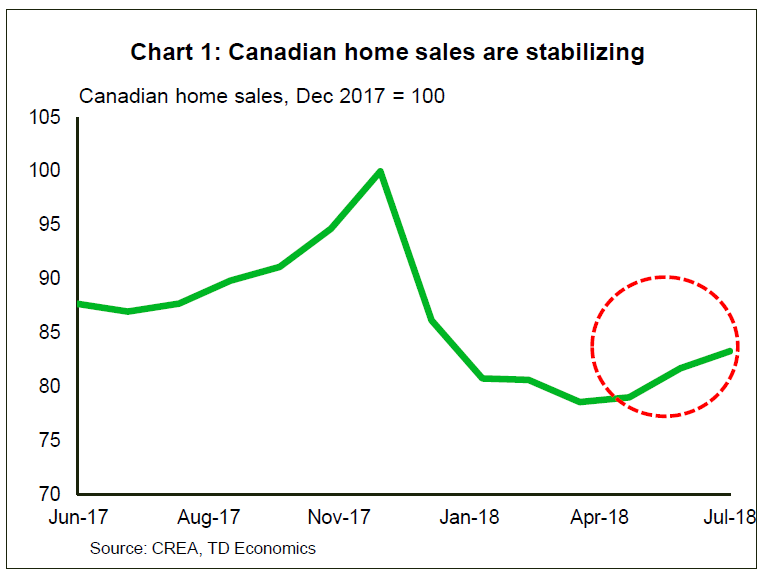

After a rough start to 2018 amid rising interest rates and new federal and provincial housing rules, Canada’s real estate market is bouncing back.

Home sales have been inching back up in May, June and July after falling off a cliff at the end of 2017. And prices are edging higher as well. The average price of a home in Canada was $481,500 last month, up 1 per cent from June.

But at a local level, the housing market looks very different than it did just a year ago, according to a new report by real estate website Zoocasa.

WATCH: Canadians who don’t qualify for mortgage ‘can buy a smaller home,’ say Bank of Canada governor

Zoocasa took at look at the sales-to-new-listings ratio, a measure of whether a certain market favours home buyers or sellers. This metric is the ratio between the number of homes sold and the number of homes newly put up for sale over a specific time period.

Get weekly money news

A ratio between 40 and 60 is usually seen as a balanced market, a tug of war where buyers and sellers have roughly equal power. Anything above that threshold is considered a sellers’ market, with homes moving quickly off the market and tight demand from buyers giving sellers’ the upper hand. Conversely, a ratio below 40 represents a buyers’ market, where for-sale signs tend to linger on lawns and house hunters have more bargaining power.

READ MORE: Baby boomers are back in the housing market – and it will impact prices: Royal LePage

You’d think Vancouver and Toronto would top the chart as the worst place to be a homebuyer. But the latest data from July shows a different story, as the Zoocasa report highlights.

The Greater Vancouver and Greater Toronto area now in balanced territory, with the sales-to-listings ratio at 43 and 50, respectively. This isn’t to say that housing there has suddenly become affordable. Prices haven’t budged much despite significant swings in home sales volumes and remain firmly out of the reach of many. Still, the data does suggest that buyers may have a bit more leeway to negotiate, at least in the market for detached homes, which, unlike the condos segment, has seen a sizable slowdown in both cities.

WATCH: Here’s what millennial homebuyers can afford across the country

The opposite is true in London, Ont., Montreal and Ottawa, which rank as the top sellers’ markets right now. Prices here are still far from the heights touched in Vancouver and Toronto, but homes are selling fast and buyers don’t have much sway.

“Tepid growth in new listings has left London’s market drum-tight, resulting in robust price growth,” write TD economists Derek Burleton and Rishi Sondhi in a paper released Wednesday that notes many of the same trends that emerge from Zoocasa’s numbers.

Montreal and Ottawa have been on real estate watchers’ radar for a while now, as higher borrowing costs and tougher mortgage and housing regulations divert buyers’ interest from Vancouver and Toronto to these two relatively affordable markets.

READ MORE: Ottawa just replaced Toronto as a foreign-homebuyer magnet: RBC

- Can Trump decertify aircraft? What experts say amid Bombardier threat

- Corus to seek court approval of recapitalization plan after shareholder vote narrowly fails

- Bombardier warns of ‘significant impact’ to travellers from Trump’s threat

- Canadians have billions in uncashed cheques, rebates. Are you one of them?

“With the sales-to-listing ratio currently entrenched in seller’s territory, prices likely have further room to run,” Burleton and Sondhi write of Montreal. While in Ottawa, benchmark prices are averaging “a robust 8% year-over-year gain so far in 2018.”

Still, perhaps the most surprising thing about the recent sales-to-listing numbers is what’s happening in Atlantic Canada. Halifax and Saint John, N.B., are now firmly lodged in sellers’ territory, with a ratio of 66 and 64, respectively.

“In a change from years past, markets in the Atlantic Provinces have outperformed Canada overall,” write Burleton and Sondhi, although Newfoundland and Labrador remains an exception.

Population growth and dwindling new listings make for a “relatively tight” market in Halifax. And sales in Saint John have increased “solidly,” since May, although that may not last amid rising interest rates and lacklustre job creation and demographic trends, the two economists note.

As for what lies ahead, Burleton and Sondhi see a sustained but slow recovery.

Unlike previous instances when the market bounced back sharply after a new round of housing-rules tightening, “pent-up demand from some buyers and healthy income gains will face a stronger headwind this time around, particularly in the face of further gradual interest rate increases by the Bank of Canada.”

Comments