Capital Economics argued.

Like others, BMO’s Guatieri said the week-that-was was likely a bloodletting of sorts that’s provided the kind of correction overheated markets were in need of.

Come the opening bell on Monday morning, traders could well be bidding up share valuations once more.

“If this is just a normal correction, then there won’t be a meaningful negative impact on the economy,” the BMO economist said. “And that would be our bet.”

WATCH: The price of oil is sitting at a level significantly below what the provincial government forecast at budget time back in March. As Tom Vernon reports, it’s going to have an impact on the bottom line in Alberta.

Comments