This year, the spring housing market looks very different from what so many Canadians have become accustomed to. Across the country, for-sale signs are lingering on home lawns. And — with the notable exception of condo markets in and around Vancouver and Toronto — bidding wars are becoming rarer.

The volume of home sales in April touched a seven-year low for the month, the Canadian Real Estate Association said on Tuesday. And home prices in most markets are stagnating.

READ MORE: Canadian home sales tumble to 7-year low in April, prices down 11 per cent

But if Canada no longer looks like a sellers’ market, buying a home hasn’t exactly become a cakewalk. Unless you’re shopping for a detached house in the country’s two priciest cities, you probably haven’t seen home prices decline.

Renting isn’t cheap either. Forty per cent of the 4.4-million Canadians who have a landlord rather than a mortgage spend over 30 per cent of their pre-tax income to keep a roof over their heads. And things could get worse if rising interest rates and tougher mortgage rules force more Canadians into the rental market.

READ MORE: Here are provinces, cities in Canada with the highest and lowest rent

So, what’s the least bad option in this era of stalling home values and sky-high rents: being a tenant or a homeowner?

READ MORE: Should you rent or buy? Take our personality quiz

Common wisdom has it both ways when it comes to the rent vs. buy question. Many people argue that renting is a waste of money: You’re not building equity in your home and your housing costs will never go down.

Others argue that since rent is usually much cheaper than the carrying costs of owning a comparable home, you can build wealth by investing what you’re saving by not having to pay for things like property taxes and home insurance.

Unfortunately, both arguments can be wrong, depending on your individual situation and the conditions of the market. Crunching some numbers will usually give you a better idea of what renting or buying entail in your specific case.

SIGN UP FOR THE NEW GLOBAL NEWS MONEY NEWSLETTER

Rent or buy? The case of a Toronto semi

Toronto is a great place to test the rent vs. buy math. When it comes to larger and more expensive homes, the real-estate craze of the past couple of years has dissipated. At the same time, rents are among the highest in the country.

