“It’s frankly astonishing.”

Those words from a man not normally given to exuberant descriptions of the ebbs and flows of the stock market.

Doug Porter, the Bank of Montreal’s (BMO) chief economist, says the recent surge in the markets in Toronto and New York has been an impressive vote of confidence for investors, consumers and businesses.

READ MORE: Markets plunge with increasing chance of Donald Trump victory

What’s more remarkable is that the market optimism coincides with the election of Donald Trump.

Is it possible that a president whose first weeks in office have been so tumultuous could be in any way be responsible for the good economic news?

“To some extent you have to have draw a line” connecting the markets and Trump, says Porter.

“It’s not just President Trump but that Republicans swept all three layers of government.”

Trump’s victory on election night came as such a shock, the markets were expected to tank the next day.

But investors woke up and concluded that they liked the election sweep by Republicans in Congress and the White House.

Investors calculated that Trump and his counterparts in the Senate and House of Representatives would quickly find common ground on the very policies that would buoy the markets: tax reduction, cuts to business regulations and investments in infrastructure.

So far that buoyant optimism has carried North American markets to record highs. The TSX has risen more than 8.1 per cent since Trump’s election.

Get weekly money news

And the Dow Jones Average in New York is up 12.5 per cent over the last three months.

For all his ranting and raving (while suggesting he’s not ranting and raving), Donald Trump has tried hard to draw attention to his country’s economic performance while deflecting criticism about his chaotic first month as president.

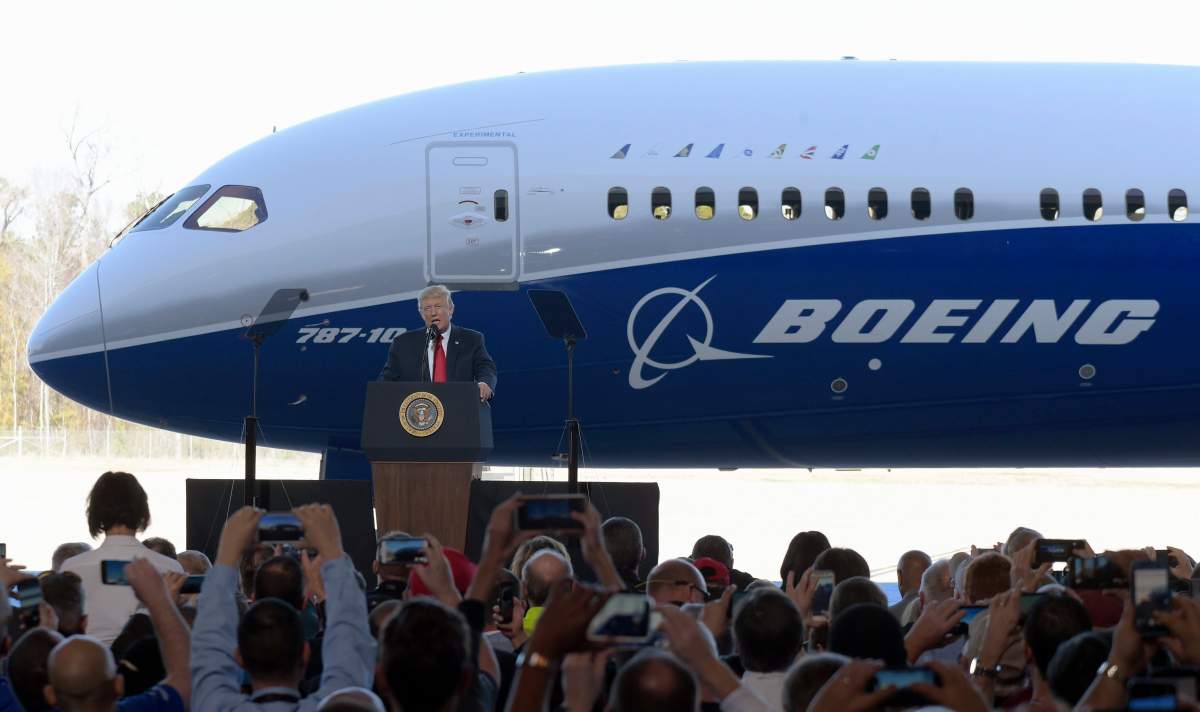

On Friday, Trump was at a Boeing plant in South Carolina bellowing a familiar theme: “America is going to start winning again.”

It may be hard for some to accept that Trump’s election has been good for the stock market.

One investor on Bay Street smiled when asked about his investments during Trump’s tenure: “They’re actually doing relatively well… (laughs) unfortunately.”

READ MORE: Donald Trump makes Mexican peso great again

He’s no fan of Trump, but said “Trump is probably more relaxed on business and regulation and that’s what’s caused a rise.”

Historically, a market rally early in a President’s first term is often followed by a correction within months.

One New York trader, Kenneth Polcari of O’Neil Securities, suggested this week that he “would not be surprised to see a three or five, even a seven per cent pullback in the market.”

Though he added that there is no reason yet for anybody to panic or think that the current rally is over.

Likewise, Doug Porter doesn’t see the market trend curtailing just yet.

He says investors are pretty rational. They see an opportunity for political gridlock in Washington to be broken by a majority of like-minded, business-friendly politicians, including the first time politician now occupying the White House.

READ MORE: Global markets rebound after historic Donald Trump election victory

Said Porter, a keen market watcher, “It’s more likely to lean to the positive side than the negative side despite all the sound and fury and bluster coming from the President.”

On Friday, Donald Trump declared, “I’m going to do everything I can to unleash the power of the American spirit.”

Certainly something’s been unleashed on the stock markets, and there’s no denying that it has coincided with Donald Trump winning the presidency and taking office.

Comments