The Liberals and Conservatives have revealed tax plans with similar price tags as they attempt to target the elusive middle-class vote with the federal election in full swing.

Affordability and cost of living is a top issue in this campaign, according to a recent Ipsos poll, with 27 per cent of respondents citing it as a top election issue. Only health care, at 35 per cent, was more popular.

Liberal Leader Justin Trudeau, hoping to move past the recent blackface controversy, announced Sunday that if re-elected, he would make the first $15,000 of income tax free for most Canadians. The Liberals said they would accomplish this by raising the basic personal income tax amount by almost $2,000 by 2023 for people earning under $147,000 a year — saving the average Canadian roughly $292 a year.

WATCH: Trudeau promises to lower cellphone bills, make first $15K of earnings tax free

Currently, Canadians don’t pay income tax on the first $12,309 earned. That would increase to $13,229 under the Liberal plan and $15,000 by 2023, according to the party.

The Liberals have yet to release independent costing from the parliamentary budget officer, but an analysis by Kevin Milligan, economics professor at the University of British Columbia, pegged the cost of the plan at $5.6 billion. According to his analysis, the Liberals’ policy would see roughly 690,000 Canadians stop paying federal income taxes and lift 38,000 Canadians above the poverty line.

Trudeau’s proposal comes just a week after Conservative Leader Andrew Scheer announced his “universal tax cut” on the lowest income bracket — on income up to $47,630 — from 15 per cent to 13.75 per cent over four years.

The plan — priced at $5.9 billion by the PBO — could save the average single taxpayer as much as $444 per year and a two-income couple (a male and a female in this case) could save more than $860, according to Scheer.

WATCH: Conservatives’ Andrew Scheer promises tax cut for lowest income bracket

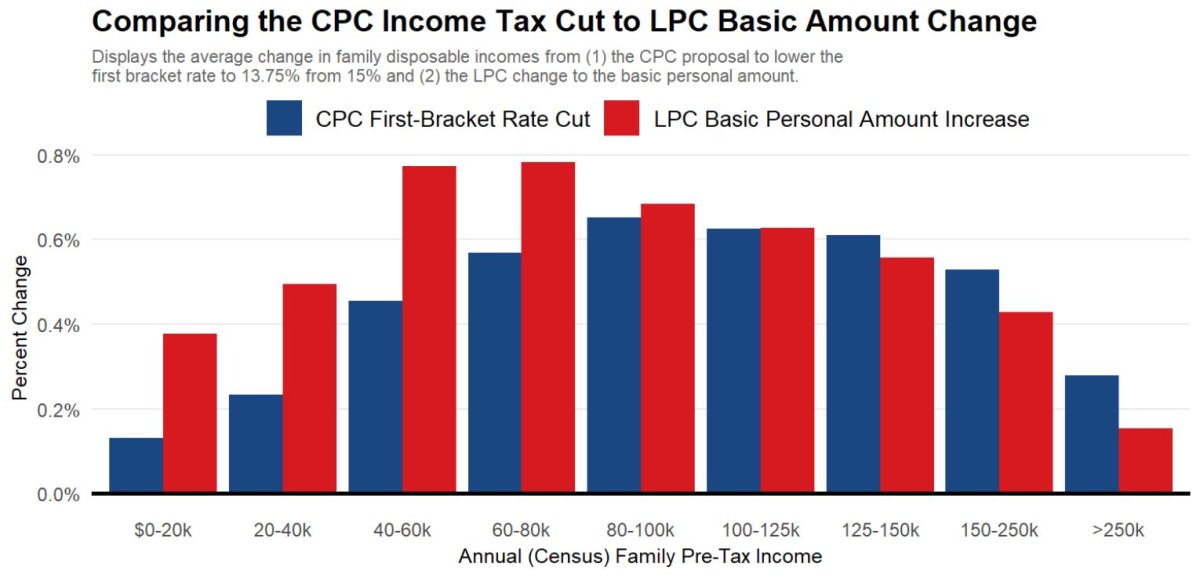

University of Calgary economics professor Trevor Tombe said that while the two plans cost roughly the same, the key difference depends on level of income.

“This is almost universal coverage, it’s just excluding the one or two per cent of top federal income tax filers.”

While both parties have promised to help the middle class, defining what that means exactly is often unclear. According to the latest available data from Statistics Canada, the median income in 2017 was $33,000 while the median income for a family was $112,000.

Tombe said that while the Conservative plan affects nearly everyone who pays taxes, you have to be earning $47,630 or more to save the maximum amount the cut would offer. According to the Canada Revenue Agency, more than nine million of the nearly 28 million people who filed taxes in 2017 had no federal income liability.

FACT CHECK: Singh’s comments on Conservatives’ tax cuts are inaccurate

Under the Liberal plan, Tombe found the biggest percentage change in disposable income would go to families earning between $40,000 and $80,000. Meanwhile, the Tories’ tax plan would see families earning between $80,000 and $150,000 receive the biggest change in disposable income percentage.

Moshe Lander, an economist with Montreal’s Concordia University, said the Liberals are focusing more on the lower end of the income distribution, while the Conservatives are focusing on the higher end.

WATCH: Grits, Tories both promise to make parental leave tax-free. Who has the better offer?

However, Lander said that neither proposal is “good economic policy” with the Canadian economy running at near capacity and unemployment at record low levels.

“What you want right now is fiscal responsibility and neither party, let alone the NDP or Green Party, are showing signs of that.”

When it comes to taxes, the Greens have said they would increase corporate tax rates from 15 to 21 per cent and would create a Federal Tax Commission to ensure the tax system is fair and accessible.

WATCH: Scheer says Conservatives would bring back ‘very popular’ tax credits

The New Democrats have pledged to hike the rate for capital gains tax (profits from stocks or the sale of properties) from 50 to 75 per cent. They also want to hike the top federal personal income tax rate from 33 to 35 per cent and impose a one per cent wealth tax on those making more than $20 million.

Lander also criticized the Liberals for failing to be transparent as they have failed to release PBO estimates for the more than $4 billion worth of campaign promises they’ve made to date.

“It’s ironic,” he said, given the Trudeau government vowed to expand the mandate of the PBO to include campaign cost estimates. “Why would you try and avoid transparency unless daylight is going expose something much worse?”

With the campaign now entering its second week, the Conservatives have had 12 items costed by the PBO, the NDP three, the Greens two and Grits zero.

Meanwhile, Trudeau has said his campaign will release a fully costed platform, along with the PBO’s analysis of big-ticket items, “in the coming weeks.”

WATCH: Scheer comments on Trudeau not taking part in Munk Debate

Comments