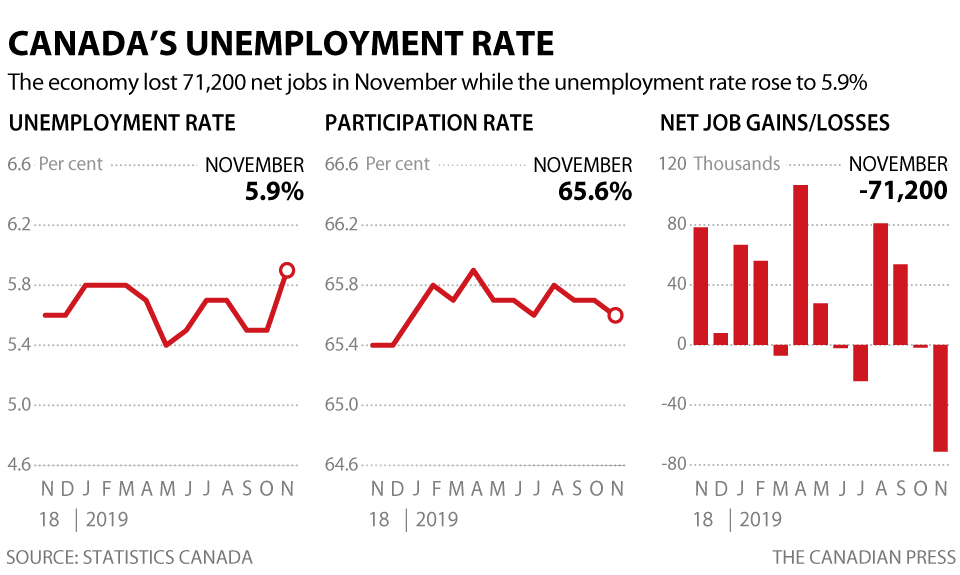

The Canadian November labour market posted its biggest monthly job loss and largest unemployment upswing since the financial crisis over a decade ago, Statistics Canada data show. The economy shed 71,200 jobs last month, while the jobless rate jumped to 5.9 per cent, up from 5.5 per cent in October.

Economists on average had expected a gain of 10,000 jobs and the unemployment rate to hold steady at 5.5 per cent, according to financial markets data firm Refinitiv.

Instead, the data showed job losses spread across industries and job types, with both full-time and part-time positions axed, CIBC economist Royce Mendes wrote in a note to clients.

READ MORE: Oil and gas workers look for more opportunity in Texas

Get weekly money news

The goods-producing sector lost 26,600 jobs in the month as the number of manufacturing jobs fell by 27,500 jobs and the natural resources sector shed 6,500. Meanwhile, the services sector lost 44,400 jobs as the number of public administration jobs fell by 24,900 jobs in November.

The loss in jobs came as both full-time and part-time employment moved lower. The number of full-time jobs fell by 38,400, while part-time employment fell 32,800.

Regionally, Ontario and Prince Edward Island were the only provinces to see job growth in the month. Quebec lost 45,100 jobs in November due to a decline in manufacturing as well as accommodation and food services. Alberta and B.C. both lost 18,200 jobs.

While Statistics Canada’s Labour Force Survey is known to be subject to sharp swings, the November report paints a grim picture, BMO economist Robert Kavcic wrote in his analysis of the numbers.

“[This] is pretty much as bad as it can possibly get.”

The steep job losses could reflect a retrenchment after several months of outsized employment gains that didn’t entirely jive with more modest underlying economic growth, several economists noted.

Still, the less volatile jobless rate number also showed the largest monthly jump since 2009, noted RBC economist Nathan Janzen. The 2009 job losses were tied to the global financial crisis.

READ MORE: Pipeline constraints to slow Alberta’s economy to single-digit growth in 2019

Overall, though, the year-to-date jobs tally for 2019 remains positive, with the economy adding 26,000 net new jobs between January and November. Another silver-lining came from wage data, which showed a 4.5 per cent increase year over year, up from 4.3 per cent in October, Janzen wrote.

The weak job numbers have implications for the Bank of Canada, which has so far stood out among other rich-country central banks for not cutting interest rates amid worries about a global economic slowdown.

READ MORE: Bank of Canada holds interest rate at 1.75% as global trade conflicts cause uncertainty

“Today’s data mean the Bank of Canada and others will be watching the next several months of data just that much more closely,” Janzen wrote.

— With files from the Canadian Press

Comments

Want to discuss? Please read our Commenting Policy first.