The country’s annual rate of inflation reached its highest level since 2003 last month, Statistics Canada said Wednesday, amid ongoing supply chain disruptions in wake of the COVID-19 pandemic.

The agency said its consumer price index was up 4.4 per cent in September compared with a 4.1 per cent year-over-year increase in August.

While the biggest driver for rising prices was gasoline, food prices weren’t left unscathed.

“Food was an important component of the September increase in inflation, and there were a number of factors that played a role,” Sri Thanabalasingam, senior economist at TD Bank told Global News.

“You had temporary factory closures. You had higher input costs as well as the general theme of supply chain disruptions. So all three factors contributed to pushing up food prices last month.”

Overall, the cost of food rose 3.9 per cent year-over-year compared to 2.7 per cent in August. The biggest gains were in food purchased in store (4.2 per cent), followed by food in restaurants (3.1 per cent).

But are higher prices here to stay? Economists say the answer to that question will depend on how long supply chain disruptions last.

“It’s probably the million-dollar question over when these supply chain disruptions will start fading. From recent reports, it would suggest that maybe sometime in the second half of 2022,” Thanabalasingam said. “So until then, you could still see price gains come through as a result of supply issues.”

RSM Chief Economist Joe Brusuelas expects inflation to peak sometime before the end of the year and then come down “considerably” after next spring.

“Things will look a lot better on the inflation front as people get back to work as supply chains get reconstituted,” he told Global News.

Most food categories saw price gains

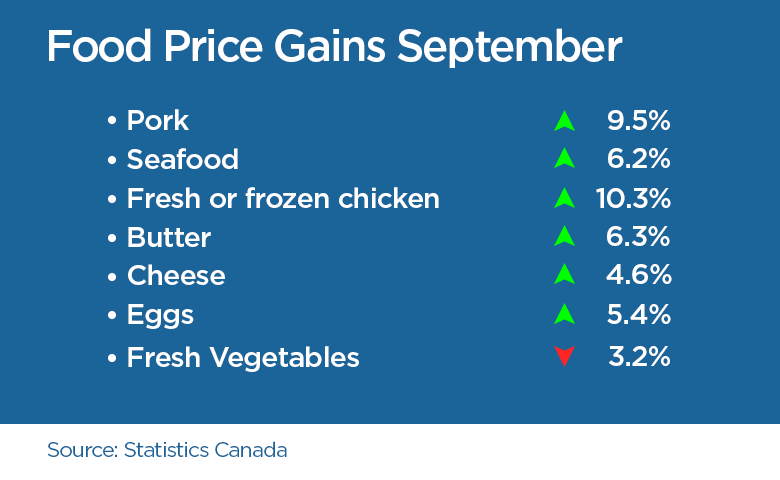

Some of the biggest price jumps in September when it came to food were seen in meat products, which rose 9.5 per cent overall, followed by seafood (6.2 per cent) and dairy products (5.1 per cent).

Prices for edible fats and oils rose 18.5 per cent, the largest annual increase since January 2009.

Get weekly money news

Bacon prices jumped a whopping 20 per cent — the largest annual gain since January 2015, which was partly driven by temporary closures of production facilities, according to StatCan.

Butter saw the highest price increase of all the dairy products (6.3 per cent) followed by cheese (4.6 per cent), and eggs (5.4 per cent).

One category that saw a decrease was fresh vegetables, where prices declined 3.2 per cent year-over-year, mostly due to tomato prices, which fell 26 per cent last month.

This year, input costs for agricultural staples such as corn, wheat and soy have jumped which makes all kinds of food, including meat and packaged goods, cost more.

“So it’s expected that we would see some of that filtering to into food prices,” RBC Senior Economist Nathan Janzen told Global News.

But he noted the food production industry is a bit less exposed to global supply chain disruptions than other sectors because Canada is a global producer of food.

“Certainly something like dairy products, they’re tightly controlled and we don’t trade a lot with the rest of the world, but we have seen food prices rising, rising productivity cost. Pretty much every household obviously has to pay,” Janzen said.

Janet Music, who is the research program coordinator at Dalhousie University’s Agri-Food Analytics Lab, pointed out climate change as having a role to play in rising food prices, too.

“Climate change has caused a lot of adverse weather effects, and so it’s been difficult harvests across the northern hemisphere,” she said. “Droughts in the West, wildfires in California, flooding in Europe … this will affect harvests, of course, also the transportation of different items.”

A recent report from Dalhousie’s Agri-Food Analytics Lab found Canadians are shifting their shopping behaviours to save money as a result of rising food costs.

Eighty-six per cent of Canadians surveyed believe food prices are higher than they were six months ago, according to the report published Sept. 29. As a result, two in five people said they have changed their behaviour at the market over the past year.

What rising inflation means for interest rates

Bank of Canada Governor Tiff Macklem has said the central bank would act to rein in inflation if the current bout of price increases looks to become more than one-off pressure points.

However, the central bank, which is set to release its next interest decision next week, has stood firm in its stance that higher inflation is transitory.

“Something is transitory if it doesn’t change behaviour,” the Conference Board of Canada said in a report after the latest inflation reading Wednesday.

“But we are seeing businesses change behaviour, for example, when it comes to setting higher prices for their goods and services. The rise in prices is a more long-lasting phenomenon and should be treated as such.”

Brusuelas and Thanabalasingam and the Conference Board of Canada expect inflation to persist into spring of 2022 because of supply chain issues.

And the consensus remains that the central bank will maintain its key interest rate at 0.25 per cent into the back half of next year.

“There is quite a bit of way to go for the economy to recover,” Thanabalasingam said. “You just look at the labour market and the fact that there are a large number of people that are still unemployed, sitting on the sidelines without a job. And so removing monetary stimulus or (doing so) too early could weaken that recovery.”

“But inflation is higher because of, again, these supply-side issues. So if they move to raise rates earlier than what they were thinking, this could weaken the economic recovery.”

The Conference Board of Canada warned, though, that if inflation figures remain hot, the central bank might be forced to hike interest rates earlier than the second half of next year.

“If the Bank hikes too early it risks stalling growth and harming its own credibility, and if it waits too long, it risks pushing prices even higher. It’s not easy being a central banker these days,” the think tank said in its report.

Thanabalasingam echoed this sentiment.

“Given the fact that inflation right now is being propelled by some of these supply-side factors, they may hang their hats on that story for a little while longer before shifting their communication.”

Comments

Want to discuss? Please read our Commenting Policy first.