While London, Ont., is bucking national and provincial trends with a slight increase in housing starts expected in 2023 over 2022, it won’t be enough to relieve pressure on the rental market, according to the Canada Mortgage and Housing Corporation.

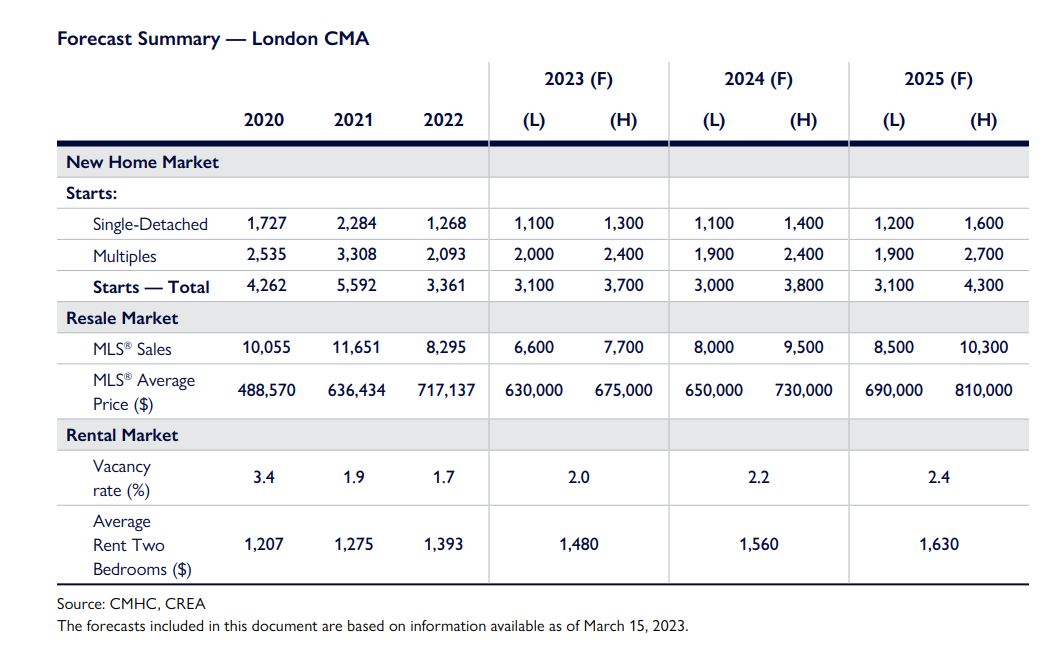

The average cost of a two-bedroom unit in the London Census Metropolitan Area in 2022 was $1,393, according to CMHC. The forecast from CMHC expects that the average household would spend $1,480 on a two-bedroom unit in 2023, $1,560 in 2024 and $1,630 in 2025.

That’s despite an expected increase in housing starts for London this year due to an increase in multi-unit starts.

Rentals.ca, meanwhile, said the average asking rate of available (vacant) two-bedroom units in March 2023 climbed 24.3 per cent year over year to $2,119.

Musawer Muhtaj, CMHC senior analyst, economics, said an increasing population due to immigration, home affordability issues keeping people in the rental market, London’s student population returning to normal and improving employment levels bringing more people into the rental market all combine.

“We don’t expect demand in the rental market to disappear any time soon. So the rental market will definitely remain tight over that 2023 to 2025 period.”

Across Canada, CMHC projects that while home prices are expected to finish 2023 at a lower mark than they did the year before, values are expected to rise through the following years.

Get breaking National news

As for housing starts, Muhtaj told Global News that CMHC expects a slight decrease nationally in 2023 and then for housing starts “to pick up as we go forward towards 2024 and 2025.”

“The major difference for London is that in 2023 we don’t actually expect a decline in housing starts,” he said.

“We expect total housing starts to increase, and that’s obviously mainly due to an increase in multi-unit starts. But looking specifically more into detail, single detached starts, we do expect those to decrease in 2023, but then moving forward in 2024 and 2025, we expect housing starts to pick up.”

For London, the outlook calls for 3,100 starts on the low end for 2023 and 3,700 on the high end. The low-end figure would actually be a decrease from the 3,361 starts in 2022, but Muhtaj said that is an alternative scenario based on many factors.

“There’s a possibility that inflation can come down quicker than expected and thus maybe interest rates lower quicker than expected as well. But the opposite scenario is also true, for there to be persistent inflation and then the Bank of Canada to have to keep interest rates high for a longer period of time,” he said.

“The low end would typically be the alternative scenario where interest rates are still high for a longer period of time in order to counteract inflation that remains high.”

— with a file from Global News’ Craig Lord.

- WestJet execs tried cramped seats on flight weeks before viral video sparked backlash

- Pizza wars? As U.S. chains fight for consumers, how things slice up here

- Health Canada says fake Viagra, Cialis likely sold in multiple Ontario cities

- Canada increased imports from the U.S. in October, StatCan says

Comments