Despite calls from policy-makers for Canadians to rein in record debt levels, use of credit cards, auto loans and other forms of credit continues to rise, according to a new bank poll. And for some, sharply.

In particular, debt levels not including mortgages appear to have surged in Western Canada, where stronger economic growth is perhaps inflating confidence about the ability to repay loans.

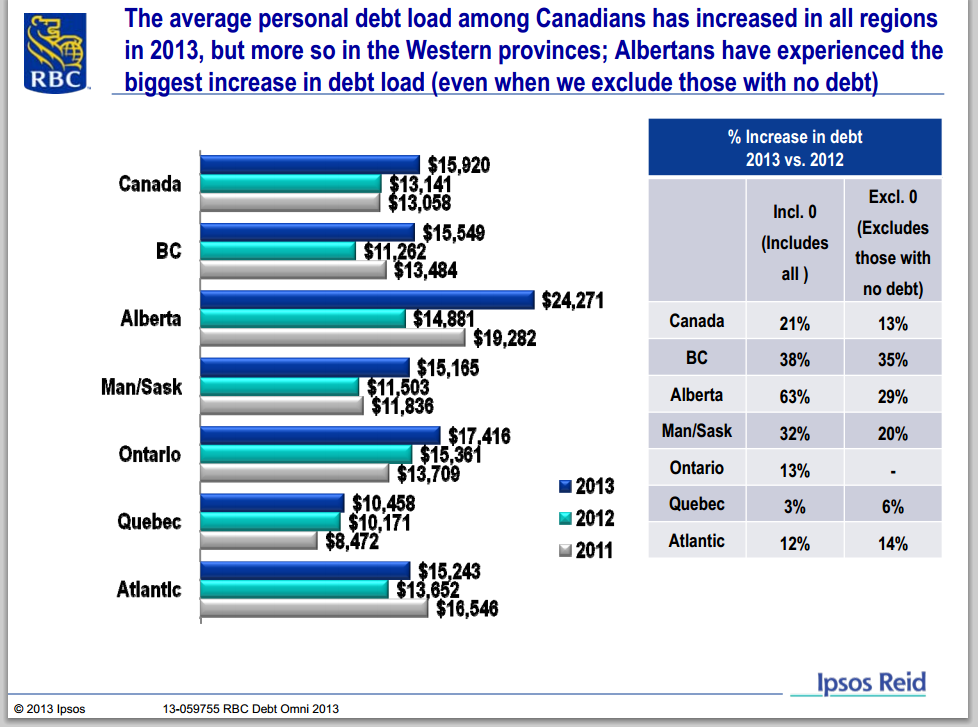

A poll released Tuesday from RBC, the country’s biggest bank, showed non-mortgage debt rose 38.0 per cent in British Columbia, a figure that pales in comparison to the 63.1 per cent spike registered in Alberta. In contrast, comparable figures for Ontario and Quebec were 13.4 per cent and less than 3.0 per cent, respectively.

Read more: Canadians richer than ever — and awash in debt

The rise in Alberta reflects the financial emergency many households faced following widespread flooding in Calgary and the southern part of the province in June, according to RBC. The average personal debt in Alberta stood at $24,271 among provincial respondents to the poll, which was taken in late August.

“In many cases, many folks wouldn’t have received their insurance payments at that time, so early in the recovery stage,” Kim Taylor, director of personal lending at the bank, said.

As for the jump in B.C., Taylor said it followed a slowdown in credit growth in the province last year as consumers took stock of the debt situations.

“They previously had retrenched,” Taylor said. But after a year seeming reflection, B.C. consumers are now “more comfortable” with their debt levels, so, “Instead of not spending, they’re going ahead and making the purchase decision they had deferred.”

- ‘FLiRT’ COVID-19 subvariant dominant in Canada. What to know about the strain

- ‘I am silenced’: Did Miss USA leave a secret message in her resignation?

- Power adapters sold on Amazon may cause electric shock, Health Canada warns

- RateMDs faces certified class-action lawsuit over alleged breach of privacy

The average non-mortgage debt for B.C. respondents was $15,549, compared to $17,416 for Ontario and $10,458 for Quebec.

Read more: Average consumer debt jumps, RBC says

The poll adds to an avalanche of data showing Canadians are highly leveraged, with households owing a record amount of debt as percentage of income in the second quarter, according to Statistics Canada.

There are emerging signs of borrowing fatigue, however.

A separate RBC Economics report issued on Tuesday says total non-mortgage debt as a whole inched 1.8 per cent higher in September – or the slowest pace of annual growth since July 1993.

Non-mortgage debt includes credit cards, secured and unsecured lines of credit as well as student and auto loans, and accounts for about 30 per cent of all outstanding debt.

Rising debt levels, mortgage-related or otherwise, have become a source of concern for the policymakers, economists and financial executives this year, especially as the housing market has rebounded sharply from last year’s slowdown, fueled by mortgage loan growth.

While most suggest fears of a debt bubble bursting are overstated, overall indebtedness is being closely monitored.

Asked about the health of Canadian household balance sheets and general debt levels, the executive said, “It’s high, are they over-leveraged, I can’t really comment.”

Leech suggested consumers should be focused on paying down mortgage debt while continuing to ease the pedal on other borrowing. “After that they really should be saving for the future,” he said.

A regional breakdown from the survey:

Comments