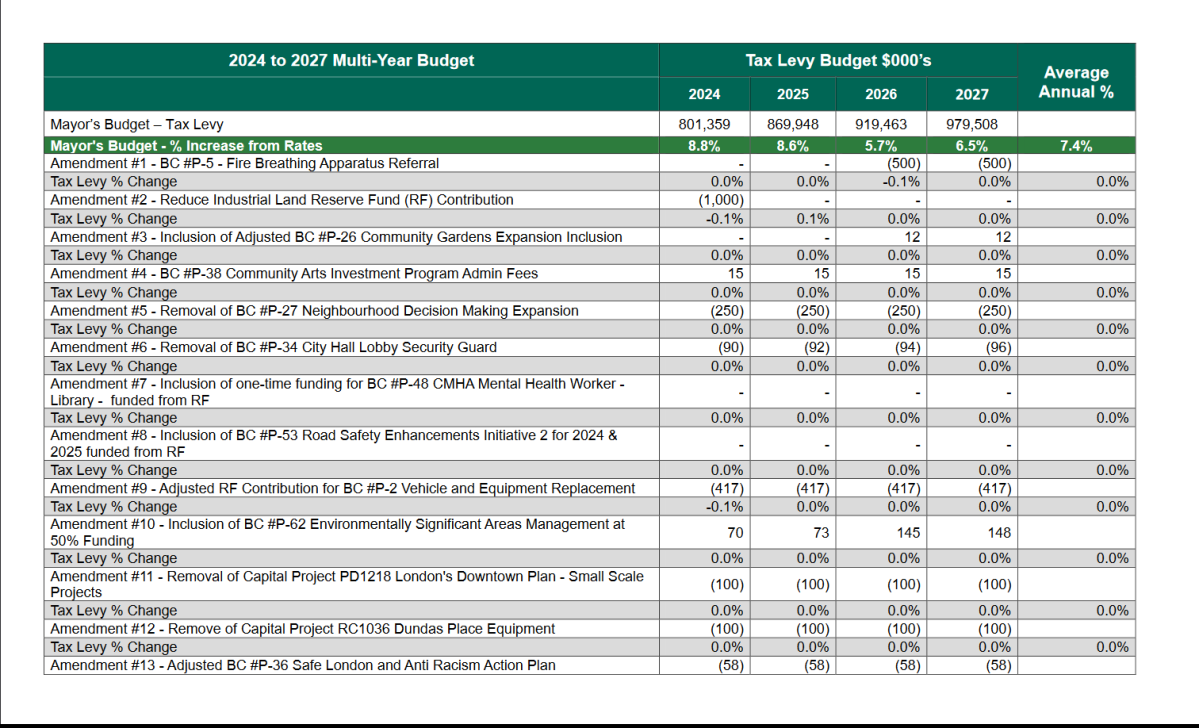

City council in London, Ont., has officially approved the four-year municipal budget, including the London Police request for an increase in the hundreds of millions of dollars over the life of the budget.

