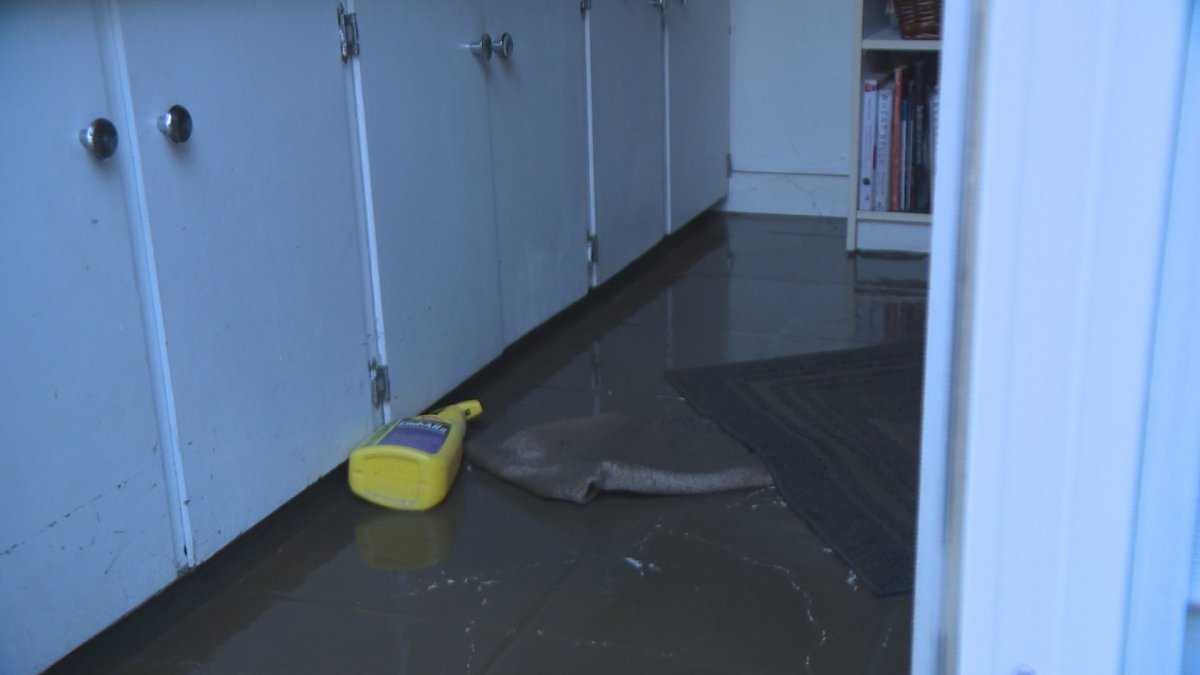

Homeowners with overland water coverage in their insurance policies are beginning to make claims across the Okanagan.

“Up until last year, home insurance policies included flood damage as it related to floods originating within your home, such as pipe leaks and appliance malfunctions, not from water entering from the outside of your home,” Susan Taylor with Valley First Insurance said in a news release. “But since 2016, you can get overland water coverage for residential properties, which ensures homeowners are insured for overland flooding—such as we’re seeing right now in B.C.’s interior.”

According to a recent study done by the University of Waterloo in Ontario, less than 30 per cent of the 2,300 Canadians surveyed are taking actions to prevent their property from flooding.

“B.C.’s Disaster Financial Assistance Program will only provide financial assistance to those impacted by a disaster who were uninsurable,” Taylor said.

The insurance company offers additional tips to prevent flood damage:

• Clear drains, gutters and downspouts of debris

• Move furniture, electronics and sentimental items out of basements or elevate them off the floor

• Ensure the ground slopes away from the house

• Ensure downspouts are disconnected from the storm sewer system

• Install a sump pump and pit to collect storm water, and a backwater valve to stop sewage from coming in

• Seasonally inspect and maintain sump pumps, floor drains and backwater valve

• Discard grease and oil in the garbage instead of flushing them down drains, where they can solidify

- Suspect in killing of temple leader Hardeep Singh Nijjar got student visa in ‘days’

- ‘Summer of discontent’ coming over public service in-office order: unions

- Panera to remove ‘Charged Sips’ drink from Canada amid wrongful death lawsuits

- Minister Boissonnault to testify before ethics committee over ties to lobbyist, PPE company

Comments