The Canada Mortgage and Housing Corporation has released its quarterly Housing Market Assessment today.

It’s a comprehensive report that identifies the level of stability in the housing markets of Canadian cities.

It’s a comprehensive report that identifies the level of stability in the housing markets of Canadian cities.

Here are some of the highlights:

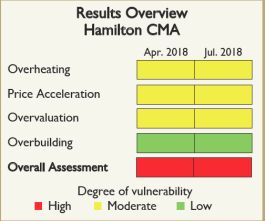

- The overall assessment for Hamilton showed the housing market displayed a high degree of vulnerability in Q1 2018, unchanged from the previous quarter’s assessment.

- The market for row and semidetached homes favoured sellers, while the markets for both apartments and single-detached homes were balanced.

- Regional markets with generally lower priced homes, such as Hamilton East and Hamilton Centre, also favoured sellers.

- The 25 to 34-year-old population is a fundamental driver of housing demand in Hamilton, as they make up the largest share of first-time home buyers in that market. That demographic continues to migrate to Hamilton for more affordable housing, particularly in the low-rise segment.

- High immigration levels have also contributed to the strong population growth in this age group.

- Row homes continued to make up the vast majority of the relatively small inventory of unsold new homes in Hamilton, predominantly concentrated in Waterdown and Ancaster.

- Real Canadian Superstore fined for ‘misleading’ Product of Canada displays

- ‘No reason to continue discussing’: Ontario mayor wants Andrew’s name dropped

- Canadian Tire says Triangle Rewards are its ‘linchpin’ for growth

- Canada wants to withhold ‘sensitive’ information from trial over Sikh leader’s killing

.jpg?h=article-hero-560-keepratio&w=article-hero-small-keepratio&crop=1&quality=70&strip=all)

Comments

Want to discuss? Please read our Commenting Policy first.