While the price of gold has surged since the start of the New Year, Canada has been selling off most of its gold reserves, but it has nothing to do with the loonie according to economists.

Canada has sold off most of its remaining gold reserves according to figures from the finance department, most through selling gold coins. Canada sold 41,106 ounces of gold coins in December and another 32,860 ounces of gold coins in January, while overall Canadian gold reserves dropped to 0.62 tonnes.

READ MORE: Canada sells off large chunks of its gold reserves

Economist Ian Lee of the Sprott School of Business at Carleton University says the government’s decision to sell the precious metal has no effect on the Canadian dollar.

“What they are doing is simply converting an asset class called gold and converting it into cash to then convert it into U.S. treasury bonds, European bonds, or U.K. bonds as part of daily market interventions,” he said. “There is nothing nefarious, and there is nothing untoward, weird or bizarre about this.”

Lee says gold is simply a precious metal that is part of an asset class that can be “bought and sold by anyone.”

Canada’s move to sell gold reserces is not surprising as no country currently uses gold to back its currency, and for decades the government has moved towards more easily tradable assets.

Get weekly money news

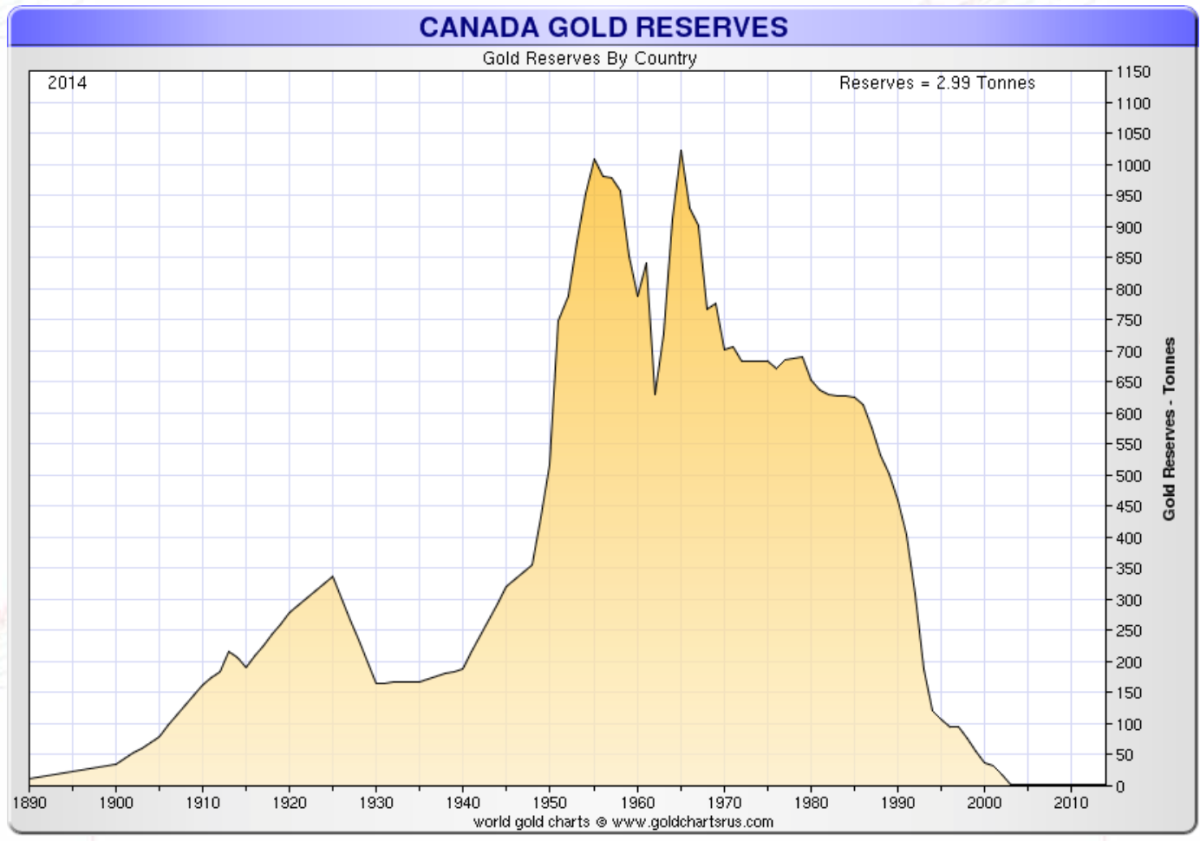

The amount of gold held by the Canadian government had been falling steadily since the mid-1960s, when over 1,000 tonnes were kept tucked away. Half of those reserves were sold by 1985, and then almost all the rest were sold through the 1990s up to 2002.

“The amount of gold bullion sold is not material and therefore has an insignificant impact on the Canadian dollar,” a spokesperson for Finance Canada said in a statement. “The Government has a long-standing policy of diversifying its portfolio by selling physical commodities (such as gold) and instead investing in financial assets that are easily tradable and that have deep markets of buyers and sellers.”

Canada could also continue its sale of gold reserves as the price of the precious metal has jumped 18 per cent since the start of 2016 rising to US$1,247.80 per ounce as of Friday.

Lee added that the amount of gold held by a country will not shield it from a monetary crisis.

“The wealth of nations is a function of the productivity of its workers, its capital and its entrepreneurs. That’s what determines how successful or unsuccessful a nation is,” he said. “Not whether you have a bunch of gold bullion sitting in a vault somewhere underground.”

*With files from Monique Muise

Comments

Want to discuss? Please read our Commenting Policy first.