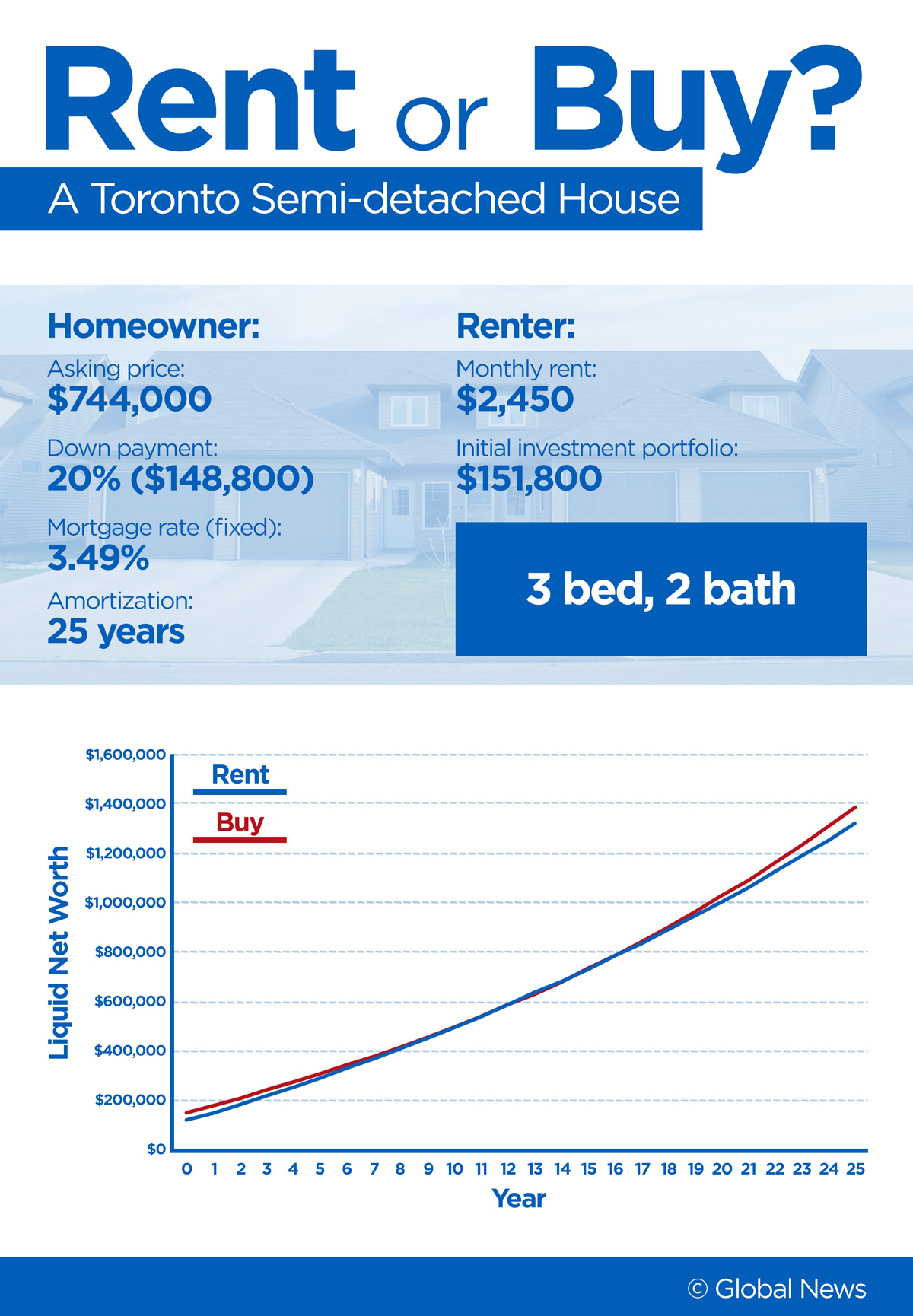

Let’s look at the example of a three-bedroom, two-bathroom semidetached house, what many would call “a starter home.”

Get weekly money news

READ MORE: Could you pass the mortgage stress test? Here’s how to find out

According to data provided to Global News by Toronto real estate website Bungol.ca, the average asking price for such a home in the Greater Toronto Area (GTA) is around $744,000. With a 20 per cent down payment of $148,800, and a five-year fixed rate mortgage of 3.49 per cent, the monthly mortgage payment would be $2,969, according to the online mortgage calculator provided by rate-comparison site RateHub. Add in property taxes, home insurance, utilities and home maintenance costs, and you’re looking at spending $3,800 a month at least.

On the other hand, the average rent for a comparable property is around $2,450 a month in the GTA, according to Bungol. That’s a difference of a whopping $1,350 in monthly costs compared to being a homeowner.

READ MORE: From broom closet to detached home: What millennials can afford across Canada

But what does that mean?

Global News run the numbers through the online “rent vs. buy calculator” provided by The Measure of a Plan, a Canadian financial planning site. If you assume that home prices will stay relatively flat for the next 25 years, it doesn’t make much of a difference whether you rent or buy that Toronto semi.

A tenant with an initial investment portfolio of $151,800, equivalent to what the buyer would likely spend on the down payment and purchase transaction costs, would end up with around $1.35 million 25 years down the line, assuming an annual return on investment of 5.5 per cent before inflation.

The homebuyer would end up with roughly that amount in home equity.

Rent or buy? The case of a Toronto condo

When you look at small condos in Toronto right now, those who can afford to buy still seem to have a clear advantage.

The average list price for a two-bed, one-bath apartment in the GTA is around $412,000, according to Bungol, which works out to roughly $2,000 in mortgage payments and $2,650 in carrying costs. Renting a comparable unit, on the other hand, will cost you around $2,330 a month. That’s a mere $320 difference in monthly carrying costs.

“In most urban markets, it’s hard to beat buying long-term when your rent payment is higher than your mortgage payment for the same property,” he added in an email to Global News.

WATCH: Here’s what millennials couples can afford under the new mortgage rules

But small towns where few homes are available for lease can also be a tough market for renters, said Jason Heath, a fee-for-service financial planner and managing director at Markham, Ont.-based Objective Financial Partners.

READ MORE: Are variable mortgage rates still the best choice for saving on interest?

In communities where the supply of rental properties is limited, it’s not uncommon to see yearly rent payments equivalent to between 7 and 10 per cent of the market value of a comparable home.

Generally, if a year’s worth of rent adds up to less than 4 per cent of the market value of a similar house, you’re probably looking at a renters’ market. If yearly rent works out to 5 per cent or more, buying is more likely to be the better option financially, Heath said.

Still, there are all sorts of variables that can skew the calculation. For example, the faster home prices rise, the harder it is for renters’ investment returns to keep up.

READ MORE: Here’s the income you need to pass the mortgage stress test across Canada

On the other hand, you won’t be building much wealth as a homeowner if you keep tapping into your home equity to borrow, Heath noted.

And if you have a generous workplace pension with your employer matching contributions, renting and being able to make larger monthly deposits into your retirement savings account might make more sense, Heath added.

The 4-per cent rule of thumb is only a starting point, he said.

“It’s important just to know when to ask more questions.”

Comments

Want to discuss? Please read our Commenting Policy first.