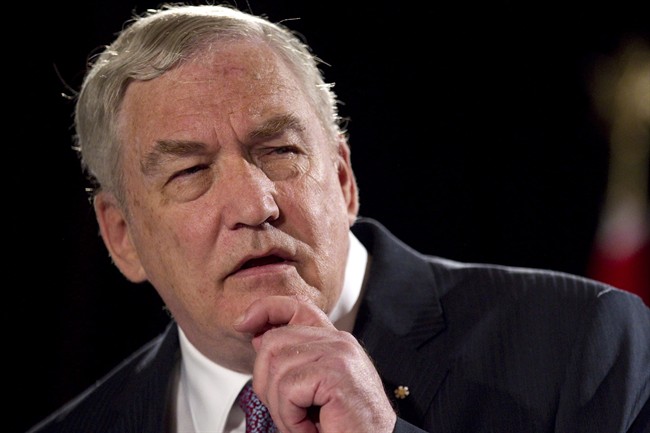

Conrad Black owes the Canadian government taxes on income and taxable benefits from 2002.

That’s the decision of a tax court that sided with the Canada Revenue Agency’s position that Black was a resident of Canada during that time and must therefore pay taxes.

His lawyers had argued that he was a resident of the United Kingdom at the time and not subject to Canadian tax rules.

The amount of income and taxable benefits that Black may have to pay tax on is still to be decided.

But according to an estimate from the Canada Revenue Agency included in court documents it could be as high as 5.1 million dollars.

Black, who renounced his Canadian citizenship in 2001 so that he could become a British Lord, has been living in Toronto since 2012, when he finished serving 37 months in the U.S. for convictions on fraud and obstruction of justice.

An appeal court tossed out two other fraud convictions against him and two other Hollinger executives.

Editor’s note: The Canadian Press has corrected this story to say Black owes taxes on a maximum of $5.1 million in income and benefits, not that Black owes $5.1 million as stated in an earlier version.

Comments