A new study of the Kitchener-Waterloo real estate market shows that homes in at least half of the neighbourhoods in the two cities are within the realm of affordability.

The study, which was released by Zoocasa Thursday morning, looked at the median household income compared with how much the household would need to earn to buy a home in 31 neighbourhoods within the two cities.

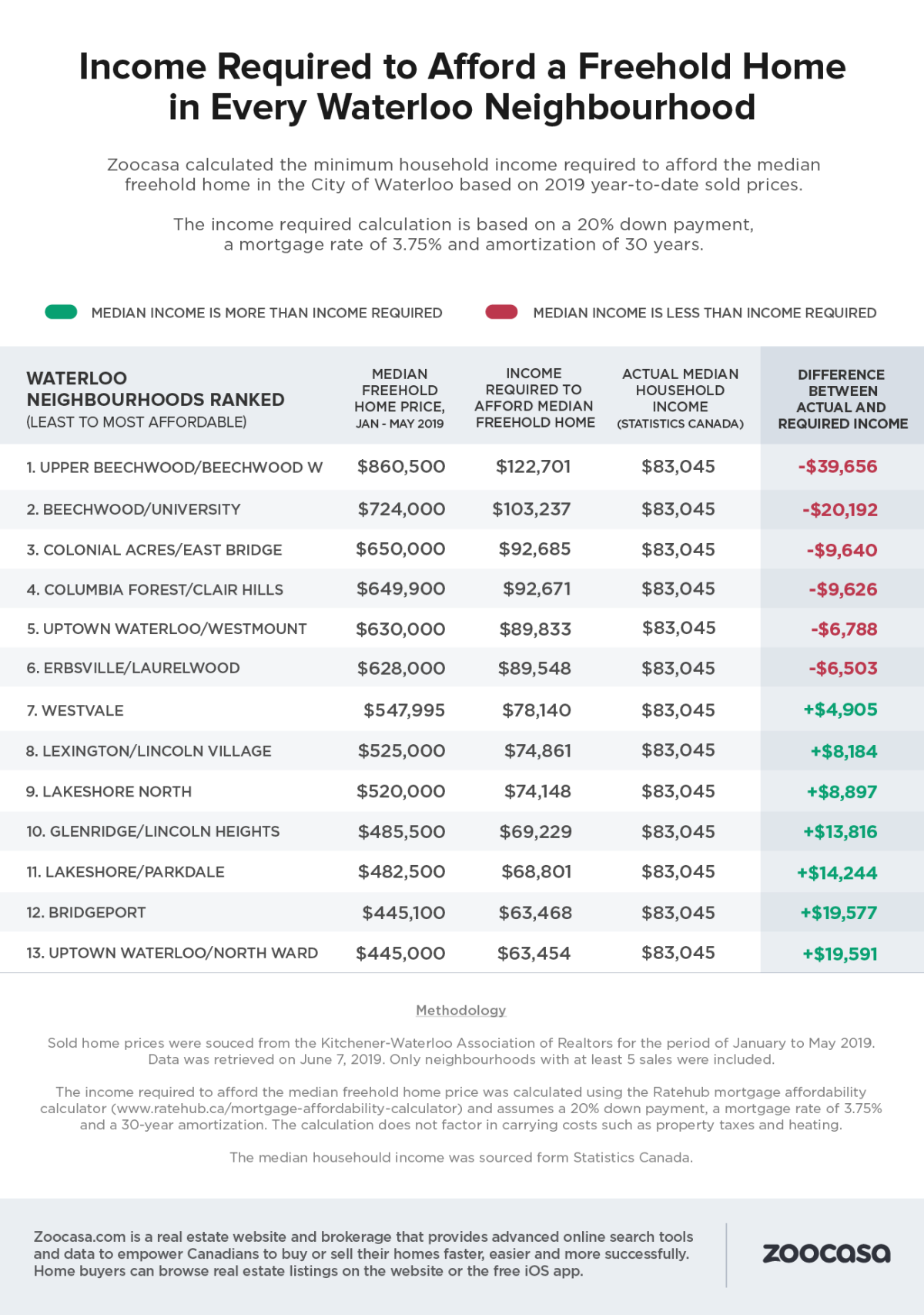

In Kitchener, half of the 18 neighbourhoods the study looked at were considered to be affordable while in Waterloo the number was just above 50 per cent (seven of 13.)

READ MORE: Kitchener-Waterloo home prices see double-digit increase in May, according to KWAR

The most affordable neighbourhood in the city of Kitchener was Victoria Hills, which saw a median home sales figure of $405,550 between January and May. With average household income in the area coming in at $70,774, Zoocasa says this would allow an income surplus of $13,017.

On the flip side of the coin, few in Kitchener would be surprised to see the Hidden Valley/Pioneer Tower neighbourhood topping the other end of the list. Homes in the area were sold for an average of $1.115 million, almost a half million dollars more than the runner-up, which was Chicopee/Freeport ($640,000.)

Get weekly money news

The price of a home in Hidden Valley/Pioneer Tower was also well above the most expensive neighbourhood in Waterloo.

READ MORE: How Chinese gangs are laundering drug money through Vancouver real estate

Homes in Upper Beachwood were sold for an average of $860,000. With Waterloo having an average family household income of $83,045, this would create an income deficit of $39,656.

At the other end of Waterloo’s spectrum were the neighbourhoods of Uptown Waterloo/Northport (445,000) and Bridgeport ($445,100).

For the purposes of the study, Zoocasa assumed there would be a 20 per cent down payment with a mortgage of 3.75 per cent with a 30-year amortization period.

READ MORE: Will it crash? Here’s what to expect from the Canadian housing market in 2019

Marcia Fukudome, a Zoocasa realtor in the region, has some words of advice for those who are priced out of the market: if a detached home is out of your price range, then consider a semi, townhome or condo.

For a full list of the affordability of freehold homes in Kitchener and Waterloo, see the below lists.

Comments