Above: Watch 16×9′s full investigation into the growing mania behind Bitcoin

TORONTO – As the dollar and the euro continue their slow path to recovery some people have traded in their money for a currency that has boomed.

It’s called Bitcoin – and it’s the currency of the internet.

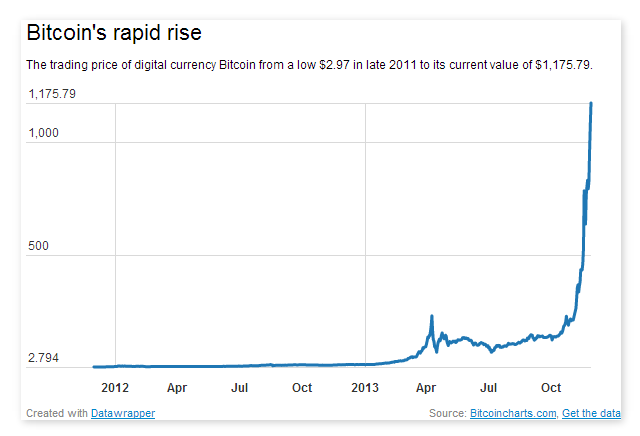

Invented five years ago by an anonymous programmer, Bitcoin has no government tied to it, no delay when sending money and few – if any – transaction fees. And while many people still don’t consider Bitcoin “real money” it’s making some people really rich.

Volatile and surging: Bitcoin popularity on the rise

Bitcoin is one of the first digital currencies used to send money through the Internet. It is a sort of Western Union, Visa or Paypal, except there is no bank or large corporation acting as a middleman.

Bitcoins are issued through a process called “mining” and are generated by super computers that crack complex codes and are issued a certain number of Bitcoins in exchange.

“When you use Bitcoin you are totally in control over your own money….You don’t hold Bitcoins in a bank account where the government can take it away… you personally control it.” – Joerg Platzer, owner of Room 77, the first brick and mortar establishment to accept Bitcoin

