TORONTO – The city has a revenue problem, not a spending problem, and its $4 billion in debt is manageable for a growing city, according to the Institute on Municipal Finance and Governance.

But despite the findings of the new study, Rob Ford, running for mayoral re-election says he’s confident he can find more cuts.

The institute, part of the University of Toronto’s Munk School of Global Affairs, took an in-depth look at the city’s finances and concluded the city’s spending roughly the same amount as it was in 2003 when inflation and population growth are taken into account, but is spending more on transit and less on social services.

The report finds the city’s debt, as a percentage of its operating revenue, is manageable and is less than the debt of Ontario municipalities such as London, Ottawa, Halton, and Peel region.

The report’s authors suggest “there is little room to find further ‘efficiencies’ without reducing services.” At the same time, the city has a multi-billion-dollar infrastructure hole and no sustainable way to source those funds, the report found.

Rob Ford doesn’t care. The mayor made his political career on ending the so-called “gravy train” he believed was at city hall.

“While we have slowed down the out-of-control spending to keep taxes low and keep our City affordable, I still firmly believe that there are millions of dollars in further waste and efficiencies that we can find,” the mayor said in a statement Wednesday, without specifying what those may be.

How about property taxes?

The city’s property tax accounts for nearly 40 per cent of the city’s $9.7-billion 2014 budget.

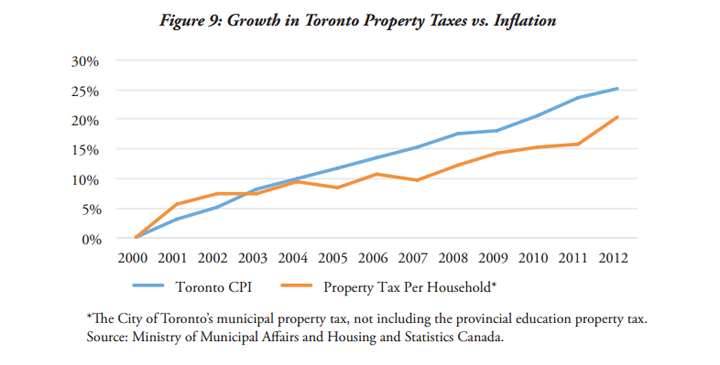

The mayor promised Tuesday to keep future property tax increases “well below” the rate of inflation. But, as the institute points out, property taxes have been growing at a rate below inflation since 2004 and the average property tax burden on each household has actually been falling.

Infrastructure Spending

While some of Toronto’s finances are fine, the report does say the city have a “major infrastructure funding shortfall” – one that’s expected to grow to nearly $2.5 billion by 2020.

The city will have to bring in new revenue to build new – or even maintain existing –infrastructure. Right now, the city relies heavily on provincial and federal transfers to pay for its infrastructure – but those aren’t permanent – and can change on the whims of new governments.

The report suggests Toronto could benefit from being able to set its own tax rate.

Comments