The uproar that swept America after the Feb. 14 Parkland school shooting in Florida is prompting some soul-searching on Wall Street.

BlackRock, the world’s largest asset manager, has pledged to ask some pointed questions of U.S. gun makers and sellers. It has also said it would think about index-based portfolios specifically intended to filter out gun stocks.

Firearms manufacturers have also been roiled by the news that Remington Outdoor, one of America’s oldest gun manufacturers, filed for bankruptcy on Sunday. The move has been linked to the potential impact of the upcoming ruling in a lawsuit linked to the Sandy Hook elementary school shooting, in which Adam Lanza killed 20 children with a Remington-made AR-15 rifle.

READ MORE: U.S. gun maker Remington files for bankruptcy, sales slump linked to Sandy Hook massacre

Many Canadians have been holding sister marches to call attention to gun violence in the U.S. But chances are their investments do not reflect their outrage.

WATCH: Montrealers to march in solidarity with Parkland shooting victims

Many plain vanilla investors have some exposure to civilian firearm manufacturers and retailers without even realizing it, said Dustyn Lanz, chief executive officer of Canada’s Responsible Investment Association (RIA).

Here’s what you can do if you want to drop guns from your portfolio.

SIGN UP FOR ERICA ALINI’S UPCOMING WEEKLY MONEY NEWSLETTER:

The options for gun-free investing

Get weekly money news

Mutual funds

“There are plenty of options for retail investors to go gun-free,” Lanz said. Ocean Rock Investments, iA Clarington Investments, RBC Global Asset Management and Desjardins are some of the investment firms in Canada that manage so-called socially responsible mutual funds, which screen out companies that derive a significant portion of revenue from manufacturing weapons. A longer list is available on RIA’s website.

READ MORE: Trudeau government introduces gun bill that would tighten control of sales, licensing

ETFs

But what about exchange-traded funds (ETFs)? Like mutual funds, ETFs are a collection of securities like stocks and bonds.

Unlike mutual funds, however, ETFs aren’t usually actively managed and instead track indices like the S&P/TSX 60 or the S&P 500. ETFs also come with significantly lower fees compared to mutual funds.

Right now, the choice of sustainable ETFs focused only on Canadian companies is rather slim. Back Rock’s iShares Jantzi Social Index ETF (XEN-TSX) tracks the Jantzi Social Index, which reflects the stock performance of 50 Canadian companies that pass the test on things like environment and social issues. The XEN has long been the only go-to for investors looking for a broadly diversified and purely Canadian ETF.

READ MORE: The difference between an AR-15 and handgun can be seen in the bullet wounds

However, “we are seeing more ETFs coming to market that have a responsible investment mandate as well,” Lanz said.

When it comes to U.S. stocks, on the other hand, “there are a few different options,” said Tim Nash, a Toronto-based fee-based financial advisor and founder of Good Investing.

In his socially responsible investment portfolio model, Nash suggests the iShares MSCI USA ESG Select Social Index (SUSA) for exposure to U.S. equities.

For exposure to international equities, Nash recommends the iShares MSCI EAFE ESG Optimized ETF (ESGD), which tracks large and mid-size companies in Europe, Australia, Asia and the Far East, and iShares MSCI EM ESG Optimized ETF (ESGE), which focuses on emerging markets.

Through the XEN, SUSA, ESGD and ESGE, “Canadian investors can get global diversification without any exposure to firearms,” Nash said.

Canadians can invest in sustainable ETFs with the help of a fee-based financial advisor or through any online broker, from those offered by all the big banks (such as TD Direct Investing or BMO InvestorLine) to discount brokers like QTrade, Questrade and Virtual Brokers.

In general, any ETF with an ESG designation will exclude civilian firearm manufacturers, but you may have to “do your homework” when it comes weapons retailers, Nash said.

