If interest rates were to rise by one percentage point over the next year, Canadian households would have to spend an additional 2 cents on debt repayments for every $1 of income, according to a new RBC report.

Take Canada’s median household income of $78,870 and that increase works out to roughly $130 more in monthly debt servicing costs, Global News calculated.

READ MORE: Could you handle a 33 per cent interest-rate hike on your debt? If not, start paying it off now

That’s in a country where over half of Canadians currently have $200 or less per month to spare after paying all their bills and meeting their debt obligations, according to a recent survey conducted on behalf of accounting firm MNP.

For 10 per cent of Canadians, the financial cushion is $100 or less.

READ MORE: Over half of Canadians are $200 or less away from not being able to pay bills

With interest rates already on the rise in the U.S. and the Canadian economy heating up, most economists expect the Bank of Canada to lift rates from historic lows sometime next year.

How will Canadian families, who have been piling on mortgage, credit card and other loan balances for a decade, cope with more expensive debt?

The data points to a number of hot spots that signal potential trouble, according to RBC economist Laura Cooper.

Canadians have a pile of expensive debt that’s about to become even more expensive

The amount of interest Canadians are paying on things like personal lines of credit and credit cards is now equal to what they are channeling toward the interest on their mortgage debt, according to Cooper.

That’s because, although mortgages make up the lion’s share of household debt, so-called consumer credit is generally far more expensive. While Canadians can get a five-year fixed-rate mortgage with an interest rate as low 2.5 per cent, most unsecured lines of credit carry rates of 7-9 per cent. And interest rates on credit card debt are well into the double digits.

Even more concerning, consumer credit tends to carry variable interest rates that will rise if the general level of interest rates in the economy goes up.

One in 10 older households owes more than $100,000

Get weekly money news

Guess who holds a lot of that pricey debt with variable interest rates? Seniors, according to Cooper.

Canadians 65 and older had an average household debt of over $30,000 in 2016, compared to $10,000 in 1999, according to a chart in the report (see below). And lines of credit account for most of that increase, which leaves this demographic “exposed to interest rate increases at a time when incomes tend to fall due to retirement,” Cooper wrote.

Notably, a whopping 10 per cent of senior households had debt in excess of $100,000 in 2016.

READ MORE: Nearly half of Canadians count on inheritance for retirement — will they actually get any money?

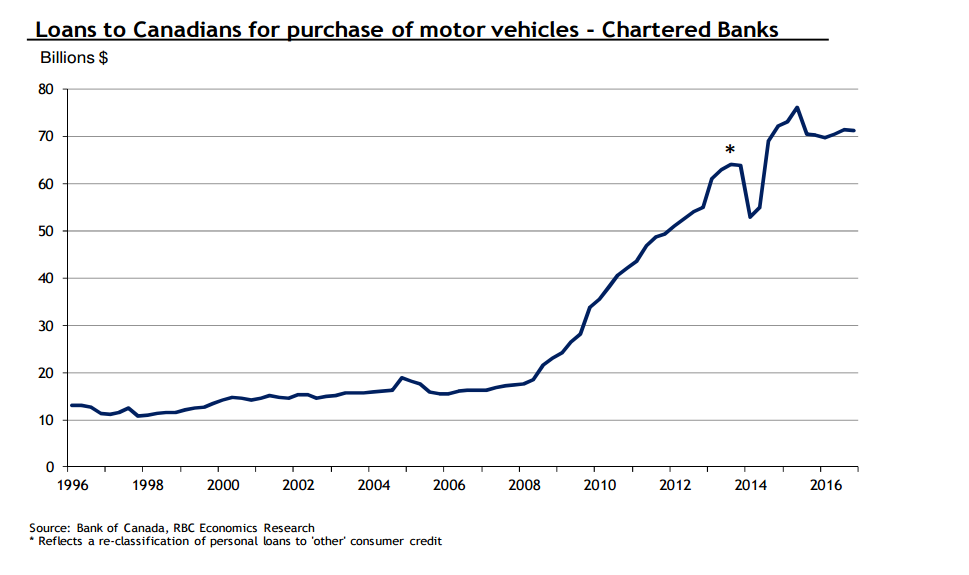

Auto loans make up 15 per cent of consumer debt, and Canadians are already struggling to keep up

Outstanding balances on auto loans have quadrupled over the last decade, and Canadians with poor credit have been driving the borrowing binge, according to Cooper. As a result, riskier car loans now account for a whopping 25 per cent of the market, posing the risk of a rise in delinquencies when rates rise.

