Torsten Slok is the chief international economist at Deutsche Bank, a global banking and financial services giant based in Frankfurt.

Slok is one of the economists at the bank who whipped up a mixture of excitement, fear and scoffs way back in December 2013 for suggesting Canadian home prices could be overvalued by as much as 60 per cent.

With a few exceptions, prices have only risen since then. Fast forward to Slok’s most recent report, and the economist is still majorly concerned about Canadians, our real estate market and how much debt we’re collectively taking on.

“Canada is in serious trouble,” a line reads above a slide in Slok’s presentation deck.

MORE: Here’s what’s keeping Canada’s central bankers up at night

Deutsche Bank has updated and republished a series of charts that showcase Slok’s concerns. Here’s four of them:

Debt to income

The amount of debt among Canadian households has rocketed past incomes, reaching a record in the third quarter. That compares to receding debt levels among American borrowers. The so-called debt-to-income ratio is 162.6 per cent, meaning for every dollar in income earned, we collectively owe more than $1.62.

That’s a far more over-leveraged position than U.S. households found themselves in when the last recession hit, according to the Deutsche Bank chart below.

MORE: Canadians pile on more debt as U.S. households pay it down

Multiple forms of debt

Mortgages haven’t just blown up over the past decade, according to Deutsche Bank. Auto loans, personal lines of credit and other obligations have soared as well.

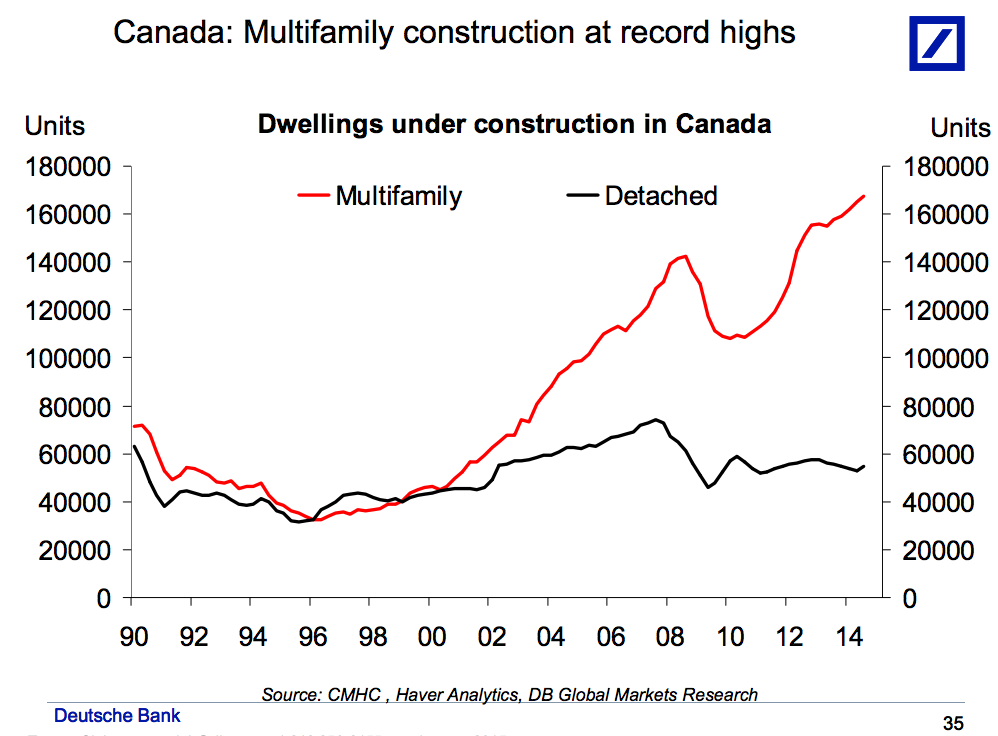

Debt-fueled condo boom

A kinda, sorta scary graph of multi-unit dwellings (read: condos) under construction. Relying on this chart, that means the vast majority of new homes being constructed across the country right now are condos. Economists here say strong rental demand underpins the boom.

MORE: What bubble? Renters underpin Toronto, Vancouver condo booms

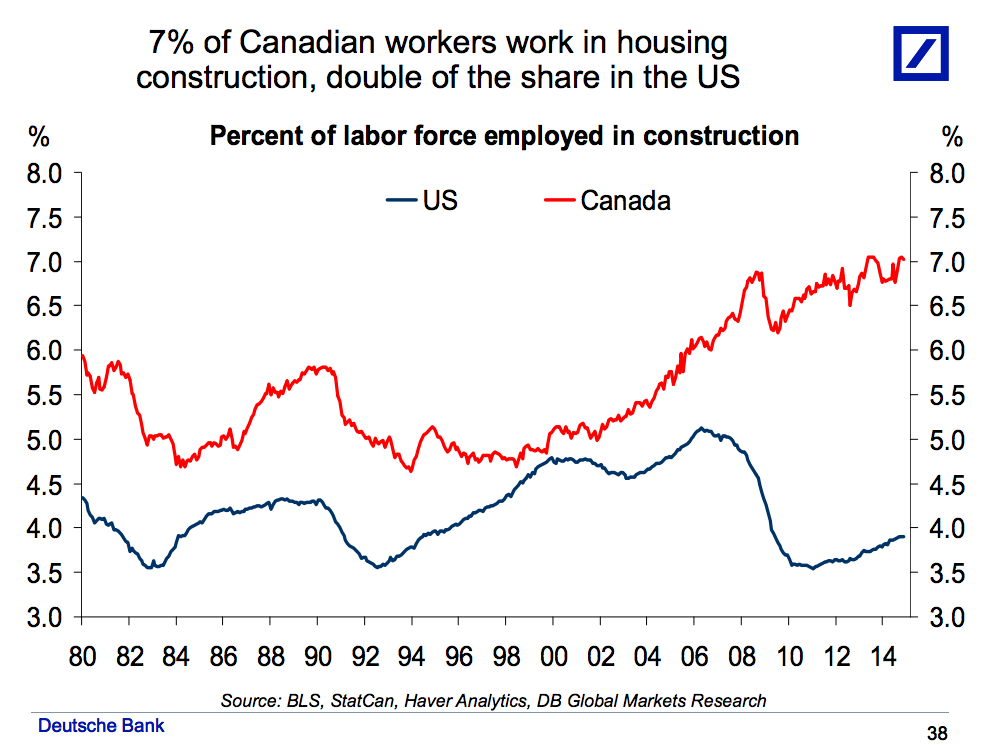

Many construction workers

The number of Canadians building homes has also reached a record high, according to Deutsche Bank. If the housing market takes a turn for the worse, or even slows down as expected, that means a major source of employment in recent years will shrink.

Comments