Canadians are more in debt than ever. The average Canadian owes roughly $1.70 for every dollar of earned income per year after taxes, two in five Canadians don’t think they’ll ever get out of debt, and more than a third of Canadians have no retirement savings, according to a 2019 survey.

But building home equity and consolidating debt into one manageable monthly payment can help consumers climb out of the hole. In partnership with the Angela Calla Mortgage Team, we take a closer look at when breaking a mortgage to get out of debt makes sense.

Who should consider debt consolidation

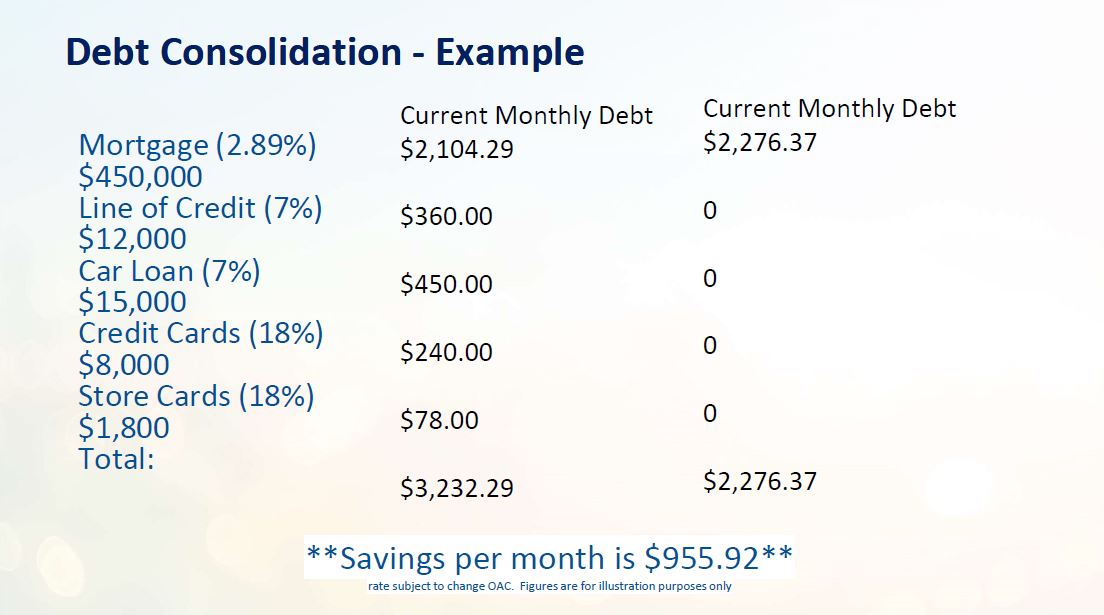

Anyone with home equity (a portion of their home paid off) and more than $300 in monthly non-mortgage debt should consider consolidating it into their mortgage, according to Angela Calla, a mortgage broker with Dominion Lending Centres in Port Coquitlam, B.C.

The exception is if a homeowner will be able to pay off that debt with an upcoming work bonus or inheritance, or if they already have the equivalent of six months of expenses saved for emergencies.

Consolidating debt lets homeowners pay money owed at a lower interest rate and create a flexible plan for the future.

“If you had any payment outside of your mortgage for, say, $480 a month, that will take away a whole hundred thousand dollars in mortgage qualification,” Calla said. “That’s if you ever want to move up the property ladder or qualify to get your money working for you in a different way.”

READ MORE: Home reno? Debt consolidation? Tapping your home equity is getting harder

Making your money work for you

Get breaking National news

When Jessica Howe and her husband needed to do small renovations and repairs on their Abbotsford, B.C., home, they went to their bank and were advised to open a home equity line of credit. The bank told them they would only pay interest on the money they used, which was fine for their situation until it came time to remortgage.

At that point, their bank pressed them to take out a bigger mortgage that would also freeze their ability to draw on their line of credit for a year.

Confused, they remortgaged, but later sought Calla’s opinion. She suggested breaking the mortgage for a small fee, consolidating the debt to give them an extra $200 biweekly in their pockets and extending the amortization to 30 years.

“We were kind of upset because we didn’t want to pay for 30 more years when we had 20 left, but she explained it to us, and we realized we could increase our payment at any time,” Howe said. “We had a lot of flexibility and we became the boss of our own mortgage.”

“Credit cards, lines of credit and personal loans are the hugest profit centres for lenders, and they make more money off them than they do a mortgage. So debt consolidation is not a suggestion they make,” Calla explained. “Their goal is to make as much money for the lender as possible.”

How debt consolidation can be a personalized solution

Howe is working part-time until her youngest child is old enough to go to school, at which point she plans to return to work full-time. Then, her family will look at bringing their amortization down by increasing their biweekly mortgage payments.

Until then, having that extra $400 a month allows them to stay out of debt while fixing doors, painting and doing other small jobs around the house. If they hadn’t consolidated their debt, she says, the family would still be drawing from that line of credit and going further into debt, all while paying a mortgage that was no longer working for them.

“It changed the next chapter of our lives, because this was a point for us where if we weren’t smart, we wouldn’t have been able to reno, which would have affected our future,” Howe added. “Our house needed to be renovated to keep our equity in it. It was really life-changing for us.”

READ MORE: Which renovations will have the biggest impact on your home’s value?

“Wages generally don’t increase rapidly enough for you to be able to not incur more debt and have your money working for you in an effective manner,” Calla said. “If you’re paying that money outside your mortgage, and your cash flow isn’t increasing or you can’t have a plan to pay that off, then you’re not getting your equity working for you in the most beneficial way.”

Calla says that a mortgage broker sits down with clients to come up with personalized solutions, while also protecting your credit and exploring various paydown scenarios, schedules and lower penalties for breaking a mortgage than are typically offered at a bank.

“We’re completely different than lenders, because we’re proactive,” she explained. “Every time there’s a change in the marketplace, we’re looking to see if there are better opportunities. We’re looking to see if it’s worth it to break your mortgage — and get a better mortgage.”

Want more information? Visit the Angela Calla Mortgage Team online.