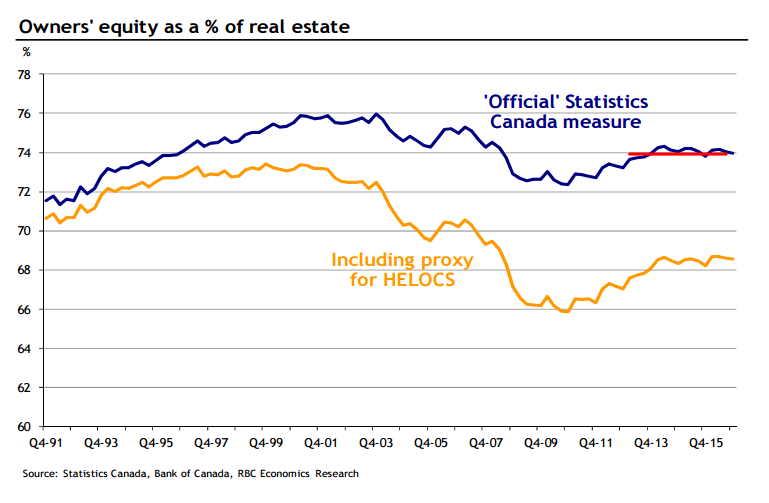

Canadians don’t own as much of their homes as one well-known official measure suggests

Canadians have, in aggregate, a 74 per cent equity stake in their homes, according to one oft-quoted Statistics Canada measure. But do they really?

That value drops to around 68 per cent when you account for how much families have been borrowing against their homes, according to Cooper.

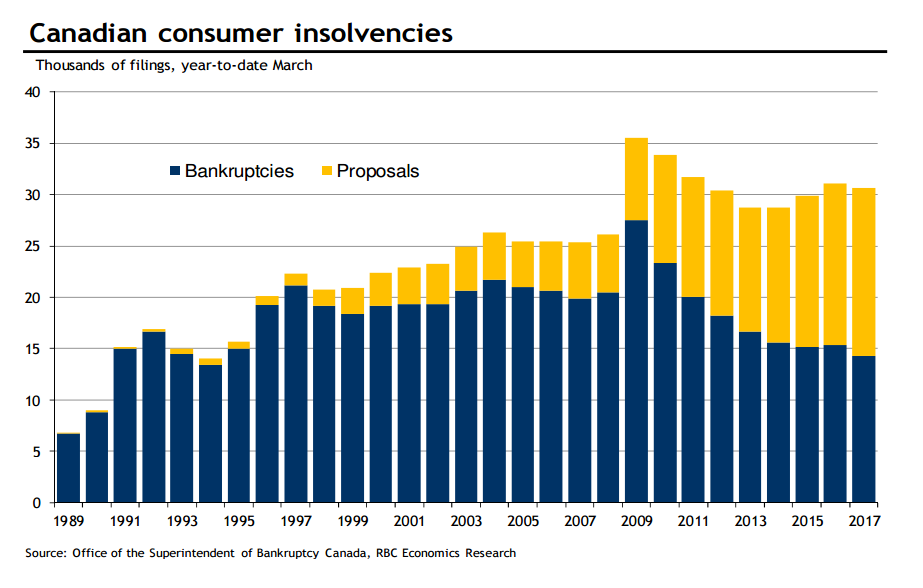

The number of Canadians filing for bankruptcy or renegotiating their debt is almost six times higher than in 1989

Canadians are struggling to keep up with their debt even without an interest rate increase, data from the report suggests.

READ MORE: The number of young Canadians going bankrupt is rising — but student debt isn’t the whole story

There were 30,000 filings for bankruptcy or debt-renegotiation proposals in the 12 months leading to March 2017, compared to the 12 months leading to March 1989:

But not all Canadians need to worry

Not all Canadians are equally exposed to an interest rate increase. Those who have locked in interest rates through a fixed-term mortgage won’t feel the impact of higher rates until their loan is up for renewal. Some homeowners may find that the rates they get when they refinance their mortgage in a few months are still lower than what they carried on their previous loan, noted Cooper.

And over half of Canadians have little to no debt. One-third of households were debt-free in 2016 and a quarter of them owed less than $25,000.

![WATCH: The emotional impact of consumer debt[tp_video id=3489547]](https://globalnews.ca/wp-content/uploads/2017/06/interest-on-household-debt.png)

![WATCH: How to help your family members manage debt[tp_video id=3509160]](https://globalnews.ca/wp-content/uploads/2017/06/oldagedebt.png)

Comments

Want to discuss? Please read our Commenting Policy first.