An economic indicator that has predicted every major recession since the 1960s is sending another warning.

It’s called the U.S. Treasury yield curve and, when inverted, is considered to be the most reliable indicator of an upcoming recession. As of July 2019, the curve has been inverted for an entire fiscal quarter.

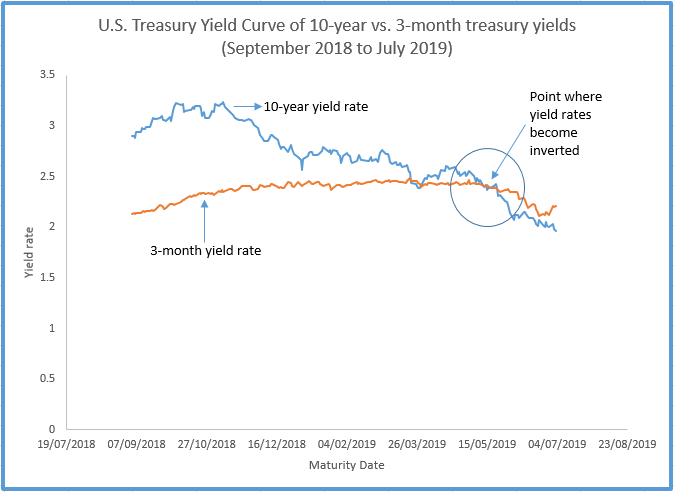

Normally, long-term bonds yield higher interest rates than short-term bonds. If represented on a graph, this phenomenon would look like an upward slope. However, when the curve becomes inverted, short-term bonds yield higher interest rates than long-term bonds, which creates a downward slope when represented on a graph.

The yield curve model was originally developed by Canadian economist Campbell Harvey while he was completing his dissertation. In the three recessions since his dissertation was published, including the 2008 financial crisis, the curve was inverted before each one.

Harvey is “very confident” the current inverted curve could be indicative of another recession on the horizon.

What is an inverted U.S. Treasury yield curve?

The U.S. Treasury yield curve describes the relationship between treasury interest rates and the maturity of treasury bonds. A bond can be thought of as a loan to a corporation — or, in the case of the U.S. Treasury, a loan to the government. Investors buy bonds because they will receive interest payments, and the government agency or corporation signs an agreement to repay the loan and the interest at a predetermined rate and on a predetermined schedule.

In an interview, Harvey told Global News that U.S. Treasury bonds are among the safest bonds out there “because the government can always print more money,” likening them to a Canadian Guaranteed Investment Certificate (GIC).

“It’s almost always the case that the longer-term rates are higher than the shorter-term rates, but on certain rare occasions, it goes the other way. And that’s what we have today.”

The relationship between the maturity of assets and their interest rates should be upward sloping, but the curve becomes inverted when short-term bonds begin paying higher rates than long-term bonds, Harvey adds.

WATCH: New report on housing market says mild recession could last 3 years

Citing a paper he authored in the Canadian Journal of Economics, Harvey also said the U.S. Treasury yield curve influences the Canadian government bonds yield curve, which became inverted in long-term versus short-term maturities for the first time in years this past May.

He adds that another red flag to look for in conjunction with an inverted yield curve is anti-growth policies such as the tariffs placed on U.S. trading partners throughout the Trump presidency in the U.S.

According to Harvey, a rate reversal is indicative of inflation, which has historically preceded financial downturns.

How can there be a recession when the economy seems to be doing so well?

Harvey understands how this can be a little confusing for consumers.

With the stock market at an all-time high and record-low unemployment rates, it can be difficult to fathom that the market is on the verge of a recession. However, Harvey points out that this is what the economy looked like a year before previous recessions as well.

“The key thing is, that’s exactly what it looks like before all recessions a year or a year and a half in advance so this is not surprising at all. This signal delivers a nine- to 18-month advance warning, historically,” he said.

This trend is known as a bear market and can be identified in the Great Depression and the financial crisis of 2008.

Not all economists agree with the yield curve

However, other economists caution consumers not to disregard other economic indicators entirely in favour of the yield curve.

“The yield curve, while it’s interesting, is only one economic indicator. There are many,” said Eric Kam, an economics and monetary policy professor at Ryerson University who does not believe that a global recession is imminent.

“Other economic indicators, which I think are as good, if not better, are very strong… The debt-to-GDP ratio is as low as it’s been since the Second World War, interest rates are still low, and right now, the cost of borrowing money is still low,” he said.

WATCH (2018): Canada has capacity to handle a recession — Morneau

“The one thing that we’ve almost proven beyond a shadow of a doubt is that when the interest rates are low, the economy is strong. And when interest rates are high, the economy is weak because people do not want to borrow money,” said Kam.

Furthermore, he said the reason for high inflation rates may actually be due to monetary policy, as central banks around the world are currently aiming to keep inflation rates at around two per cent. These inflation targets have been adopted over the past few decades to increase competition, reports the Financial Times.

Financial markets can be a self-fulfilling prophecy

While Kam and Harvey disagree on the imminence of an economic recession, they do agree that, in theory, the social behaviour influenced by fear of a recession could bring on a financial downturn in reality.

“You start to create this panic and then people start to not invest in bonds and save their money. And then, lo and behold, you have basically a recession based on fear and panic,” Kam said.

Harvey suggested that while this may be true, it may not be a bad thing.

“If everybody is looking at this indicator and says, ‘Well, the curve is inverted; we’re going into recession. I’m going to take these actions, defensive actions,’ then it could be causal,” he said. “So self-fulfilling prophecy actually potentially transforms this indicator from something that reflects what’s going on to something that causes what’s going on.”

He adds that because he considers the curve to be an accurate forecaster, this also gives people the opportunity to lessen the impact on their personal and corporate wealth ahead of a recession that is likely to take place anyway.

Comments