WATCH: 16×9’s full investigation into the growing mania behind Bitcoin

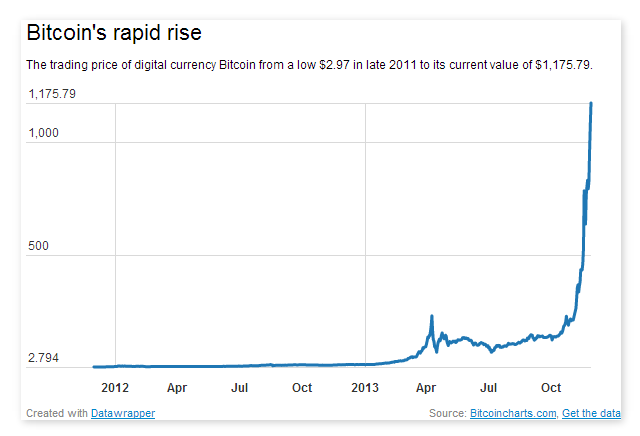

Like many who have watched its surge with wonderment in recent months, the country’s big banks may not know much about Bitcoin, the upstart digital currency that’s now valued at over $1,000 a ‘coin’.

They do know they’re suspicious of it.

Most of Canada’s so-called ‘Big 6’ banks – made up of RBC, TD, BMO, CIBC, Scotiabank and National Bank – have frozen or shut down accounts owned by the handful of Canadian companies who trade the digital currency and convert it to cash for customers.

Since late spring when the currency first spiked to $230, “anything that interfaces with the bank has been having problems,” a source at one Canadian Bitcoin brokerage said Thursday.

Accounts owned by the brokerage have been frozen and shut down, and it’s not alone. Reports indicate that RBC and TD have closed accounts owned by more than one domestic Bitcoin business.

READ MORE: Volatile and surging — Bitcoin popularity on the rise

There’s been little explanation, the brokerage source said. When reached, an RBC spokeswoman declined to comment, saying “with respect to privacy, we are not able to comment on client matters.”

Like a traditional broker, companies like Canadian Bitcoin, LibertyBit and others acts as middlemen matching up a buyers with sellers. They oversee the transfer of funds in exchange for the Bitcoins between the two for a fee.

- What is a halal mortgage? How interest-free home financing works in Canada

- Capital gains changes are ‘really fair,’ Freeland says, as doctors cry foul

- Budget 2024 failed to spark ‘political reboot’ for Liberals, polling suggests

- Tesla’s net income drops 55% in first quarter amid falling global sales

They play a crucial role in converting the new and unregulated digital currency to actual money.

The brokerage source said the banks may be uneasy with the legal grey area that the companies exist in.

But FINTRAC, or the Financial Transactions and Reports Analysis Centre of Canada, which helps govern the financial services industry, however, has told Bitcoin brokerages they do not require approval from the body, a source at one of them said.

A spokesman for FINTRAC confirmed Bitcoin brokerages don’t have to register as financial services companies. “The dealers handling or exchanging Bitcoin aren’t dealing in currency, that’s the short of it,” Peter Lamey, a spokesman said.

“The banks and the government aren’t on the same page. That’s been our problem. As soon as the banks find out what the nature of the business is, lately they’ve just been blindly closing the account without any communication,” the broker source said.

READ MORE: How one Toronto agency is using Bitcoin

The person said there’s been no problem getting funds out of accounts once they’ve been notified it’s being closed. “But there’s no recourse to discuss the issue, to find out exactly why they’re closing it.”

Banks collect millions of dollars annually in wire transfer fees, money Bitcoin could threaten if it gains wider popularity.

The person, who spoke on condition of anonymity out of concern he would jeopardize accounts held with the lone Canadian bank it still transacts with, said the company has moved to lump sum transactions using third-party payment providers to avoid creating traffic that could draw unwanted attention from the bank.

But Canadian banks aren’t alone in their reservations, according to a posting from July on Bitcoin Forums outlining similar account freezes among international institutions.

Bitcoin, which was created in 2008 as tradable currency that exists entirely online and in the digital wallets of those who hold it, has faced plenty of fraud claims.

The anonymous use of Bitcoin by organized crime on sites like Silk Road to acquire illicit goods has also raised alarm bells, as has the currency’s role in money laundering activity — concerns that likely make regulated financial institutions rightfully hesitant.

“My personal opinion is that they don’t understand what it’s about and view it as a high risk business,” the Canadian brokerage source said.

Comments