WATCH: Liberals introduce new gun legislation, calling for tighter background checks and mandatory record-keeping

Robo-advisors

In between turning to an investment advisor and investing by yourself through an online broker are robo-advisors like Wealthsimple, ModernAdvisor and BMO Smartfolio. Robo-advisors use algorithms to pick ETFs based on your risk tolerance, stage in life and financial goals, although the degree of customization and human interaction involved in this can vary.

Both Wealthsimple and ModernAdvisor offer socially responsible investment portfolios.

Good for your conscience — and your wallet

Trying to keep guns out of your investments comes with certain downsides. For one, it may involve a little extra legwork, whether it’s asking questions to your investment advisor about socially responsible investing (SRI), seeking out SRI ETFs and mutual funds, or doing your own research about whether and how certain funds screen gun sellers.

Another limitation is that you can’t avoid just guns. BlackRock says it’s working on that, but for now investment funds that exclude weapons makers also filter out a series of other companies, which you might or might not care about excluding.

READ MORE: What do the changes to Canadian gun laws mean for you?

Finally, ETFs that have a sustainable designation are generally a bit more expensive than regular ETFs, though still much cheaper than mutual funds.

But even accounting for those higher costs, most sustainable ETFs have produced returns that were just as good or slightly better than mainstream ETFs over the last 10 years, Nash said.

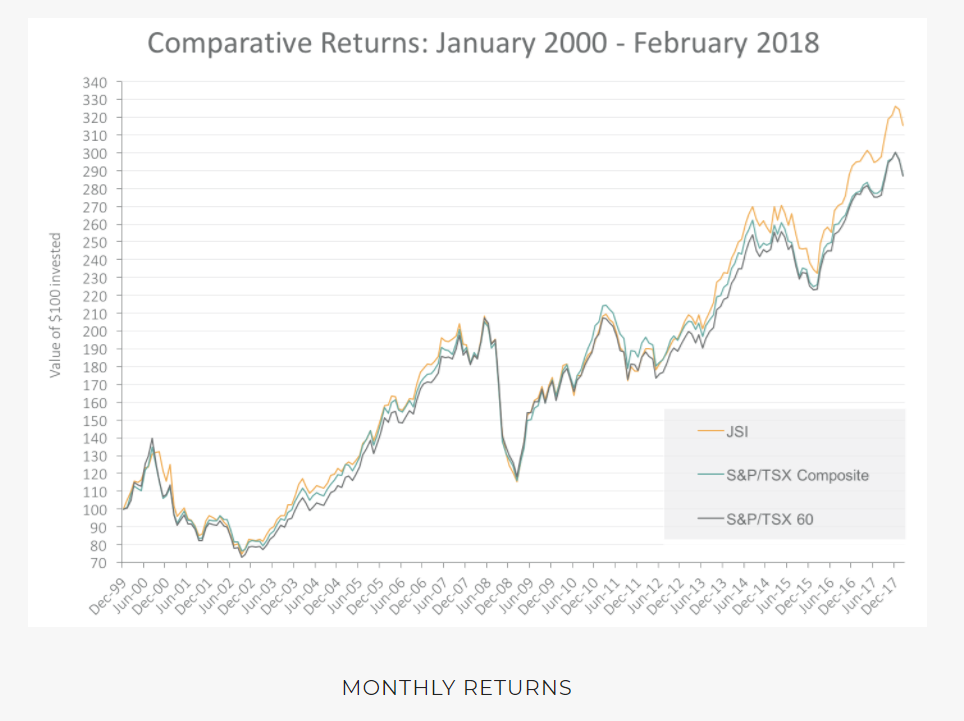

Since 2000, the Jantzi Social Index has usually outperformed both the S&P/TSX 60 and the S&P/TSX Composite.

Socially responsible investing tends to pay off because it picks up on risks that traditional investment analysis might miss, RIA’s Lanz told Global News.

For example, investment research firm MSCI dropped Volkswagen from one of its sustainable indexes months before the German automaker’s stock started plunging after the company came under fire for cheating on U.S. emission tests.

“By excluding weapons manufacturers, there’s no need to sacrifice financial returns,” Nash said. In fact, you might actually be better off.

Comments