Many Americans have already planned out what they’d do with the combined US$2.2 billion up for grabs in the Powerball and Mega Millions lotteries this week. But you could maximize your potential winnings with a little planning ahead of time, because the payout can vary by up to $200 million depending on where you buy your ticket.

The Mega Millions lottery jackpot currently sits at a record $1.6 billion for Tuesday’s draw, while the Powerball jackpot is at $620 million ahead of the Wednesday draw. The Mega Millions odds currently sit at approximately one in 302 million, while the Powerball odds are at one in 292.2 million.

WATCH: ‘They can stay anonymous’ says South Carolina Education Lottery COO

Anyone who wins one of the two grand prizes would be automatically bumped up to the highest tax rate of 37 per cent in the U.S., according to information from the Internal Revenue Service. That tax bracket is reserved for individuals who make more than $500,001 or couples who file jointly with an income of more than $600,001.

You wouldn’t have to pay the 37 per cent of your money to the IRS upfront, but you would have to surrender a significant portion of your winnings before income tax time.

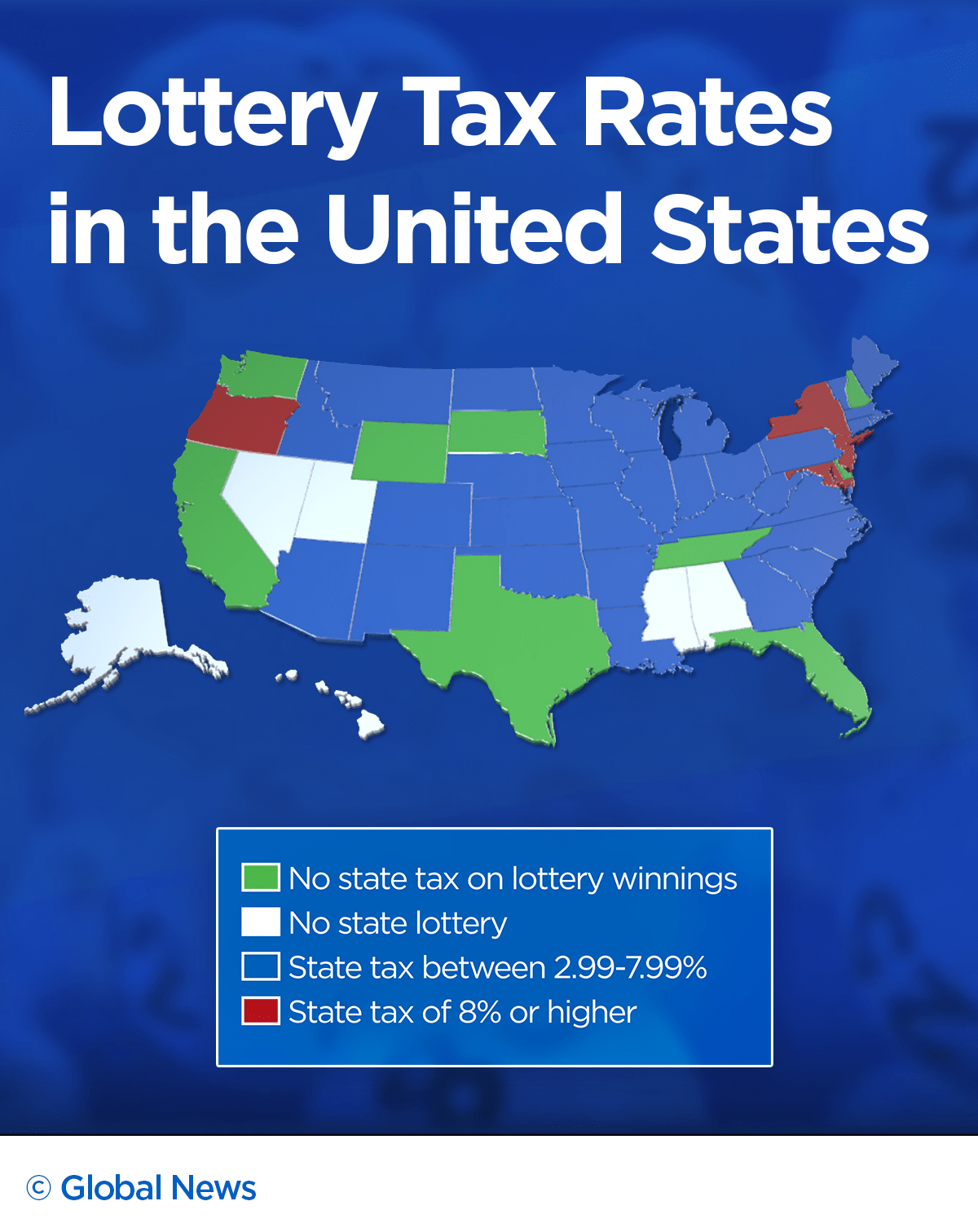

The U.S. government automatically withholds 25 per cent of all lottery winnings for prizes over $5,000, regardless of where the ticket is purchased. Most states also withhold a chunk of the winnings off the top, although there are a few places where the state tax man will hit you particularly hard, and others where he’ll leave you alone entirely. Taxes are based on where the ticket is purchased, not where the ticketholder lives. Final income tax payments are calculated at the end of the fiscal year, after charitable donations and other factors are worked in.

WATCH BELOW: What if you really do win the lottery?

New York is the only state where three levels of government will withhold a chunk of the lottery payout, making it the most heavily taxed state in the country for lottery winners, according to USA Mega, the organization that runs the Mega Millions and Powerball lotteries.

Anyone who buys a ticket in Manhattan will lose 25 per cent of any jackpot winnings to the federal government, 8.82 per cent to the state and an additional 3.876 per cent to the city. That means someone who wins $1.6 billion in New York City would lose approximately $603 million (37.696 per cent) to taxes. Someone who wins in a state with no lottery tax would only lose $400 million (25 per cent).

