TORONTO – A man who lost hundreds of thousands of dollars because of a negligent lawyer has finally received partial compensation years after winning a court judgment that has proven unenforceable.

The $150,000 payout to Nalliah Balachandran late last month came after The Canadian Press reported in December on a glaring gap in the insurance system designed to protect victims of unscrupulous or incompetent Ontario lawyers.

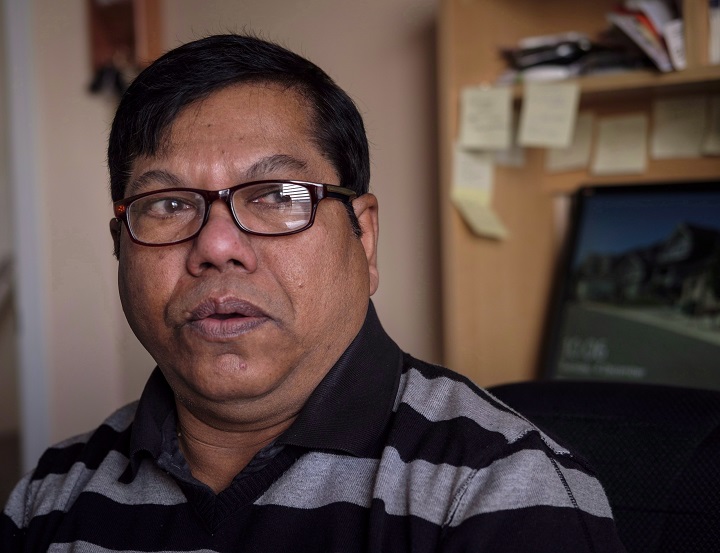

“This money will help,” Balachandran said. “At least I can pay off some debts.”

Balachandran, 64, now of Calgary, had been unable to collect on $188,646 in damages an Ontario Superior Court justice awarded him in 2012 against lawyer Michael (Mike) J. Webster, who was disbarred after an avalanche of complaints.

Other cases The Canadian Press reviewed turned up several people who had lost out on compensation for car-crash injuries or ended up in jail because lawyers failed to do their jobs. None was able to collect on court-ordered damages, even though all members of Ontario’s legal profession must carry liability coverage through the insurance company known as LawPro.

Despite judicial criticism of the situation, LawPro denies coverage when lawyers fail to report a client’s claim against them or refuse to help defend the action. The result is usually disbarment – and clients left without access to compensation.

Several lawyers trying to help hapless clients expressed dismay LawPro, owned by the 50,000-member Law Society of Ontario and with assets of close to $735 million, would take that position.

Get breaking National news

“It’s very unfair and unfortunate – and to my mind shocking,” one lawyer, Ava Hillier, said last year. “People need to know that they’ve got nothing if their lawyer just decides not to pick up the phone.”

What lawyers involved in such cases said they had never heard of is a policy the law society adopted in 1997. It provides victims of lawyers access to an internal compensation fund when LawPro declines coverage. The fund can reimburse victims up to $500,000.

Days after an interview with its treasurer last November, the law society updated its website to explicitly refer to the obscure policy. Five claims, including Balachandran’s, have since been made against the fund, one quarter of all claims in 1997. Two have been settled.

Over the past 20 years, a spokeswoman said the fund has paid out a total of $552,565 for 14 claims involving 13 lawyers – a fraction of the $100-million LawPro lays out for claims annually.

“Our focus as the regulator is on protecting the public, and, as per our policy, the Law Society’s compensation fund will consider claims where LawPro coverage is denied in special circumstances where a lawyer fails to report a claim to the professional liability insurer or fails to co-operate with the insurer,” Susan Tonkin said.

Balachandran, who works for Alberta Health Services, received his cheque for the maximum amount in effect at the time of his initial claim. A timely payout, he said, would have spared him and his wife years of stress and tens of thousands of dollars in interest on mounting debts he still can’t pay off.

He also faulted the society for its previous failure to make the compensation fund widely known, potentially saving him from a fruitless battle to collect the almost $200,000 Webster now owes him and which the law society will try to recover.

As important, he said, is the law society’s move to transparency about the 1997 policy.

“It’s going to help not just me but the whole community,” Balachandran said.

LawPro, which has been subject to several lawsuits over its refusal to cover such cases, has called such situations rare. It has defended the mandatory insurance program as being in the best interests of the public and Ontario lawyers.

The Canadian Press first published this article on Oct. 6, 2019.

Comments

Want to discuss? Please read our Commenting Policy first.