ABOVE: The battle for your cellphone dollars could be intensifying soon, as Ottawa announces a fresh auction for access to Canada’s wireless spectrum. Jacques Bourbeau has the details (Jan 10).

A much-ballyhooed auction for public airwaves begins this morning in Ottawa. Cellphone companies — with one notable exception — are lined up to bid on blocks of “spectrum” that will allow each to enhance services by speeding up data transmission to and from cellphones as well as deliver a more stable signal to each device.

If you’ve found yourself asking what is spectrum, where is it and why should I care, here’s a primer on what you need to know:

What is spectrum?

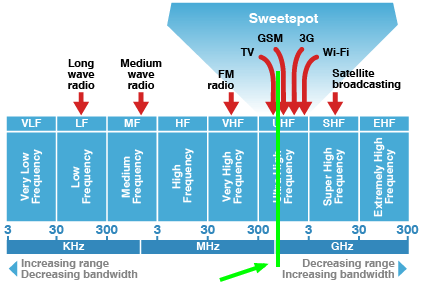

Spectrum refers to the radio frequencies that surround us. For decades, services like radio and television programs have transmitted their broadcasts over different spectrum frequencies to antennas attached to devices like TVs and car radios. Cellphones and smartphones operate on the same principle, with each device housing a small antenna and other micro-equipment responsible for sending and receiving signals sent over different frequencies. A basic characteristic of spectrum is that the lower it is on the dial, the longer distance those signals can travel – that’s why AM radio stations can be heard further afield than that FM rock channel can be.

How will it help cellphone service?

Just like TV companies until cable came along and radio companies to this day, spectrum is the lifeblood for cellphone services. In today’s world of ever more sophisticated smartphones, it takes more spectrum than ever to accommodate the heavy uploading and downloading of signals to and from your iPhone, BlackBerry or Android device.

More spectrum – especially the kind of lower frequency bands being sold by Ottawa at the moment – means more info can be zipped to and from devices and cell towers at faster speeds. Opening up the so-called 700Mhz bands that go up for bidding Tuesday will allow Rogers, Bell, Telus and regional operators like MTS, SaskTel and Videotron in Quebec to deliver signals to smartphones at speeds that in some cases are faster than a home connection through a modem attached to fixed Internet connection.

Where will it help cellphone services?

Everywhere. As mentioned above, the entire range of radio spectrum surrounds us. Ottawa is auctioning off a slice of those bands beginning Tuesday (see graphic above). Cellphone companies who win the licences to use the 700Mhz bands will optimize their network equipment across the country as well as customers’ phones to begin using the frequencies.

In rural Canada however, services stand to improve the most. The long distances that the 700Mhz bands can carry signals means better service (read: faster wireless Internet speeds) can be delivered relatively quickly and cheaply into large areas where only limited data services are currently available. In cities where wireless high-speed access is already available, the new frequencies for sale will help push signals deep into parking lot garages and other areas where signal strength is poor currently.

Subscribers to older feature phones won’t see much difference in service because the bands will primarily be used to improve the performance for smartphone devices that send and receive lots of data or Internet traffic – but that’s a customer description fast-becoming the norm.

- What is a halal mortgage? How interest-free home financing works in Canada

- Capital gains changes are ‘really fair,’ Freeland says, as doctors cry foul

- Ontario doctors offer solutions to help address shortage of family physicians

- Starbucks looks likely to win U.S. Supreme Court case involving pro-union workers

Who owns it?

You do. Radio spectrum is a public resource managed by the Government of Canada, which for decades has issued licences to private-sector companies as well as the Canadian Broadcasting Corp to broadcast the news as well as entertainment with the goal of informing the electorate and fostering a common cultural bond.

Why is Ottawa selling it now?

Television broadcasters like Global, CTV and CBC are moving over to all-digital transmission, a process first started 2011. The switch has meant TV broadcasters have vacated the radio spectrum they formerly broadcast programming over in the 700Mhz bands. Those bands were picked by TV companies for a reason – they’re ideal for travelling long distances as well as moving through barriers like wall more easily than higher frequencies do.

Now, cellphone firms can use those frequencies to quickly deliver mobile data services on the same premise.

Who is buying it?

The country’s dominant wireless firms – Rogers, Bell and Telus – are all lined up to carve up three quarters of the ‘prime’ blocks of spectrum up for sale. Regional operators MTS (Manitoba), SaskTel (Saskatchewan), EastLink (Atlantic Canada) and Videotron (Quebec) have been given access to acquire a fourth prime block which will allow each to better compete for customers with the far bigger three.

A major question mark as of Tuesday is who will fill a void left by Wind Mobile, a new entrant operator who was the biggest competitor to Rogers, Bell and Telus in the major markets of B.C., Alberta and Ontario. Wind backed out of the auction suddenly Monday, saying its financial backer – Amsterdam-based cellphone behemoth VimpelCom – won’t release the funds necessary for Wind to buy more spectrum.

READ MORE: With new entrant signals weakening, what happens to wireless prices?

Wind’s withdrawl opens up all kinds of questions about the fate of the country’s biggest cellphone markets, not least whether Rogers, Bell and Telus will regain their collective grip over big cities like Toronto, Vancouver and Calgary, an outcome which could have a negative impact on consumer wireless prices.

How much money will be raised by Ottawa?

Good question. Before Wind withdrew, experts estimated that between $1.8-billion and $2.5-billion would be spent collectively by the cellphone companies. That figure is well below the auction proceeds from the previous sale in 2008, which raise more than $4-billion as Wind, Videotron and other new entrants bid to enter the market. With no new players this time around – and now Wind’s sudden departure – the proceeds will be much lower, experts say.

Who gets the cash?

You do. Kind of. The money flows directly back into federal coffers and is used to pay for services, government debt, etc. Here’s how the Feds’ put it: “As has been the case with all previous spectrum auctions, funds generated by the auction will be remitted to the government’s Consolidated Revenue Fund.”

Comments