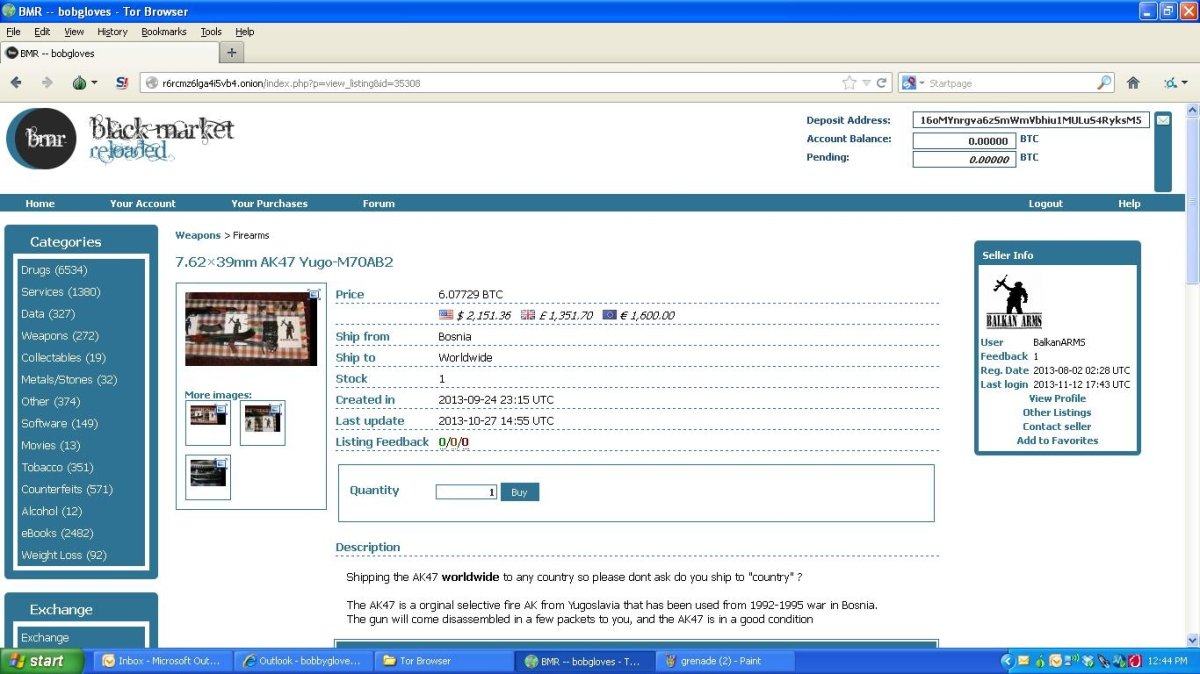

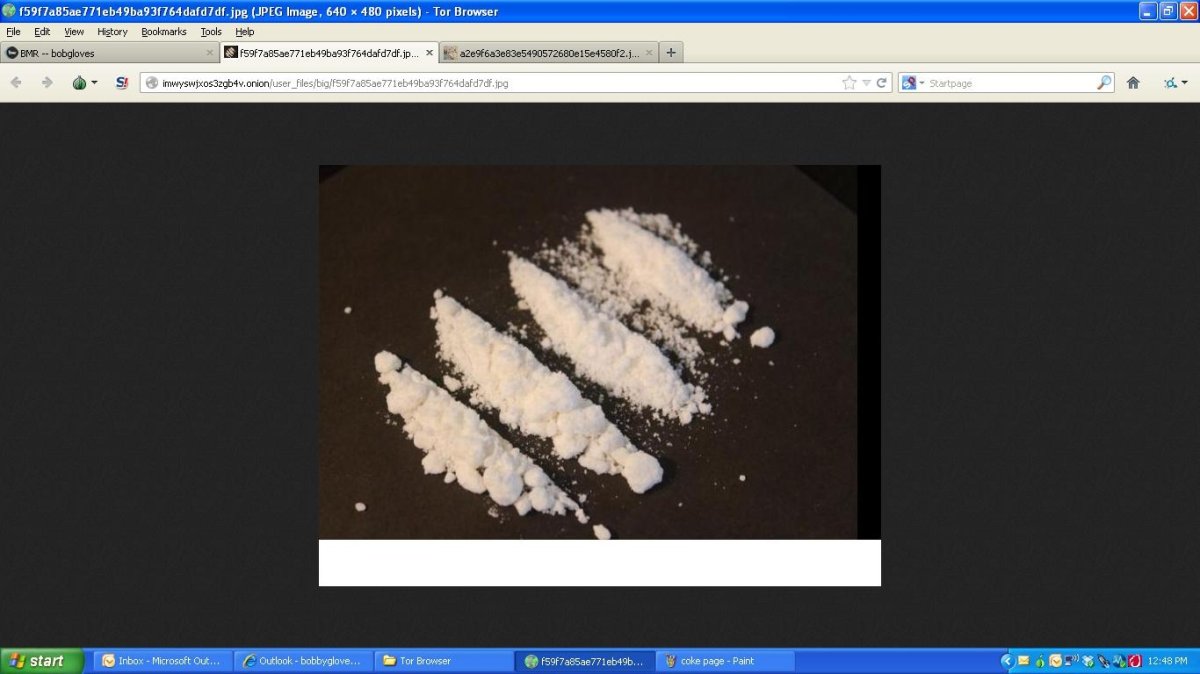

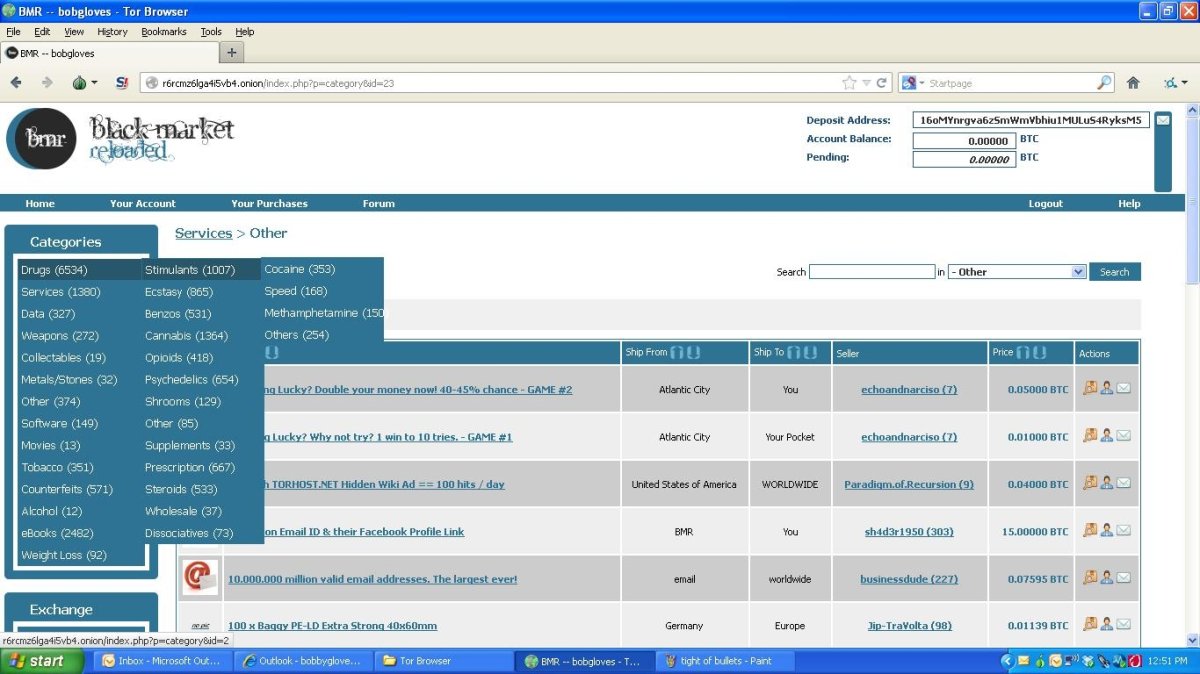

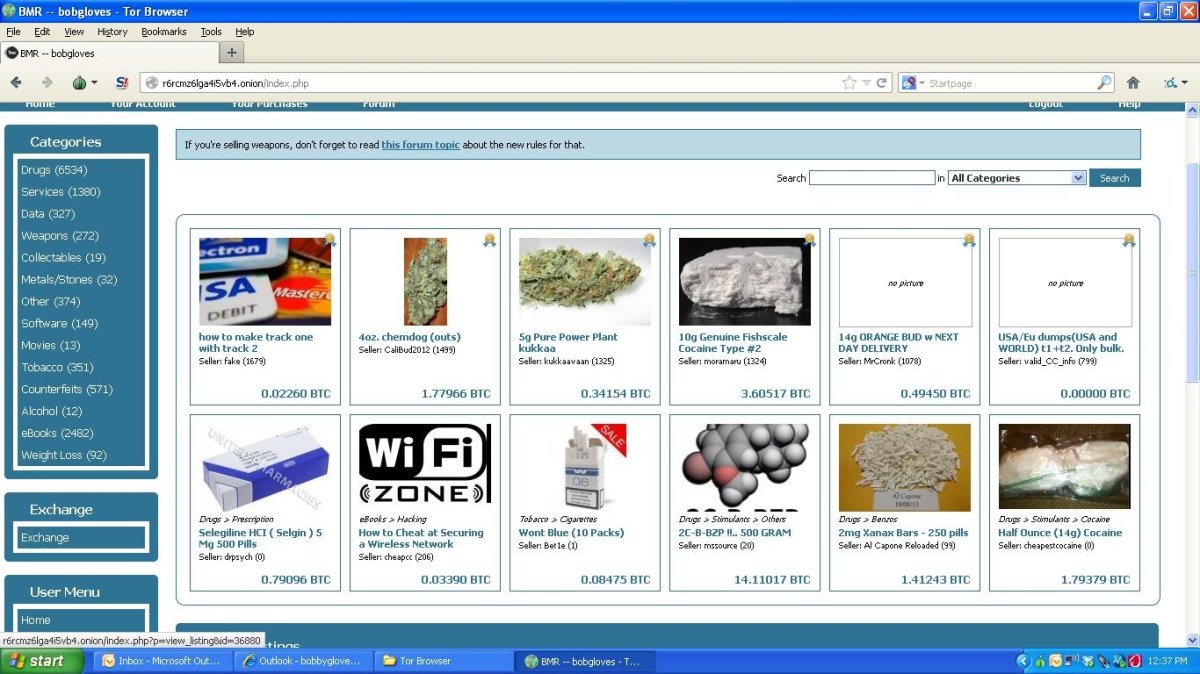

Black Market Reloaded: Purchasing illegal goods using Bitcoin

Critics say that Bitcoin is the perfect tool for criminals who want to purchase guns or drugs anonymously.

Silk Road, a website that dealt in selling a wide array of illegal goods, only accepted Bitcoin. When the FBI shut it down in October, they called it “the most sophisticated criminal marketplace on the Internet.”

But already another illegal bazaar that uses Bitcoin has sprung up in Silk Road’s place.

As Bitcoin surges, Canadian banks make converting to cash difficult

Most of Canada’s so-called “Big 6” banks – made up of RBC, TD, BMO, CIBC, Scotiabank and National Bank – have frozen or shut down accounts owned by the handful of Canadian companies who trade the digital currency and convert it to cash for customers.

Since late spring when the currency first spiked to $230, “anything that interfaces with the bank has been having problems,” a source at one Canadian Bitcoin brokerage said Thursday.

World’s first Bitcoin ATM comes to Vancouver

Mitchell Demeter who runs Bitcoiniacs – The Bitcoin Store, Vancouver’s first physical Bitcoin exchange, is also behind the launch of the first ever Bitcoin ATM.

Demeter said the Robocoin is similar to a regular ATM, except it involves no bank.

“How it works is if you want to buy Bitcoins, you walk up to the machine, select a dollar amount that you would like to purchase, say you want to buy $100. You then deposit $100, and our system connects to the market, buys the Bitcoins in real time, and either sends them to your smartphone or prints off a paper wallet for you.”

Click here for complete coverage of Bitcoin

Watch the full Nov. 30, 2013 episode of Global’s 16×9

With files from Global News

Comments