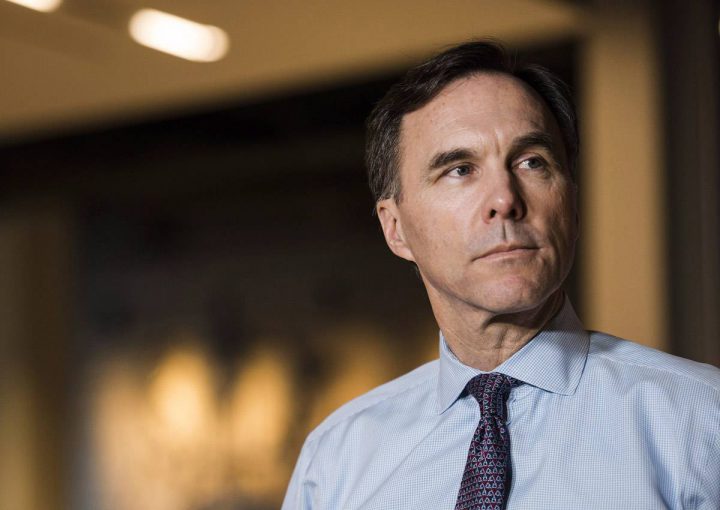

Finance Minister Bill Morneau did not break federal conflict of interest rules by sponsoring a bill that reformed Canadian pension regulations.

Federal Ethics Commissioner Mario Dion published the conclusion of his investigation into complaints made by two MPs last year that alleged Morneau had broken the rules by sponsoring C-27, which amended pension rules, given that he and his family members hold shares in Morneau Shepell Inc., a pension administration firm.

READ MORE: The Morneau Report 2018

NDP MP Nathan Cullen and Conservative finance critic Pierre Poilievre had filed the complaints.

They said the firm and its shareholders, including Morneau, stood to benefit from an increase in value under the rule changes introduced by Morneau and asked the commissioner to investigate.

READ MORE: Ethics commissioner investigates Bill Morneau over Bill C-27 questions

But in the report released Monday morning, Dion said that because the rule changes would apply generally to any and all firms operating in the industry, rather than only benefit Morneau Shepell Inc., Morneau’s introduction of the bill was not a conflict of interest.

WATCH BELOW: Bill Morneau targets small business, uses loopholes himself

“The Office of the Conflict of Interest and Ethics Commissioner has previously determined that, when a matter affects all those governed within an area of activity, without exception, the matter is considered to be of general application,” Dion wrote.

Get breaking National news

“Because Bill C-27 is of general application, I find that Mr. Morneau did not place himself in a conflict of interest and did not contravene subsection 6(1) or section 21 of the Act in this matter.”

Poilievre told reporters Monday that despite the conclusion of the report, he was still critical of Morneau’s involvement in the file.

“Even if the Finance Minister’s actions were not illegal, his decision to introduce pension legislation while owning significant shares in a pension company demonstrated extremely poor judgment,” he said.

WATCH BELOW: Poilievre: Morneau’s actions still showed bad judgement

It was far from the first time Morneau has faced accusations of conflicts of interest.

Last fall, he sold his shares in Morneau Shepell Inc.

That came after former federal ethics commissioner Mary Dawson fined him $200 for failing to disclose he owns a villa in France through a holding company under his control and amid intense scrutiny over his corporate interests.

WATCH BELOW: Morneau under scrutiny over pharmacare consultations

In January 2018 he was cleared of accusations of insider trading following an investigation by Dawson into the sale of shares by Morneau and a family member in Morneau Shepell Inc., which is his family company.

Those sales took place just days prior to the introduction of legislation to increase income tax on those earning more than $200,000 per year.

However, because the legislation was actually announced earlier in November and prior to the sale of the shares, Dawson said there was no wrongdoing.

And in March 2018, Morneau again faced ethics questions over whether he should be involved in discussions around the possibility of creating a national pharmacare program.

Morneau Shepell Inc. does consulting on health and benefits coverage for pension plans and opposition critics say because of that, Morneau should not be involved in the discussions.

- Carney unveils ‘Buy Canadian’ defence plan, says security can’t be a ‘hostage’

- Rhode Island shooter killed ex-wife, son before bystanders intervened: police

- Canadian immigration officers investigating hundreds identified by extortion task force

- ‘Canada can broker a bridge,’ Carney says on new trading bloc efforts

Comments

Want to discuss? Please read our Commenting Policy first.