With the Ontario election just a day away, here’s a breakdown of what the three main parties are promising on taxes.

Political parties that intend to increase, introduce or authorize other bodies to collect taxes had until two weeks before the election to file a letter with the chief electoral officer that provides a “clear, concise and unambiguous description” of the changes and annual revenues associated with them.

This is in compliance with the Taxpayer Protection Act, which outlines the circumstances in which Ontario governments can raise taxes without holding a referendum. One of those cases is if the party communicates its intentions during the election by way of a letter to the chief electoral officer.

The three main parties, along with the Green Party, have filed letters with Elections Ontario, though the Progressive Conservatives aren’t planning on introducing new taxes.

The Liberal and the NDP letters are posted on the Elections Ontario website here and here. (Chief Electoral Officer Greg Essensa found that for both parties “a referendum will not be required with respect to these tax initiatives,” he stated in a letter).

Here’s a look what, if any, tax increases the parties say they are planning to implement should they form the next government.

The Progressive Conservatives

The Progressive Conservatives have indicated they would not implement new taxes. They did publish their letter filed with Elections Ontario, but the chief electoral officer found it didn’t include any changes that would apply to the Taxpayer Protection Act.

“In my capacity as leader of the Ontario PC Party, I am proud to inform you that under no circumstances will any government I lead introduce new taxes or increase taxes on the people of Ontario,” Leader Doug Ford stated in the letter.

Their platform introduces billions in spending and tax cuts, which Ford said he can accomplish by finding efficiencies without cutting a single job. Ford’s political opponents, as well as some economists, have cast doubts on whether this is realistic and have criticized the party for not releasing a fully costed platform.

Get daily National news

The NDP

Should the NDP form Ontario’s next government, it plans to make six changes to taxation. These efforts, according to the party’s platform, would add $1.4 billion to provincial coffers in the first year of an NDP mandate, which would increase to $5.3 billion by the fourth year of the plan.

- The NDP wants to raise corporate taxes by one percentage point and 0.5 percentage points in 2021–22. This means the corporate tax rate will raised to 13 per cent.

- The party also wants to phase in changes to the Employer Health Tax, a business payroll tax that ranges between roughly 1 to 2 per cent, depending on the amount paid out to employees annually. In the second year of an NDP mandate, the party would lower the cap for exemptions on this tax, so that businesses with payrolls over $3 million would no longer qualify. The following year, the cap shrinks to include only businesses with payrolls under $1.5 million.

- Personal income taxes under an NDP government would be increased for high earners. Those making over $220,000 will see their tax rate grow by one percentage point. The marginal tax rate for those making north of $300,000 would be increased by two percentage points.

- Cribbing a policy recently implemented in British Columbia, the NDP wants to introduce a three per cent tax on luxury cars — those sold for over $90,000 — which it says would lead to windfalls of $12 million per year.

- Another made-in-B.C. revenue proposal is the NDP’s plan to tax non-resident buyers. Those who own properties in designated areas but don’t pay taxes in Ontario will pay a tax of $5 per $1,000 of the property’s assessed value next year, rising to $20 the following year. Once fully implemented, the party says this plan would generate $671 million per year.

- The NDP plans to generate more cash from tobacco by basing the tax on value of the product, rather than its volume.

The Liberals

In the party’s letter to Elections Ontario, the Liberals don’t indicate that they plan to introduce new taxes, but rather outline their plan to simplify how taxes are applied in Ontario. These moves were introduced in the budget.

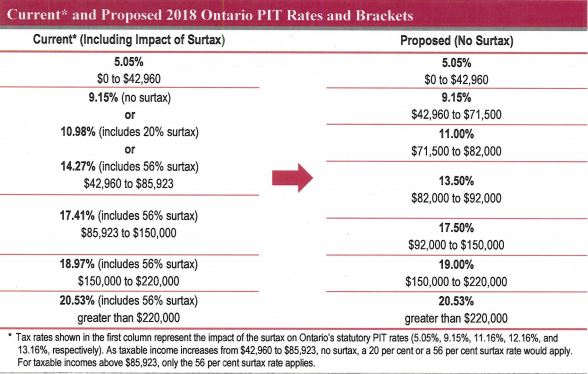

Over and above the province’s regular income tax rates, Ontario’s middle and high income brackets are also subject to surtaxes — additional taxes on the rate of tax. The Liberals want eliminate that surtax, and adjust tax bracket rates to compensate — a move they said would increase transparency.

READ MORE: Here’s what Ontario’s parties are promising voters for dental care

The changes are expected to generate an additional $275 million per year, though the party said those who have incomes below $71,500 would end up paying less income tax or see no increase. (Those earning $95,000 could see increases, however).

The changes are outlined in a graphic the party provided in its submission:

The party said in addition to these changes, they would increase the top rate of the non-refundable Ontario Charitable Donations Tax Credit, which could help lower tax bills for some.

_JUNE_6_848x480_1249857603550.jpg?w=1200&quality=70&strip=all)

_848x480_1249857091710.jpg?w=1200&quality=70&strip=all)

Comments

Want to discuss? Please read our Commenting Policy first.