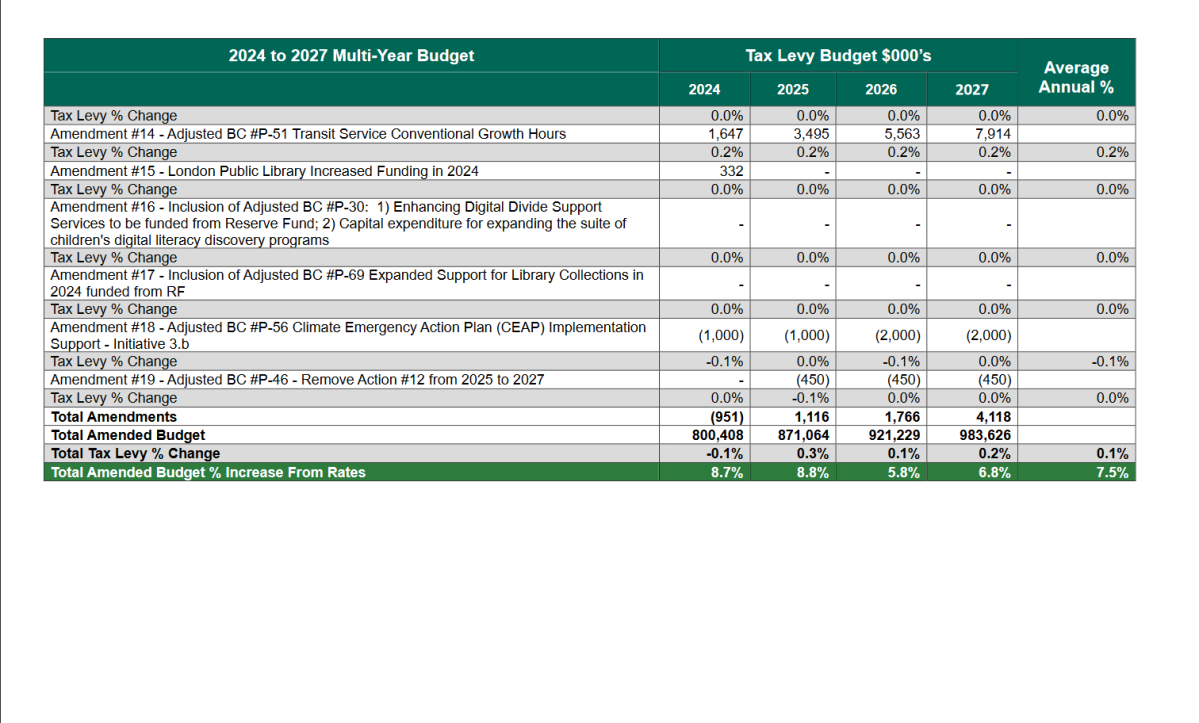

The budget includes a four-year average tax increase of 7.5 per cent, with an average increase of $277 to the “average” London home, which is defined as a home assessed at $252,000.

The first year of the budget includes a tax increase of 8.7 per cent, or a $286 increase.

Five per cent of that increase comes from the controversial London police budget request for $672 million over four years. That funding will cover the costs of 97 new officers, new equipment, a training facility, and a second light-armoured vehicle.

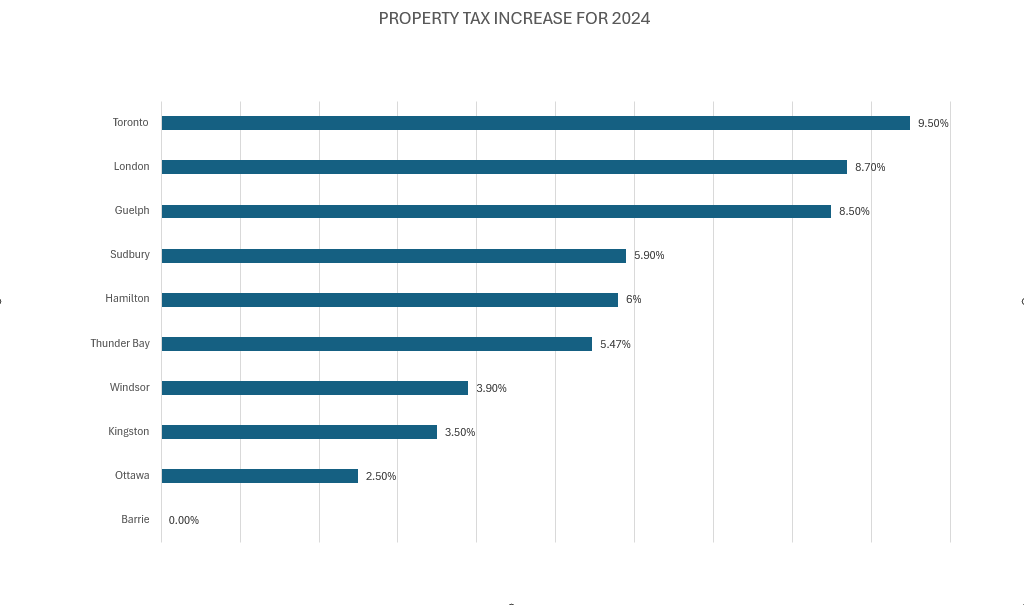

So, how does London’s tax increase stack up to other municipalities?

