TORONTO – The next chief executive of Potash Corp. of Saskatchewan Inc. (TSX:POT) will take the helm at a time of transition for the fertilizer giant as it completes a multi-billion dollar expansion plan.

Jochen Tilk has over 30 years of experience in the mining industry, but the former president and CEO of Inmet Mining has none in the potash sector.

RBC Capital Markets analyst Andrew Wong says Tilk has a proven background as a strong operator during nearly 25 years at Inmet.

“We view this as a positive for PotashCorp’s operations as the company exits its capacity expansion phase and transitions into an operations optimization phase,” Wong writes in a report to clients.

“We think PotashCorp is set to enter a period of strong cash flow generation starting in 2015 and Mr. Tilk will have a lot of flexibility to execute his strategy and vision for the company.”

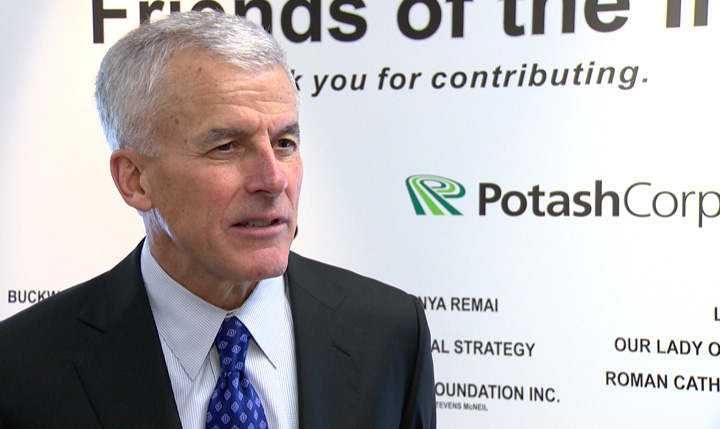

PotashCorp announced Sunday that chief executive Bill Doyle will step down and Tilk will take the top job on July 1, which will be the 15th anniversary of Doyle’s appointment to the job.

Doyle, who has four decades of experience in the industry including 27 years at PotashCorp, is expected to remain as a senior adviser until June 2015.

Doyle leaves PotashCorp as it nears the end of a massive $8.3-billion capital expansion that will leave it with the ability to significantly grow its sales volume.

- What is a halal mortgage? How interest-free home financing works in Canada

- Capital gains changes are ‘really fair,’ Freeland says, as doctors cry foul

- Budget 2024 failed to spark ‘political reboot’ for Liberals, polling suggests

- Tesla’s net income drops 55% in first quarter amid falling global sales

The end of the program also means significantly lower capital spending compared with recent years, giving Tilk the cash to shape the future direction of PotashCorp.

At Inmet, which was acquired last year by First Quantum Minerals Ltd. (TSX:FM) in a $5.1-billion hostile takeover, Tilk oversaw a wide array of operations in Turkey, Spain, Finland, and a large scale copper development project in Panama.

Scotiabank analyst Ben Isaacson said the company hired Tilk for his experience with asset optimization, organic growth and strategic acquisitions.

“We are comfortable on where organic growth prospects lie, as well as PotashCorp’s priorities for strategic acquisitions. What could be interesting though is asset optimization,” Isaacson said.

“However, we don’t think Tilk will pull any radical levers until at least mid-2015, when Doyle permanently departs.”

Wong said RBC was taking a “wait and see approach” with Tilk as he takes over PotashCorp at a challenging time in the potash market.

However, the analyst noted that Doyle’s decision to remain as an adviser offers some comfort.

“We think having Mr. Doyle remain in an advisory role is a prudent move and will alleviate some potential concerns as Mr. Tilk becomes more experienced with the fertilizer industry and his new role,” Wong wrote.

In December, PotashCorp announced plans to cut its workforce by about 18 per cent, affecting 1,045 people due to soft demand for potash and phosphates, two major types of crop fertilizer.

The move prompted Saskatchewan Premier Brad Wall, who was a staunch defender of the company during its fight to defeat a hostile takeover attempt by BHP Billiton, to criticize the company for putting shareholder dividends ahead of jobs in his province.

The cuts came at the end of a year that saw potash prices drop after Russian-based company Uralkali, one of the world’s largest potash producers, quit the Belarusian Potash Company export partnership.

The move prompted China and India – key markets for fertilizer – to delay purchases, sending shipments and prices lower.

In a report last month, TD Bank said it expects international potash prices to average around US$305 to US$320 per tonne over the next two years, but warned they will be volatile.

Canpotex – the Canadian export partnership that includes PotashCorp, Agrium and Mosaic – recently announced an annual contract with the government and private sector partners in India for one million tonnes of potash at a price of US$322.00 per tonne.

PotashCorp shares were down 95 cents at C$36.87 in trading on the Toronto Stock Exchange.

Comments