Get weekly money news

WATCH ABOVE: People are shovelling out large sums of money as the jackpots for the United States’ two national lotteries, PowerBall and MegaMillions, reached more than US$2 billion

The city rate is slightly lower for tickets purchased in Yonkers (1.477 per cent).

Nearby New Jersey only has an 8 per cent lottery tax rate, making it more lucrative to win there than in New York City. Most states have lower tax rates for lotteries, between 3 and 7 per cent.

However, the best way to maximize your potential winnings is to buy your ticket in a state with no tax on lottery winnings. These states are scattered throughout the country, and there are even a few near the U.S.-Canada border, making them attractive destinations for Canadians trying to win the big prize.

The Powerball and Mega Millions rules dictate that foreigners can win the U.S. lottery, but they stand to automatically lose 30 per cent of the winnings to the U.S. government. That would amount to forfeiting $480 million to the IRS, along with whatever amount the state withholds.

California, Delaware, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington State and Wyoming do not tax lottery prizes, making them the most lucrative places in the U.S. to win the lottery.

WATCH BELOW: Three winners split the $1.6-billion Powerball jackpot in 2016

Nevada, Utah, Mississippi, Alabama, Hawaii and Alaska are the only states that do not participate in lotteries.

The map below shows the best and worst places to buy a lottery ticket if you’re planning to hit the jackpot.

Based on sales projections, there is a 75 per cent chance that one of the 302 million possible combinations will be chosen for the Mega Millions draw on Tuesday, according to Carole Gentry, a spokeswoman for Maryland Lottery and Gaming. That’s up from 59.1 per cent in Friday’s draw.

“It’s possible that nobody wins again, but it’s hard to fathom,” Gentry told The Associated Press.

WATCH BELOW: Here’s what people would do with the Mega Millions jackpot

Approximately 280 million tickets were sold in Friday’s draw.

The Mega Millions jackpot has been steadily growing since July when 11 office workers from California won $543 million.

The current Mega Millions jackpot is the largest in U.S. history.

—With files from The Associated Press

Comments