Compared to other Ontario single-tier municipalities of similar sizes, London has one of the largest tax increases for 2024, with only Toronto coming out on top.

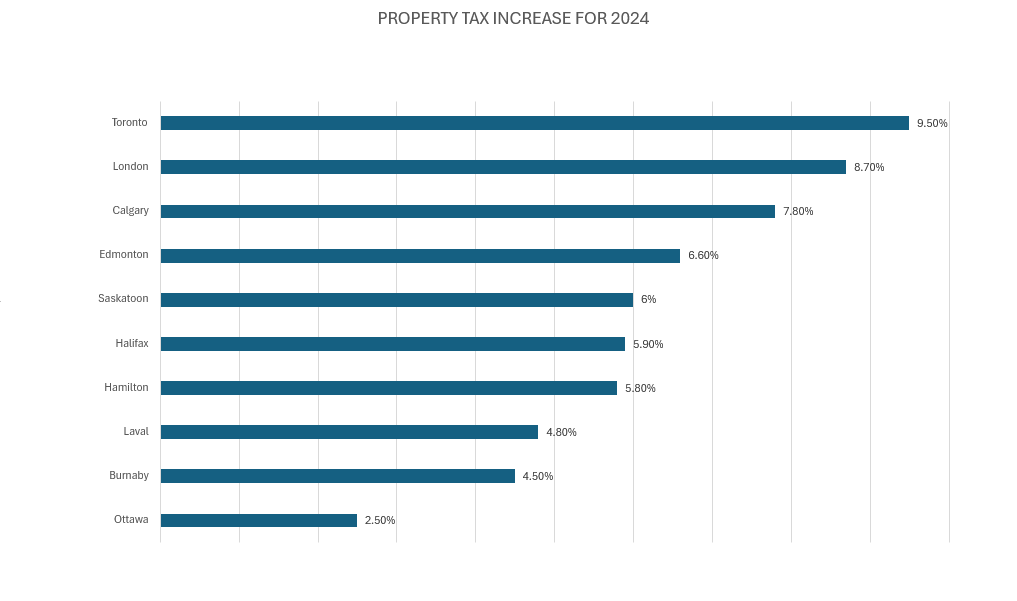

Compared to national budget increases, London again comes out close to the top.

Looking at the country’s most populous cities that have passed a budget and don’t pay any regional property tax, London maintains its second-place spot.

However, Mayor Josh Morgan says comparing municipalities to each other is not a simple matter of percentages.

Get daily National news

“Your tax rate is this, what did you actually do to get there? What are you investing in or not investing in? Are you just getting the status quo for this money? Or are you delivering on services and service enhancements that the population is expecting?” Morgan said.

“If you don’t start asking those questions, then what are you really comparing across municipalities, just a percentage?”

Morgan also said that it’s easy to change a percentage in an irresponsible way, through raising reserve funds and not investing in any services.

“Taxes are always very hard because nobody likes them. But at the end of the day, taxes are investments for services. That’s what the percentages actually mean at the end of the day.”

“Strong Mayor” legislation also tossed a wrench in the budget plans this year.

Morgan had to present a budget by Feb. 1, at which point council had 30 days to table any amendments they wanted made to the budget.

For London, staff presented a draft budget on Dec. 12, allowing councillors to consult with their constituents on local priorities.

“When I tabled budgets and fulfilled the legislative obligations… there weren’t a lot of new surprises in the budget because everybody had seen all the things that might be on the table.”

Also new this year, council decided not to have staff trim down the business cases presented.

“In previous multi-year budgets, we might have had 20, maybe 25 business cases at the most,” Morgan said.

“There were over 70 business cases that we had to consider as a council… So, that put us in a very difficult spot because we had to be the ones to say ‘no.’”

Eighteen changes were made to the budget during the amendment process. The mayor did have the ability to veto any changes made by council, but he declined to use that ability.

Comments