Calgarians won’t be facing another hike in property taxes next year after the city announced Tuesday that it has found ways to hold the line on a 3.6 per cent increase.

In a news release announcing next year’s budget adjustments, the city says the increase means the owner of a typical single residential property, assessed at a value of $700,000, will pay an additional $8.37 in property tax for an annual municipal tax bill of $2,665.

The same homeowner, who uses an average amount of water (90 bathtubs full), will also $5.09 more in water, waste and recycling fees per month.

The city says the owner of a condo assessed at $360,000 will pay an average $1,370. in property tax in 2025.

Get weekly money news

Property taxes on some downtown office buildings will decrease by 1.6 percent, while other non-residential property taxes will see an increase of between 0.2 per cent and 3.1 per cent.

In September, city administrators proposed a 4.5 per cent increase, which put them at odds with council members who wanted to hold the line on a 3.6 per cent hike.

But the city’s acting Chief Financial Officer, Les Tochor, says administration was able to identify additional investment income to allow it to limit the tax hike to the lower amount.

The city says the changes made will also allow it to invest more in the four priority areas that Calgarians have identified — infrastructure, housing, public safety and transit — because “Calgarians have been clear that what matters most to them.”

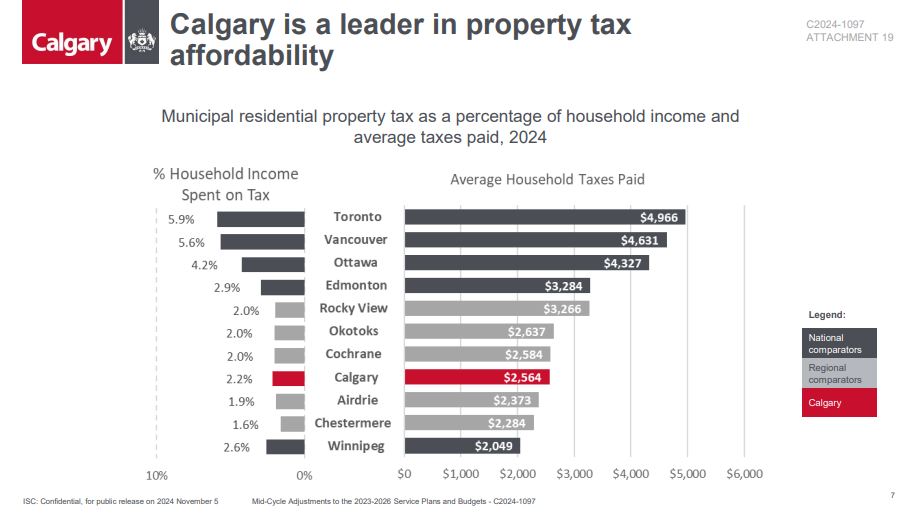

Despite the increase, the city claims Calgary’s property taxes have increased at a slower rate than many other major Canadian cities such a Edmonton, Toronto and Vancouver and that the average taxes paid by Calgarians are significantly less than those in other cities.

More information on the 2025 budget adjustments is available on the city website.

Comments

Want to discuss? Please read our Commenting Policy first.