The federal budget contains at least two measures that will have working seniors cheer.

The first would allow working seniors to keep more of the money they earn before triggering a claw-back in the Guaranteed Income Supplement (GIS).

The GIS is a tax-free benefit available to low-income Canadians who receive the Old Age Security pension (OAS).

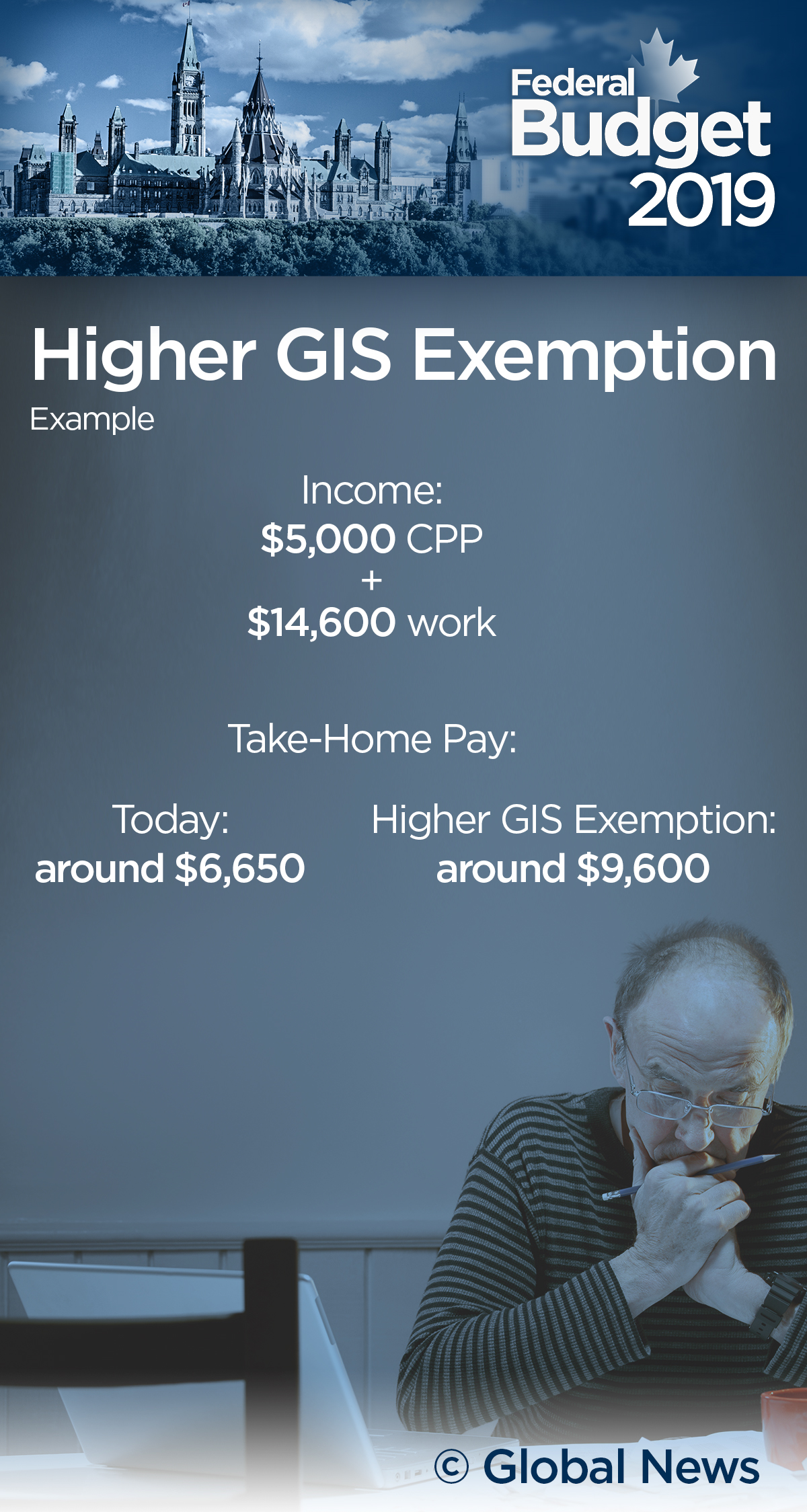

Currently, eligible seniors and their spouses can earn only up to $3,500 a year each before triggering a reduction in their GIS benefits. And that limit only applies to employment income. For those earning money from self-employment, there is no exemption.

The new rules would apply equally to employment and self-employment earnings and allow seniors to make up to $5,000 a year before the government starts rolling back their benefits.

WATCH: Finance Minister Bill Morneau presented the 2019 federal budget in the House of Commons Tuesday.

For the next $10,000 in annual earnings, the budget proposes a 50-per cent exemption.

The changes mean the annual income at which GIS benefits are fully rolled back would rise to just under $30,000 a year. That’s up from just over $20,000 a year for seniors with employment income and up from less than $20,000 for those with self-employment income.

The higher GIS exemption would take effect beginning in July 2020 and cost around $1.76 billion over four years.

A new option to defer some retirement income until age 85

Get weekly money news

Another measure that might help working seniors is a proposal to introduce so-called advanced life deferred annuities, or ALDAs.

Annuities pay out a set amount beginning on a certain date and are one of the investments Canadians can buy with funds held in a registered retirement account. Currently, annuity payouts must start by age 71.

With an ALDA, however, Canadians would be able to defer payouts until the end of the year their turn 85.

Individuals would be able to hold ALDAs worth up to 25 per cent of their registered retirement holdings, for a maximum lifetime dollar value of $150,000.

Crucially, the value of the ALDA would not be included in the math the government uses to calculate how much seniors over 71 must withdraw from their registered retirement income funds (RRIF) every year, Doug Carroll, a tax and financial planning expert at Meridian said.

The measure would allow Canadians to keep more of their money into their RRIFs for longer, Carroll said.

This will likely be welcome news to working seniors, for which RRIF withdrawals add to earnings as taxable income.

It would also help Canadians cordon off a portion of their retirement savings for their later retirement years, which are often the most expensive due to higher healthcare costs.

Auto-enrollment in the Canada Pension Plan

A third pension-related proposal is to automatically enroll eligible Canadians in the Canada Pension Plan (CPP).

Currently, Canadians have to apply to receive CPP by the age of 70. Those who don’t meet the deadline don’t receive the benefit, even if they’ve contributed to the plan.

In other words, “You should be receiving a cheque, but you’re not,” said David Macdonald of the Canadian Centre for Policy Alternatives.

Some 40,000 seniors over the age of 70 are estimated to be missing out on their CPP payments. That would change starting in 2020.

It would be “a big move forward,” said Macdonald.

The plan would cost $9.6 million, with the funds coming from the CPP Account.

Watch: More from federal budget day

Comments

Want to discuss? Please read our Commenting Policy first.